Getting exposure to health, Botox and a big acquisition

This giant American company has been in an uptrend for many years, but analyst Rodney Hobson believes there’s another chance to buy.

11th December 2024 08:21

by Rodney Hobson from interactive investor

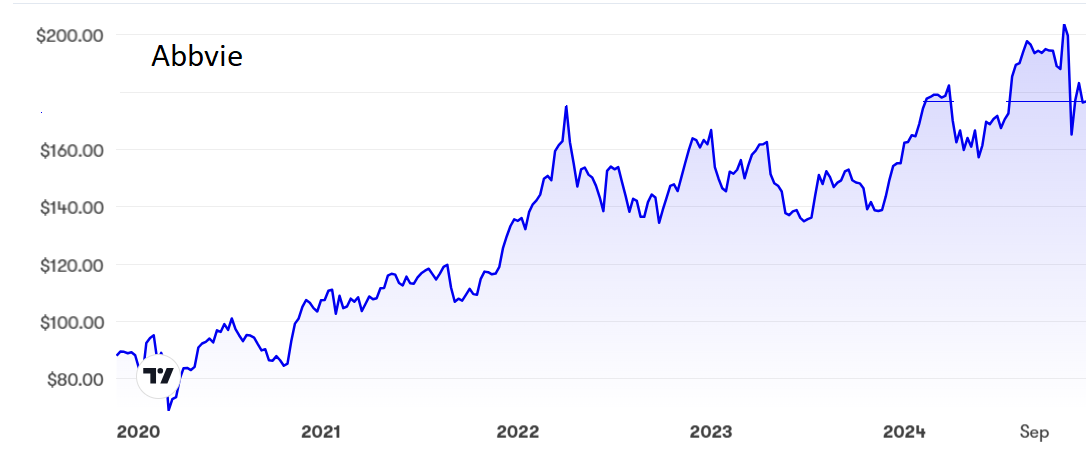

Shares in drugs companyAbbVie Inc (NYSE:ABBV)have come off the boil since peaking above $200 last month. Latest results were mixed, but this could still be an opportunity to buy into a solid, dividend paying stock. However, caution is required.

Abbvie concentrates on immunology and oncology. It has been a steady performer and, while it did not benefit from the Covid vaccine bonanza, it has similarly not suffered from the fall in pandemic cases.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Its blockbuster has been Humira, the Botox brand, which has lost its patent protection in the United States and is now subject to competition from generic alternatives. So revenue growth slipped into single digits last year, well below the average for the biotech sector.

Other drugs in the portfolio have generally fared well, although it should be remembered that all pharmaceutical companies struggle to get their products through the expensive lottery of testing regimes and into public use.

Things have started to look up, although the latest quarter brought mixed results that hardly justified chief executive Robert Michael’s claim that "we delivered another quarter of strong commercial execution and significant pipeline progress".

Revenue rose just 3.8% to $14.5 billion in the quarter to the end of September, but net earnings slumped 11% to $1.56 billion. On the positive side, full-year guidance for diluted earnings per share was raised from $10.67-10.87 to just over $10.9. The quarterly dividend was increased by 5.8% to $1.64.

The outlook for new drugs is reasonably encouraging. Abbvie has secured marketing authorisation in the European Union for Elahere, the only new treatment for a particular form of ovarian cancer that is resistant to other treatments.

This is a potential major breakthrough that could be of enormous benefit, as most patients suitable for the drug are already in late stages of cancer and options are limited.

On the other hand, two phase 2 clinical trials for schizophrenia treatment emraclidine did not show the necessary results. The drug was acquired as part of the $8.7 billion acquisition of Cerevel which was completed at the beginning of August, a reminder of the risks involved in taking over smaller rivals in this sector.

- 10 hottest ISA shares, funds and trusts: week ended 6 December 2024

- Five takeaways from T. Rowe Price’s 2025 outlook

- Key reasons S&P 500 will surge another 10% in 2025

The acquisition also included potential treatments for several neurological and psychiatric conditions such as Parkinson's and mood disorders, so there is still a possibility, though not a guarantee, that some part of this deal will come good.

Undeterred, Abbvie has decided to pay $1.4 billion in cash for Boston-based Aliada Therapeutics, a biotech firm working on diseases affecting the central nervous system, including a treatment for Alzheimer's disease. The acquisition should be completed by the end of this year.

Abbvie shares hit $203 on 1 November but lost impetus and are now back down to $175.50, where the price/earnings ratio is admittedly at an eye-watering level above 60, but the yield is an attractive 3.5%. That leaves an awful lot of good news priced into the stock, but at least the dividend is some consolation if there is further slippage.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I last commented on Abbvie in March last year when I described it as a credible alternative to some better-known names in the pharmaceutical sector. I rated the shares a hold a month earlier at just above $150, and those who stayed in have enjoyed a small capital gain and a decent dividend since.

The downside looks limited to $164, which has been both a ceiling and a floor in the past. Investors should, however, be aware that there could be serious resistance if the shares move back above $180. The hold recommendation stays but if the shares slip below $170 that rating becomes a buy, or above $180 a sell.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.