The funds benefiting from the energy crisis

5th September 2022 13:42

by Douglas Chadwick from ii contributor

Saltydog investor has noticed another period of strong performance for natural resources funds and is considering investing more into the sector.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

As momentum investors we are always looking for trends in the markets. We want to invest in sectors that are going up and avoid the ones that are going down. Unfortunately, this year most have been going down.

It looks like there is going to be a global recession and stock markets around the world are struggling.

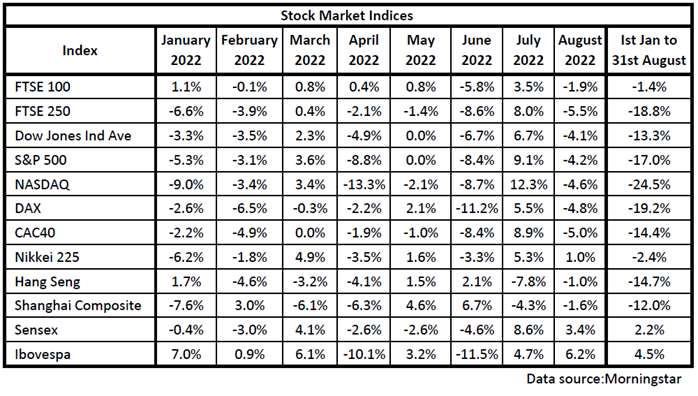

There was a pickup in July, when most of the stock market indices that we track went up, but that trend reversed in August. Most are now showing losses after the first eight months of the year.

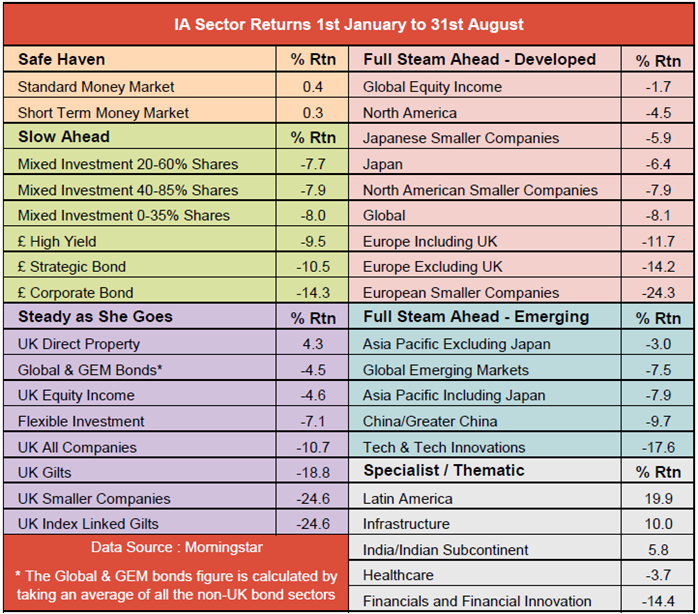

This general downturn is also reflected in the performance of the funds that we monitor on a weekly basis. Nearly 90% are lower now than they were at the beginning of the year, and most of the Investment Association sectors are showing losses.

Fortunately, there are a few sectors that are bucking the trend. The best, Latin America, is up nearly 20%.

There are also a few sectors where the Investment Association have decided that it is not appropriate to calculate an average return. This is because the group of funds is not considered homogenous, and the investment strategies can vary very widely. One sector which falls into this category is Natural Resources and Commodities.

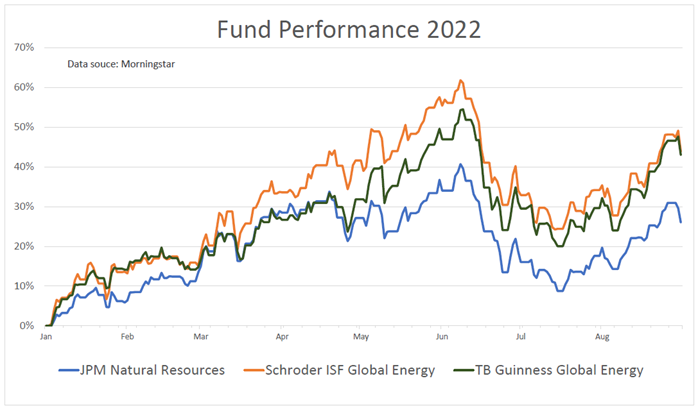

Earlier in the year we identified a number of funds from this sector that were performing well and our demonstration portfolios invested in a couple of them: JPM Natural Resources and TB Guinness Global Energy.

- Discover: How to buy Shares | Free regular investing | Super 60 Investment Ideas

We also invested in the Schroder ISF Global Energy fund which is in the Global sector. These funds had a good run until June, but then started to go down in value. We sold the JPM Natural Resources and Schroder ISF Global Energy funds but held on to TB Guinness Global Energy, although we did reduce our holding. In the last few weeks, it has started to go up again.

Energy prices have been rising this year, partly because demand has returned after the Covid lockdowns and partly because supply has been restricted due to sanctions on Russia. These three funds benefitted earlier in the year, and it looks like they might now be back on track after the downturn in the summer. We will be keeping a close eye on them and are considering adding to our current holding or maybe going back into one of the funds that we sold in June.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.