The fund winners powering our performance

Saltydog’s two portfolios are currently at record highs, but which funds are driving performance?

12th October 2020 13:53

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog’s two portfolios are currently at record highs, but which funds are driving performance?

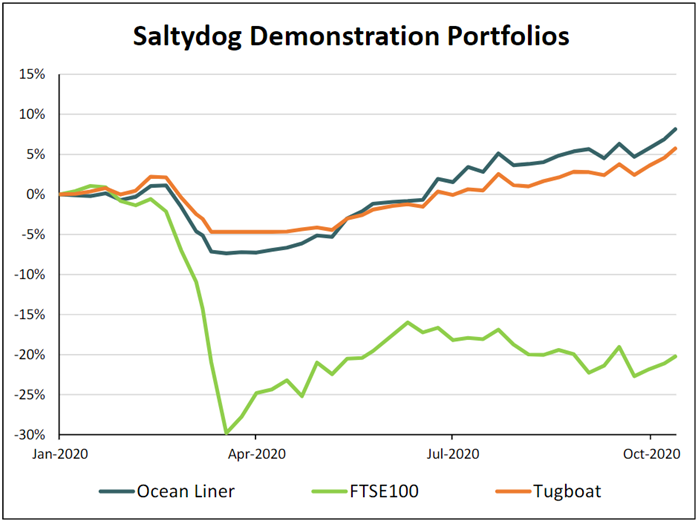

After a little wobble a few weeks ago, our two demonstration portfolios, the Tugboat and the Ocean Liner, have both recovered well and gone on to record new all-time highs. The Tugboat, which started with an initial investment of £40,000 at launch on 23 November 2010, went through £70,000 for the first time last week to reach £70,788.

The Ocean Liner, which was launched three years later on 23 November 2013, has seen its initial investment of £41,452 rise to a current value £63,223.

Since the lows in March, the Tugboat has gone up by 10.9% and the Ocean Liner has made 16.7%.

Past performance is not a guide to future performance.

Although part of this gain can be attributed to the stellar performance of some higher risk funds such as Baillie Gifford American, Polar Capital Global Technology and Ninety One Global Gold, it wouldn’t have been possible without the underlying support of the four funds that we hold from the “Slow Ahead” Group.

Each week, we review the performance of thousands of funds that we put into our own Saltydog Groups based on which Investment Association sector they are in. The groups are: Safe Haven, Slow Ahead, Steady as She Goes, Full Steam Ahead – Developed Markets and Full Steam Ahead – Emerging Markets.

The nautical names give an easily recognisable indication of the volatility of the sectors and funds which are allocated to the groups.

The demonstration portfolios were originally designed to help people understand how our data can be used to manage a portfolio and so we thought it prudent to focus on the more cautious end of the spectrum. This means investing a large proportion of the portfolio in the lower volatility funds found in the “Slow Ahead” Group. Although this may limit the overall returns, it should also reduce any possible downturns while our members grow in confidence and experience.

Having grasped the principles of building a portfolio, then moving from the Ocean Liner to a more aggressive type of portfolio should be relatively straightforward. In essence, you are just investing a larger amount into the more volatile sectors (but only when they are performing well).

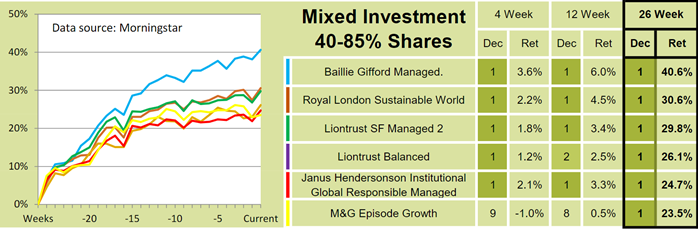

The funds that we are currently holding from the “Slow Ahead” Group are Royal London Sustainable World, Janus Henderson Institutional Global Responsible Managed, Liontrust Sustainable Future Managed, and Baillie Gifford Managed. We include more than 40 funds from the Mixed Investment 40-85% Shares sector in our analysis, and these four have consistently featured at the top of our tables.

Past performance is not a guide to future performance.

When we calculate the decile rankings, we compare all the funds in each group. Funds in decile one are therefore in the top 10% of their group for whichever period we are looking at. Although we initially started going back into these funds around six months ago, they all still rank in decile one over one, four, 12 and 26 weeks. That is exactly the kind of trend that we are looking for and has provided some welcome stability in the portfolios. We hope that they do just as well over the next six months.

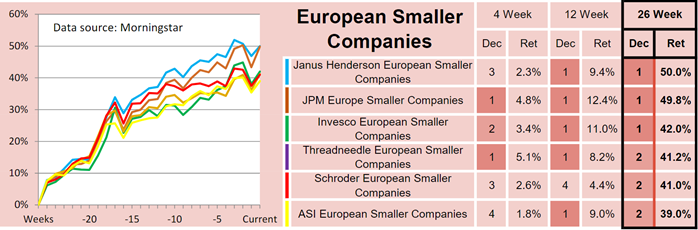

The best-performing sector over the last 12 weeks has been European Smaller Companies, and it is also the second best over four and 26 weeks. We’ve held the Janus Henderson European Smaller Companies fund since June and it also still features in both our four and 26-week tables. It did drop a few weeks ago, along with other funds in its sector, but has started to recover and has gone up by more than 2% in the last week.

Past performance is not a guide to future performance.

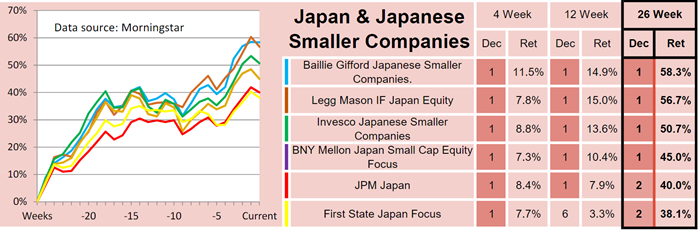

The leading sector over the last four weeks has been Japan and Japanese Smaller Companies. We have only recently invested in a fund from this sector, Baillie Gifford Japan Small Companies.

Past performance is not a guide to future performance.

It will be interesting to see if this develops into a more sustained trend.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.