Fund Spotlight: a UK fund to play a rally that has further to run

The ii Research Team offers an update and view on a Super 60 fund with a track record of beating the UK stock market over the long term.

13th November 2024 10:50

by ii Research Team from interactive investor

Towards the end of 2023 and throughout much of 2024, the UK market enjoyed a much-needed improvement in performance.

Over the past 12 months, the FTSE All-Share has risen over 16%, while the FTSE Small-Cap has rocketed an impressive 24.1%.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

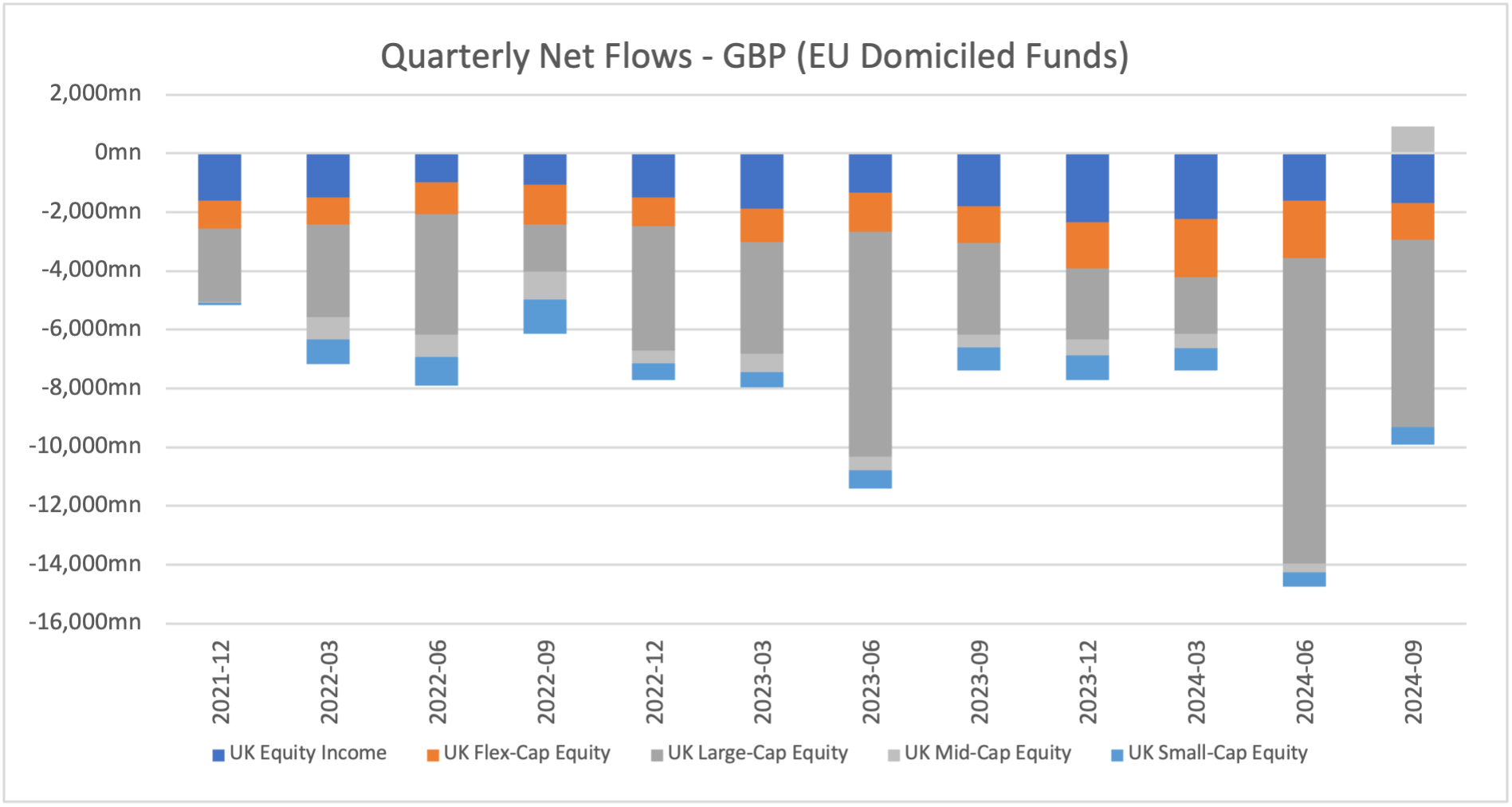

While UK investors have been on tenterhooks for an influx of capital into UK public-limited companies, this hasn’t happened yet. The UK remains oversold and out of favour versus global markets.

These positive market uplifts came about without any notable uptick of inflows into UK PLC, and is instead reflective of an improving economic, corporate and, debatably, policy environment.

From an economic perspective, the consumer price index (CPI) measure of inflation has fallen back towards target levels and looks better under control. Accordingly, the Bank of England has started cutting interest rates.

Economic indicators have begun to look less glum as increasing wages have supported consumer confidence. In addition, Purchasing Manager’s Index (PMI) data, an indicator of business conditions, across economically sensitive sectors, such as construction, have surged from the levels seen during the UK’s “technical recession” in the fourth quarter of 2023.

- Fund Spotlight: this fund taps into a powerful long-term trend

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

From a corporate point of view, UK-listed businesses are buying back shares at notable rates and underlying dividend growth has, for most sectors, been strong. While there’s been an uptick in valuations across the FTSE All-Share, they remain unflattering when compared with historic levels or with other developed regions.

RGI UK Recovery – managed by fund firm River Global (previously River & Mercantile) – aims to find those companies poised to recover as the market turns in their favour.

The abundance of negative sentiment and weak valuations over the past two years has created a prime environment for its fund manager, Hugh Sergeant, to take advantage.

What does the fund invest in?

RGI UK Recovery seeks quality UK companies at attractive valuations where profitability and sentiment are diminished, but recovery is on the horizon.

The fund has been managed since its 2008 inception by Hugh Sergeant, co-founder of River Global, while the small overseas allocation (circa 15%) is managed by colleague Eduard Hernandez.

The unconstrained portfolio is diversified and holds 300 to 400 names (currently 408) right across mega-cap down to micro-cap – and typically biasing towards small/mid-cap.

Due to the numerous holdings the fund has a low active share (meaning it has a high degree of crossover in its holdings with the benchmark) at circa 63%. Besides some bias to consumer discretionary, technology, and communications, the sector allocation doesn’t hugely deviate from benchmark. The aim here is to add value by gradually applying capital to a range of recovery ideas, rather than focusing too closely on a subset of stocks.

- Watch our RGI UK Recovery video: why the UK rally has legs - and what we’re buying

- Watch our RGI UK Recovery video: the shares and sectors we are backing under Labour

As with all funds across River Global’s stable, the process begins with a quantitative screen to source ideas, before management review and meet company directors. Companies are scored on the basis of three criteria: potential, valuation and timing.

The “potential” aspect aims to find fundamentally good businesses traversing different points in their life cycle. Given the “recovery” focus of the fund, around 62% of the portfolio is in the recovery stage, while 26% and 12% are in quality and growth stages.

The “valuation” component aims to detect companies trading at valuations that underestimate their economic worth, while the “timing” aspect looks for stocks that are already seeing an improvement in fundamentals, such as upwards revisions of earnings per share.

How has the fund performed?

While the fund has a low active share,this doesn’t mean it performs like its benchmark (MSCI UK IMI). Given the focus on recovering and cheaply valued stocks, as well as a bias towards small and mid-cap names, performance can be very differentiated.

The focus on “recovery” has been a strong tailwind as the UK market has rebounded over the past year.

Rolls-Royce Holdings (LSE:RR.) and Barclays (LSE:BARC), both companies that languished over the prior three years, are good examples of portfolio companies that have experienced reversals of fortune thanks both to macro and micro factors.

The past year has seen the fund return 21%, outpacing its benchmark index by 5%.

| Investment | 01/11/2023 - 31/10/2024 | 01/11/2022 - 31/10/2023 | 01/11/2021 - 31/10/2022 | 01/11/2020 - 31/10/2021 | 01/11/2019 - 31/10/2020 |

| RGI UK Recovery | 21.9 | 7.4 | -12.1 | 55.0 | -17.6 |

| MSCI UK IMI Index | 16.0 | 6.1 | -1.4 | 35.9 | -20.8 |

| Morningstar Category - UK Flex-Cap Equity | 17.9 | 3.7 | -13.8 | 37.6 | -14.5 |

Source: Total Return (GBP) to 31/10/2024. Past performance is not a guide to future performance.

Over three years, the fund has underperformed, in part due to its overweight positions across small and mid-cap.

However, over longer time frames, the fund has also been able to consistently outperform. Over 10 years, an annualised return of 8.4% is ahead of the index return of 5.9%.

Since the fund’s inception under Sergeant in mid-2008, the fund’s impressive annualised 11.1% return outstrips its index by over 4%.

Why do we recommend this fund?

RGI UK Recoveryoffers a unique approach to investing in businesses that are undervalued by the market but for whom fortunes are turning.

The quantitative Potential, Valuation, Timing process is the invention of manager Hugh Sergeant, and has proved to be a solid basis for defining an investible universe since the fund’s inception. While the focus is on recovery and does stray into the realms of cheaply valued companies, the approach to screening across a range of ratios and share price technical aids in avoiding the pitfalls of value traps or poor-quality businesses.

Sergeant is a veteran of UK-listed equities, with experience that includes the less-easily navigable small/mid-section of the market. The fund’s track record under his tenure speaks to the team and process’ ability to outperform in varying market conditions, outperforming in all but four calendar years of the fund’s 15-year lifetime.

- 10 hottest ISA shares, funds and trusts: week ended 8 November 2024

- Is it time to come out of cash? And what to buy now

The manager’s vast experience and repeatable process mean this fund holds a place on ii’s Super 60 rated list as an “adventurous” way to invest in recovering UK equities.

Calling the bottom of any market is a fool’s errand. Rather, while accepting the opportunity cost of being reserved, it can pay to await some material indication that recovery is under way before diving in.

However, there are plenty of signs that the UK economy is beginning the recovery leg of the economic cycle, with investors starting to feel some overdue reward for backing the UK.

The latest factsheet can be viewed here.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.