Fund Spotlight: a smoother ride to tap into fast-growing economies

The ii Research Team offers an update and view on a fund that has consistently achieved its objective of growing both capital and income.

20th March 2025 09:49

by ii Research Team from interactive investor

Amid the “exceptional” and, until now, relatively uninterrupted run for US equities since late 2022, it has been easy to neglect, or under-allocate to other regions, including Asia.

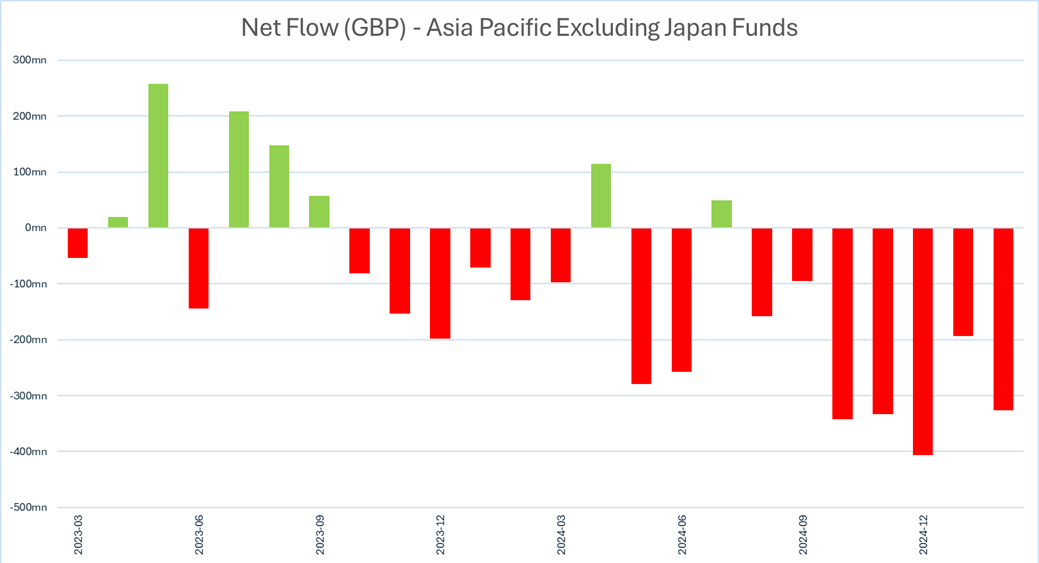

This has manifested first in terms of fund flows (figure one), with the Investment Association’s Asia Pacific (excluding Japan) sector showing on balance a negative flow picture over the past year.

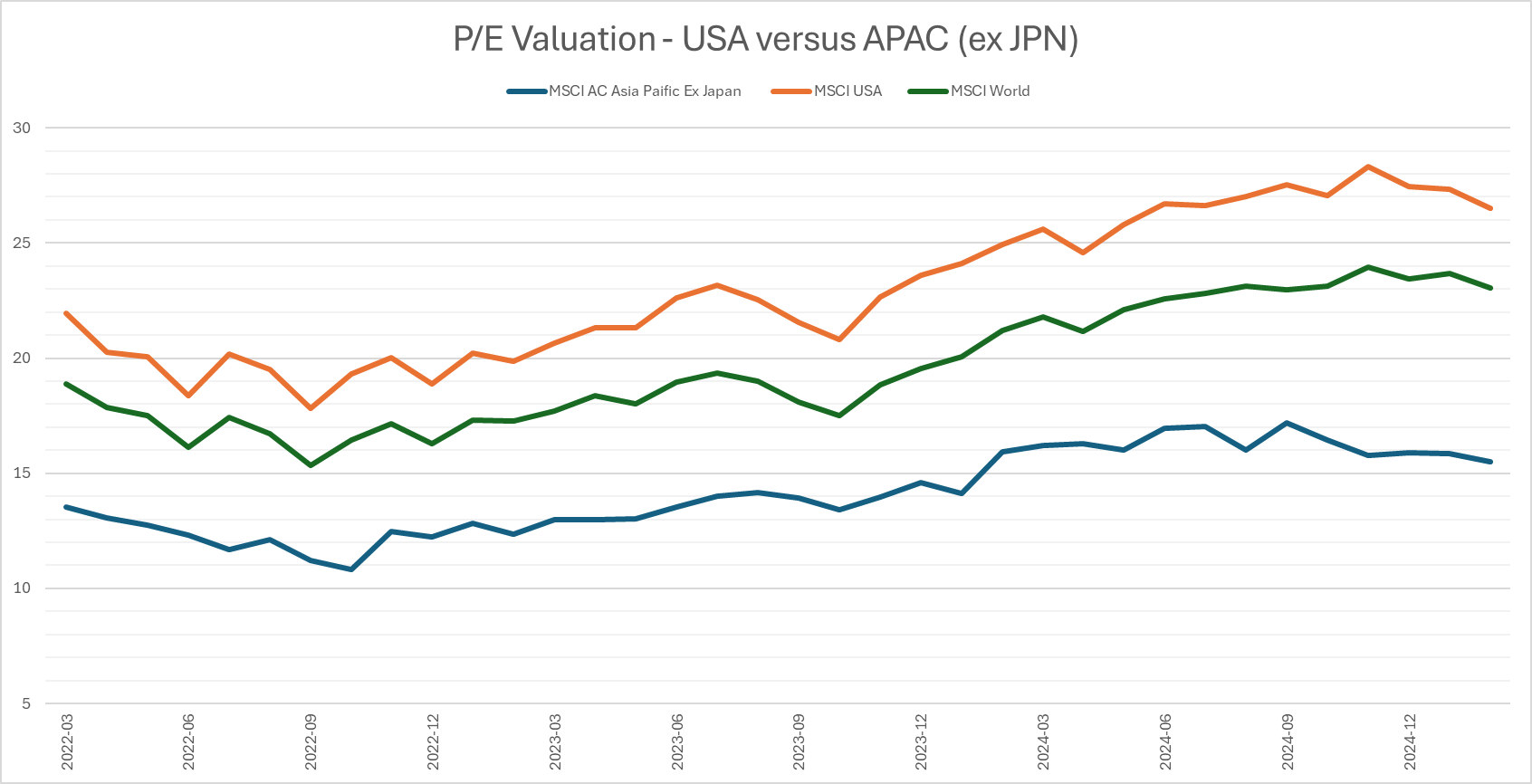

Second, a weaker investor sentiment is reflected in valuations of Asia-Pacific companies versus US or developed markets generally (figure two). In particular, markets such as China, South Korea, and Indonesia, trade at many multiples below the wider equity markets.

- Invest with ii: ii Super 60 Investments | Transfer an Investment Account | Free Regular Investing

Despite this, persistently US-focused investors have missed some pockets of immense strength over the past 12 months: Chinese and Taiwanese equities 2025 to name two, which rose 40% and 28% in the past year. Of course, there has also been abject weakness, for example South Korea, in the context of political crisis, and Indonesia, as the domestic economy struggles.

Asian equities are an opportunity set in their own right. Many of the supply chains and products in innovative areas, such as artificial intelligence (AI), electric/autonomous vehicles, and renewables are based in Asia. China particularly has shifted from a perception of copying or reverse engineering Western tech, to being at the forefront of new developments.

Second, Asia provides diversification as the various economies are often at different points in the economic cycle to the West. Furthermore, Asian markets can provide a hunting ground for dividend investors. Quality stocks with stable dividends can act as a buffer during equity market volatility given the steadier yield component of the total return.

Positioned at this cross section of rising economies, regional diversification and attractive yields we take a look at the Guinness Asian Equity Income Y GBP Acc fund.

What does the fund invest in?

The Guinness Asian Equity Income fundmanaged by Edmund Harriss and Mark Hammonds, offers a high-conviction, low-turnover approach to investing in dividend-paying Asian companies. It holds 36 stocks and is equally weighted, reducing risk of exposure to a single name and making for differentiation versus benchmark. The managers look for profitable companies with strong returns on capital that are well placed to provide dividend growth over time.

The portfolio’s overall country and sector allocations are a product of stock selection decisions, with each stock being allocated to equally in the portfolio. There is a notable overweight to China (38% vs 29% for index – MSCI All Country Asia Pacific ex Japan). The next largest country allocation, Taiwan, is about in line with index (18%) followed by (a slight underweight) allocation to Australia (10% versus 14.6% for the index). A notable underweight is that of India, which forms just 2.6% of the portfolio, but over 16% of the benchmark.

- The equity income trusts with high tech weightings

- DIY Investor Diary: I invest so I don’t have to worry about money

Over the past three to four years, the managers have stuck with an overweight position in China throughout the property market woes and economic weakness that has plagued the market and is now perhaps beginning to abate. Conviction is rooted in belief in the country’s potential as an innovator in growth sectors, as well as its status as the paragon of growing regional trade between Asian countries. This focus on intra-regional trade is key, especially given the threat US tariffs pose for non-US exporters. Guinness Asian Equity Income’s portfolio is notably positioned in favour of companies that are exposed to Asia-Pacific economies. In fact, according to Morningstar data, only about 11% of revenues for its portfolio companies derive from the US.

In terms of sectors, many opportunities are found across financials at 32% of the portfolio (24.4% for benchmark), followed by technology (24% of portfolio and 23% of benchmark) and consumer discretionary (16% of portfolio and 14% of benchmark). There are no holdings in energy, materials or industrials.

Unsurprisingly given the focus on offering an attractive portfolio yield, there is a bias towards value for the fund, versus a benchmark that leans closer to growth. As a result, on aggregate the stocks in the fund trade at notably lower valuations versus those of the benchmark.

How has the fund performed?

The fund’s performance has been consistently strong, outperforming benchmark and peers over one, three, five and 10 years. Impressively, the fund has achieved its strong returns with lower volatility than its benchmark since the fund’s inception.

More recently, the fund has beaten its benchmark in four of the past five calendar years. The fund has tended to see lesser drawdowns than its benchmark in times of market turmoil - with the exception of the first half of 2020.

| Investment | 01/03/2024 - 28/02/2025 | 01/03/2023 - 29/02/2024 | 01/03/2022 - 28/02/2023 | 01/03/2021 - 28/02/2022 | 01/03/2020 - 28/02/2021 |

| Guinness Asian Equity Income | 15.2 | 2.5 | 0.6 | 5.3 | 19.0 |

| MSCI AC Asia Pacific Ex Japan | 13.0 | 0.9 | -2.4 | -8.5 | 27.3 |

| Morningstar Category - Asia-Pacific ex-Japan Equity Income | 9.6 | 1.0 | -0.5 | 0.0 | 18.6 |

Source: Morningstar Total Return (GBP). Past performance is not a guide to future performance.

On the grounds of their general lack of dividend-paying attributes, the fund is underweight a number of the Chinese technology giants, such as Tencent Holdings Ltd (SEHK:700), Alibaba Group Holding Ltd ADR (NYSE:BABA), Xiaomi Corp Class B (SEHK:1810), Meituan Class B (SEHK:3690). Despite those stocks helping to drive the Chinese market in the first two months of 2025, the fund’s performance has still held up well versus rivals. Moreover, it has seen broadly robust dividend growth across its portfolio in February. The fund has still benefited from its allocation to one of China’s “Terrific Ten” tech stocks in the form of popular video game developer NetEase Inc ADR (NASDAQ:NTES), which has helped to power the fund’s returns so far in 2025.

Why do we recommend this fund?

The Guinness Asian Equity Incomefund, which appears on our Super 60 list of investment ideas,offers a unique approach to investing in Asian equities, consistently achieving its objective of growing both capital and income. The equal-weighted approach and focus on quality dividend-paying businesses leads to great differentiation versus benchmark and peers, from a stylistic perspective as well as in terms of sectors and regions. This differentiation is also reflected positively in performance over the short and long term.

The absence of sector or geographical constraint means the portfolio can diverge greatly in weightings or even omit sectors/geographies. While this can result in certain areas of concentration risk, the managers are aware and conscious of this and seek to maintain a degree of diversification across the fund.

- How investors can hedge against Trump’s trade wars

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

While this isn’t a fund that focuses on income above all else, the yield of 3.9% is attractive and typically comprises a stable and substantial portion of the fund’s total return.

Under Harriss and Hammonds’ tenure, the strategy has proven itself able to consistently outperform over time, and has done so versus income-focused peers as well as more growth-oriented options and in varying market conditions.

The fund’s relatively concentrated profile and exposure to still emerging economies makes it a satellite exposure for most investors’ portfolios. Asia ex Japan equities, while offering the benefit of diversification, face their own challenges in terms of US tariffs, political instability and the influence of the US dollar on returns.

However, the opportunity set of Asian companies is huge and ought not to be underestimated. For those seeking regional diversification and wishing to tap into the structural tailwinds and income potential that Asia’s equity markets hold, the Guinness fund offers a prudently-managed and time-tested approach to doing so.

The latest factsheet can be viewed here.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.