Fund spotlight: Fundsmith Sustainable Equity

11th October 2021 10:39

by Liberty Godfrey from interactive investor

interactive investor analyst Liberty Godfrey examines Terry Smith’s sustainable fund, which is a member of our ACE 40 list.

Fundsmith Sustainable Equity fund aims to achieve long-term growth in value through investing in high-quality equities across the globe. The fund adopts similar investment principles to the better-known Fundsmith Equity fund, but excludes specific companies and sectors from its investment universe.

The manager aims to select high-quality businesses that: can sustain a high return on operating capital employed, whose advantages are difficult to replicate, do not require significant leverage to generate returns, have a high degree of certainty of growth from reinvestment of their cash flows at high rates of return, are resilient to change, and whose valuation is considered to be attractive.

Since launch in November 2017, the fund has grown to a size of £618 million. The fund is not managed with reference to any benchmark, but sits within the Investment Association (IA) Global sector. The fund is managed by highly experienced manager Terry Smith, who is the founder and chief investment officer of Fundsmith and has run the fund since launch.

- Terry Smith on Warren Buffett and how to find good companies

- Terry Smith: outperformance during value rally tells its own story

- Terry Smith: my view on tech shares, and why it’s not too late to buy

How it invests ethically

The fund will not invest in businesses that have substantial interests in any of the following sectors: aerospace and defence, brewers, distillers and vintners, casinos and gaming, gas and electric utilities, metals and mining, oil, gas and consumable fuels, pornography, and tobacco.

In addition, further criteria is applied to screen investments in accordance with its sustainable investment policy, which takes into account environmental, social and governance (ESG) policies and practices as well as companies’ policies and practices on research and development, new product innovation, dividend policy, and the adequacy of capital investment.

Note: inception of fund 1 November 2017.

Drilling down into the fund

The fund aims to invest in 20 to 30 companies, currently it holds 25. The concentrated portfolio results in the companies having a meaningful impact on the performance.

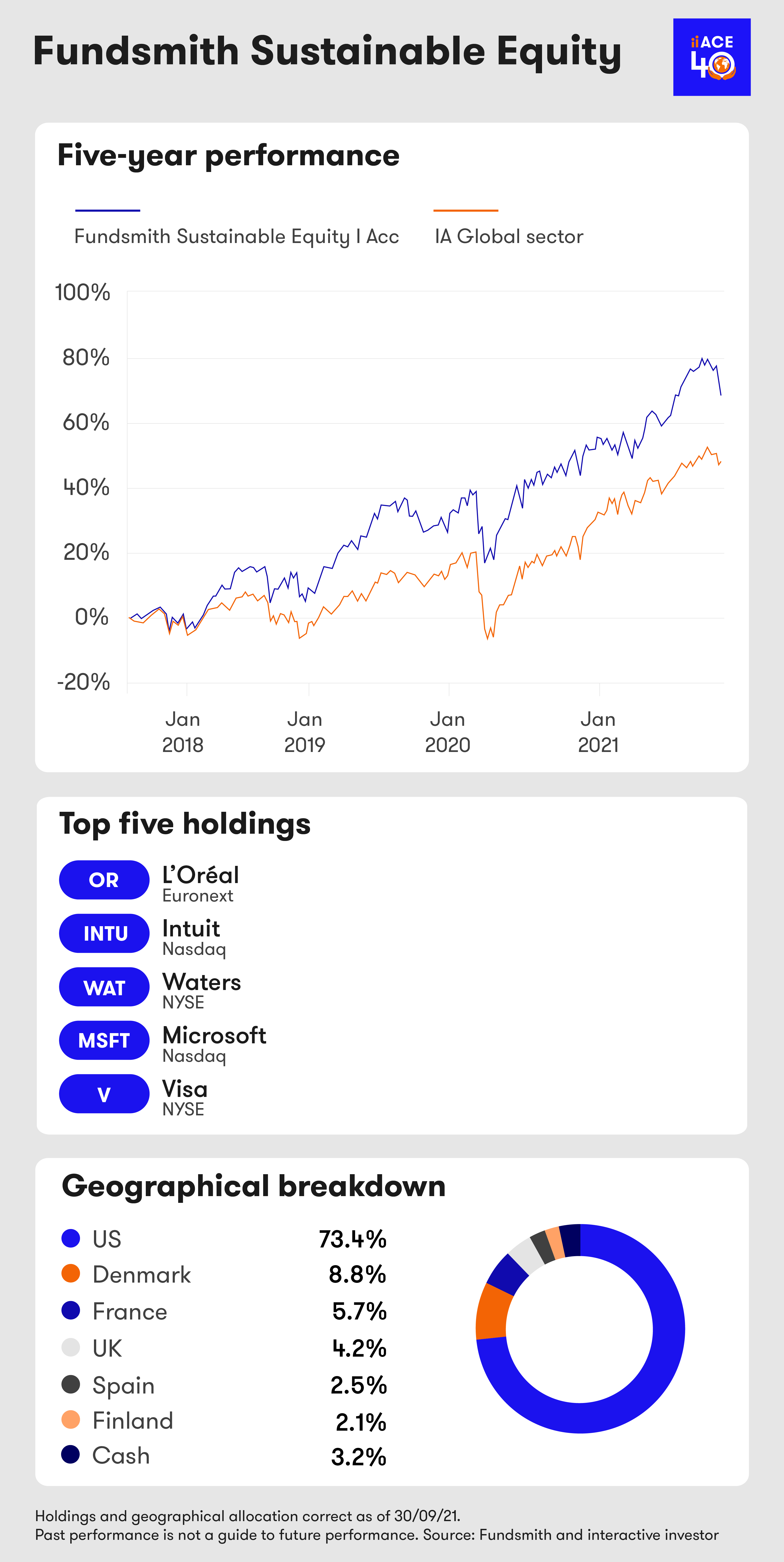

The companies have a median market cap of £89.5 billion. The fund is highly exposed to the US with more than 70% of the portfolio in this region. Other top countries for the fund include Denmark (8%), France (6%) and the UK (4%). In terms of sector exposure, the manager finds the most opportunities within healthcare (29%), consumer staples (29%) and technology (24%), which make up most of the portfolio.

Top holdings in the fund include French personal care company L'Oreal (EURONEXT:OR), US multinational technology corporation Microsoft (NASDAQ:MSFT), and PayPal (NASDAQ:PYPL), a US multinational financial technology company.

Performance

The fund has delivered strong performance since launch in 2017. Over three years, it has outperformed the Investment Association (IA) global sector, 50.9% versus 39.2%.

- Ethical investing jargon buster: all you need to know

- Want to invest ethically? ii’s ACE 40 list of ethical investments can help

Since the beginning of the pandemic in March 2020, the fund has marginally outperformed the sector, 36.3% versus 35.7%, with the fund proving to be relatively resilient.

Year-to-date, the fund has returned 12.8%, which marginally beats the IA global sector average of 12.3%. The top five contributors in August were Novo Nordisk (NYSE:NVO), Intuit (NASDAQ:INTU), Waters (NYSE:WAT), Microsoft (NASDAQ:MSFT) and Estee Lauder (NYSE:EL). The top five detractors were Amadeus (XMAD:AMS), Visa (NYSE:V), Coloplast (XETRA:CBHD), Starbucks (NASDAQ:SBUX) and Unilever (LSE:ULVR).

| 02/10/2020 - 01/10/2021 | 02/10/2019 - 01/10/2020 | 02/10/2018 - 01/10/2019 | 02/10/2017 - 01/10/2018 | 02/10/2016 - 01/10/2017 | |

| Fundsmith Sustainable Equity I Acc | 15.70 | 12.52 | 13.61 | — | — |

| MSCI ACWI Growth NR USD | 17.08 | 25.85 | 8.60 | 18.22 | 15.32 |

| IA Global | 20.53 | 7.53 | 5.84 | 11.92 | 14.79 |

Source: Morningstar, Total Returns, GBP.

Why do we recommend it?

Fundsmith Sustainable Equity fund is part of the ACE 40 list of ethical investments as a global equity, adventurous recommendation. It also sits within the ACE ‘Considers’ category, meaning that it carefully considers a wide range of ESG issues or themes when balancing positive and negative factors. The fund is managed by a highly experienced manager and the investment process aims to achieve long term growth in value.

The fund has shown itself to be resilient over the recent difficult period and, in addition, the ethical philosophy allows investors to be mindful of ethical issues while gaining exposure to companies around the globe.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.