The fund sector delivering consistent returns despite choppy markets

One strategy in this sector makes the grade for Saltydog Investor.

13th November 2023 13:57

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

At Saltydog Investor we normally focus on the short term, anything from one week up to about six months.

Each week we generate new graphs and tables showing our members the performance of a wide range of funds over the last few weeks and months. We present the data in a way designed to help DIY investors identify which sectors are trending up, and then highlight the best performing funds in each sector. It works well for people who look forward to reviewing their investments on a weekly basis, but we understand that there are many others who prefer to take a longer-term view.

- Invest with ii: Invest in Unit Trusts | Top Investment Funds | Top ISA Funds

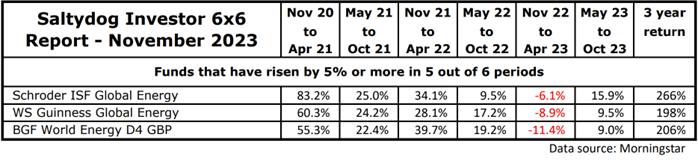

That is why we trawl through our fund data every three months looking for funds that have consistently achieved gains of 5% or more in six consecutive six-month periods. The results are published in our ‘6 x 6 Report’. When we crunched the numbers at the beginning of November, no funds had met the target in each of the six-month periods. However, there are three funds that have risen by more than 5% five times out of six.

They are the three energy funds, Schroder ISF Global Energy, WS Guinness Global Energy (which used to be TB Guinness Global Energy), and BGF (Blackrock) World Energy.

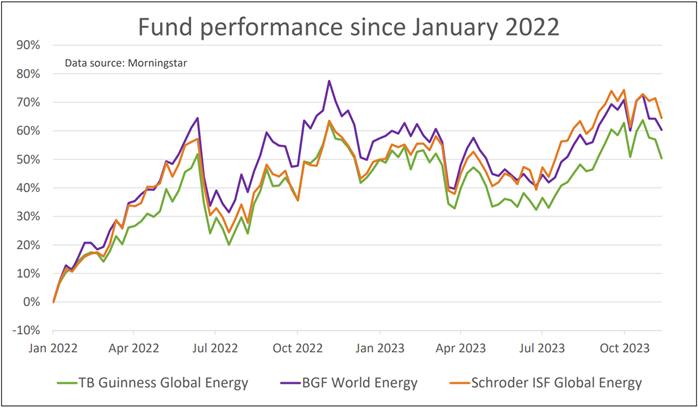

These funds were badly hit by the Covid-19 pandemic when the world went into lockdown and demand for energy plummeted. However, they then recovered and performed well in 2021 when most other funds were struggling. Demand for commodities like oil and gas accelerated as countries went back to work, while supply was being disrupted by the war in Ukraine.

They continued to perform well through the first half of 2022, but then saw a sharp correction. Inflation was soaring, interest rates were rising, and it looked as though America and other developed economies were heading into a recession. The anticipated demand for energy and natural resources might have been overstated.

However, so far, the recession has been avoided and inflation has started to come down. The energy funds soon recovered and went on to set new highs in November 2022.

The following six months were disappointing, and all three funds dropped. The recovery in China was much slower than many had expected, and overall global growth was sluggish.

- Terry Smith adds tech stock owned by Smithson to flagship portfolio

- Five fund trends catching our eye

Since then, there has been a bit of a recovery. In the six months from the beginning of May to the end of October these funds made gains of 9% or more. China’s economy finally seems to be getting going again, with annual GDP growing by 3.9% in quarter three compared with 0.4% in quarter two, beating expectations. The US also had a good quarter, with its economy growing at its fastest rate since the end of 2021. This will be pushing up demand for oil, while supply is limited by OPEC and Russia.

The outbreak of war in Gaza also temporarily pushed the price of oil up at the beginning of October, but it has subsequently eased back. However, with political tension in the Middle East, there is always the possibility that oil supply will be affected.

Over the years we have held all of these funds in our demonstration portfolios, but at the moment we are only invested in the Schroder ISF Global Energy fund.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.