The fund up 40% over the past six months that we’re adding to

24th July 2023 14:17

by Douglas Chadwick from ii contributor

Saltydog Investor explains why it has upped exposure to a fund in fine form, but is avoiding the temptation to take out a bigger position.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

In recent months, a couple of themes keep reoccurring - the high level of volatility in global stock markets and their extreme sensitivity to any changes in expected central bank interest rates.

- Invest with ii: Top Investment Funds | Index Tracker Funds | FTSE Tracker Funds

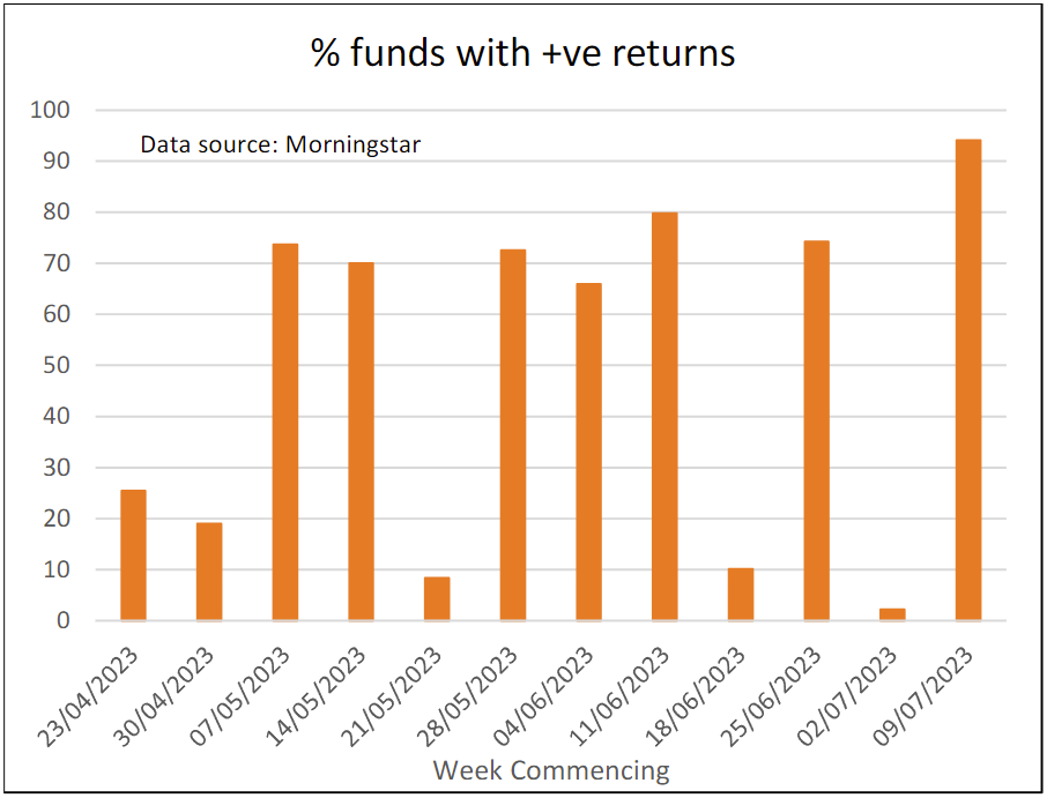

This has been particularly noticeable in the past few weeks. When we did our analysis last week, nearly 95% of the funds we monitor had gone up in the previous week. The week before, more than 95% of them had gone down.

Past performance is not a guide to future performance.

We try to make a considered response to these wild swings in market sentiment when reviewing the two Saltydog demonstration portfolios – Tugboat and Ocean Liner. When nearly all the funds were going down, we did not panic and sell everything. In addition, when things were looking better last week we did not go 'all in', although we did add to some of our holdings.

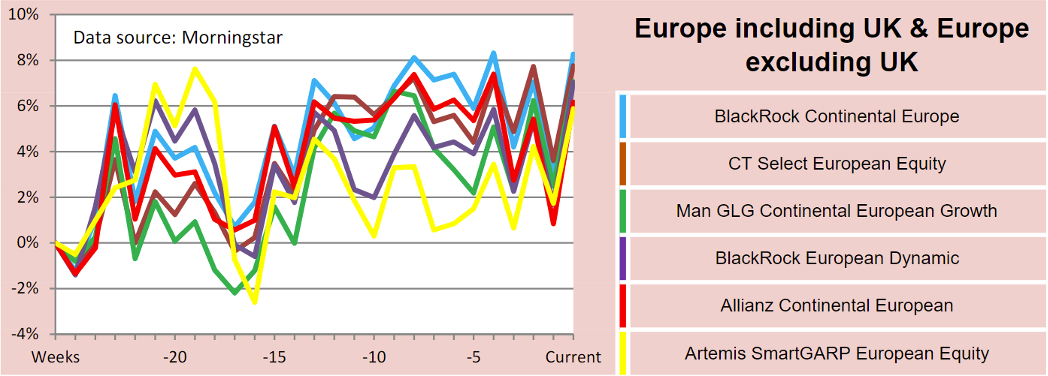

Although most sectors have been volatile over the past few months, some have definitely been worse than others. As an example, here is a graph from last week’s reports, showing the performance of the leading funds from the Europe excluding UK and Europe including UK sectors over the previous 26 weeks.

Past performance is not a guide to future performance.

The top one may be showing a gain of over 8%, but it would not have been the previous week, and who knows where it will be in a couple of weeks’ time. This is a fairly extreme example, but there are many sectors where the best-performing funds have followed a similar trend.

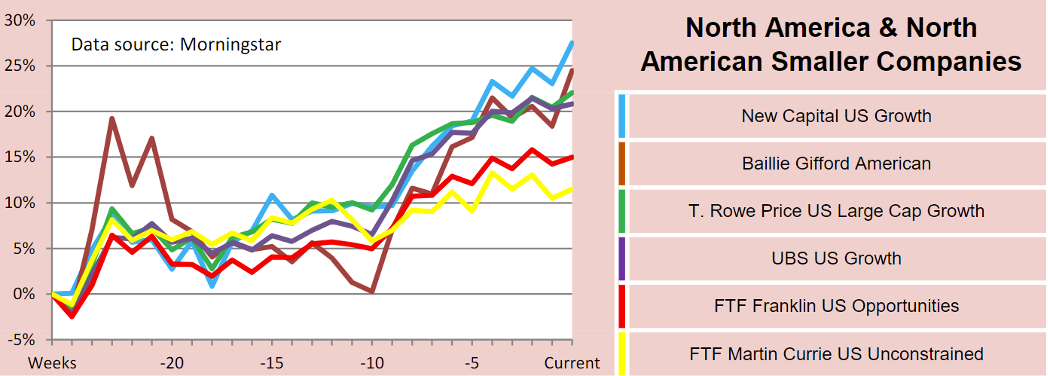

In contrast, some of the leading funds from the North American and North American Smaller Companies sectors have been much less volatile.

Past performance is not a guide to future performance.

It would be unfair to suggest that they have not also had their setbacks, but their overall gains are much greater, and it has definitely been a more comfortable ride.

We hold the UBS US Growth fund in our portfolios and last week added to our investment.

There is a close link between the performance of the 'technology' stocks and the broader US indices.

I recently read a Bloomberg article that pointed out that “just seven companies now make up 26% of the S&P 500 index’s total value”. It went on to say, “the companies — Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), NVIDIA (NASDAQ:NVDA), Tesla Inc (NASDAQ:TSLA), Alphabet (NASDAQ:GOOGL) and Meta (NASDAQ:META) — are valued at more than $11 trillion”.

- Why tech has another great decade ahead of it

- Top tech investor on how to profit from artificial intelligenc

That is pretty amazing when you think that the total UK GDP is less than £2.5 trillion ($3.2trillion). I am not convinced that having so much wealth tied up in so few companies is such a good thing, but we are where we are.

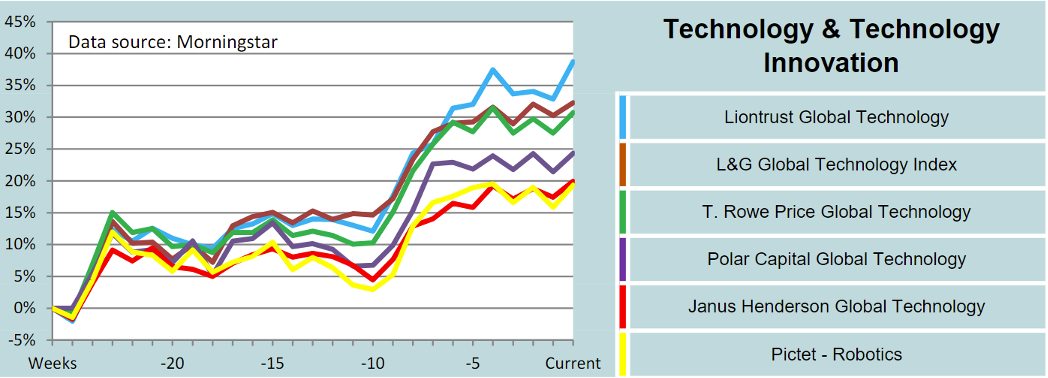

Our portfolios are currently invested in two funds from the Technology & Technology Innovation sector, L&G Global Technology Index and Liontrust Global Technology.

Past performance is not a guide to future performance.

Both have done well and are currently in first and second place in our 26-week table, but the Liontrust fund just has the edge. Last week, our Ocean Liner added to its holding in the Liontrust fund, taking it from 4.2% to 6.5% of the overall portfolio value.

You may well wonder why we are not taking an even bigger position, especially when you consider that it is up almost 40% in the past 26 weeks, but there are a couple of things to take into account.

First, our demonstration portfolios are designed to be cautious. We are trying to explain how our data can be used to make gains, but at the same time protect ourselves from sudden drops in the market. We are looking for long-term trends and are happy to take our time growing holdings that have a proven track record. For people with more experience, and a higher or lower tolerance to risk, we aim to provide the data needed to help them tailor their investments to suit their own requirements. I know that many of our subscribers are happy to do this.

- Fund managers still not convinced by stock market rally

- Five takeaways for fund and trust investors from first half of 2023

Second, it is very easy to be wise with hindsight. You can see that the funds in the graph above initially shot up by around 10%, then did very little for the next 15 weeks, before having another surge. They could have just as easily gone the other way. If we had looked over the past 12 months you would find that the Liontrust Global Technology fund initially went up, but then fell by 20% before starting on the upward trend that we have seen over the past six months. It is also worth noting that it is still lower than it was when it peaked towards the end of 2021. So, it has not been plain sailing all the way.

The most recent upturn has been attributed to the fact that inflation in the US has now fallen to 3%, down from over 9% a year ago, and that the US Federal Reserve did not increase interest rates last month. The technology funds are also gaining additional momentum from the recent hype surrounding anything to do with artificial intelligence (AI).

Last week, the latest data from the Office for National Statistics (ONS) showed that annual UK inflation has dropped from 8.7% in April and May to 7.9% in June. Hopefully that will give UK stocks a similar boost.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.