FTSE rebound: big winners in a sea of blue

Just a handful of FTSE 350 stocks are down today, but which popular shares are leading the pack?

16th June 2020 13:00

by Graeme Evans from interactive investor

Just a handful of FTSE 350 stocks are down today, but which popular shares are leading the pack?

Fallers among the London stock market's top 350 shares were hard to find today as investors set aside fears of a second wave of Covid-19 to snap up housebuilders, airlines and banks.

The resumption of the stock market recovery was triggered by the US Federal Reserve outlining its corporate bond buying plan, as well as speculation that President Trump is readying a $1 trillion infrastructure spending boost for the world's biggest economy.

FTSE 100 index beneficiaries included North America-based plumbing and building supplies specialist Ferguson (LSE:FERG), with its shares up 5% alongside a rise of 9% for Ashtead (LSE:AHT) on the day that the Sunbelt equipment rental owner posted a robust set of full-year results.

Other notable blue-chip performances featured gains of 6% for housebuilders Taylor Wimpey (LSE:TW.) and Barratt Developments (LSE:BDEV), 5% for Royal Bank of Scotland (LSE:RBS), Barclays (LSE:BARC) and Lloyds Banking Group (LSE:LLOY) and rises of over 7% for easyJet (LSE:EZJ) and BA owner International Consolidated Airlines Group (LSE:IAG).

The only stock in negative territory was car insurer Admiral (LSE:ADM) as the FTSE 100 index jumped more than 2% to reverse some of the losses seen last week, when resurgent markets were stopped in their tracks by new Covid-19 cases in Beijing and parts of the United States.

It was a similar story in the FTSE 250 index, which surged 2.5% with only four stocks on the fallers board. Struggling outsourcing firm Capita (LSE:CPI) set the pace with a 10% rise, while Wood Group (LSE:WG.) was 8% higher after securing two US-based solar power contracts.

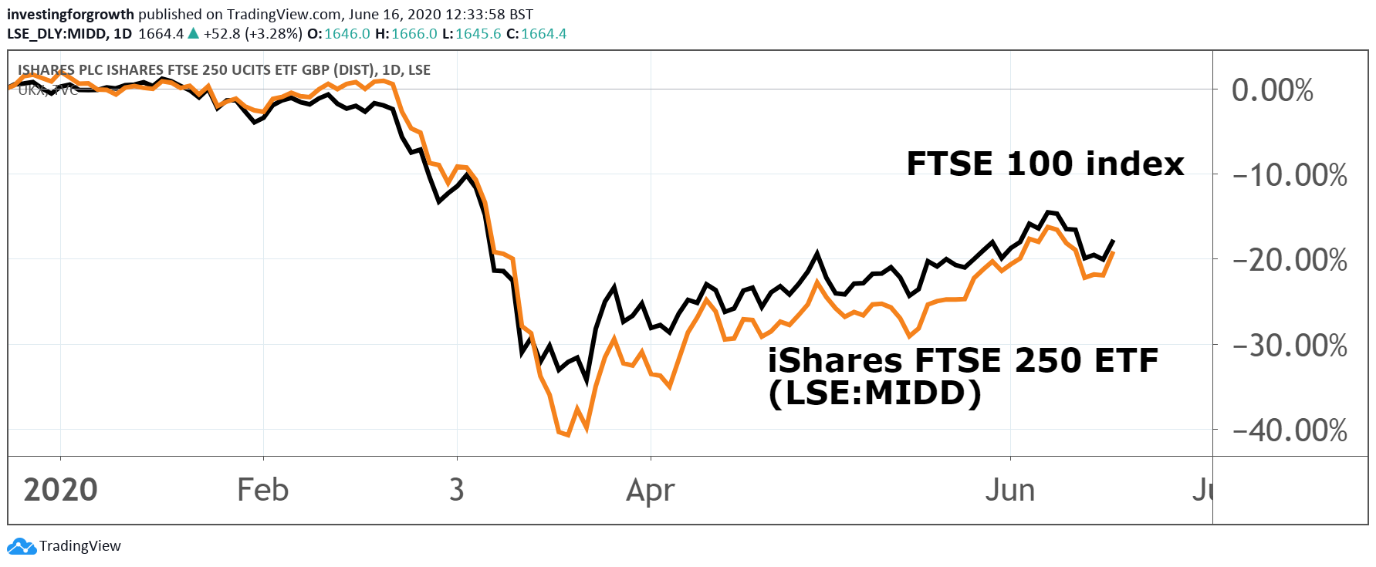

Source: TradingView. Past performance is not a guide to future performance.

Aston Martin Lagonda (LSE:AML) was again one of the most traded stocks across the FTSE 350 index, with the luxury car maker's shares continuing to attract buying interest in the wake of Formula One motor racing financier Lawrence Stroll taking a 25% stake in the company. Shares were up another 8% to 75p, compared with 35p less than a month ago.

The re-opening of the retail sector was again in focus after Greggs (LSE:GRG) said it would trade from 800 shops on Thursday, with the rest of its 2,050-strong estate set to follow early next month.

The initial product range will be limited to best-selling products, with the company also warning that social distancing measures will mean sales may be lower than normal for some time. Greggs has also temporarily suspended its new shop opening programme.

Despite the ongoing uncertainty, shares rose 6% to 1,748p. That compares with the price of 1,588p when CEO Roger Whiteside bought £178,000 worth of Greggs shares at the start of the Covid-19 lockdown in late March. The stock was at a near all-time high of 2,440p in February.

- Richard Beddard gives this top AIM share the thumbs up

- The fund I sold after a 22% rally

- ii view: Can BP dividend survive switch to greener world?

Joules Group (LSE:JOUL) shares also jumped 9% to 125p today after the lifestyle brand emerged from the lockdown in better than expected health, driven by e-commerce sales 40% higher than the same period a year earlier.

The group, which raised £15 million from investors in a 80p a share placing in early April, said it ended its 31 May financial year with net cash of £4 million and headroom of £53 million against borrowing facilities. Twelve stores re-opened yesterday, with the rest of the 128-strong estate due to resume trading on a phased basis in the coming weeks.

Other interesting moves in the FTSE 250 index included 4imprint (LSE:FOUR), which is the biggest direct seller of promotional materials in the United States, where it earns the vast majority of revenue.

In April, the Manchester-based company said the spread of the pandemic and stay-at-home messages had resulted in orders for corporate-branded pens and other merchandise reducing to about 20% of a year ago. But with the partial or full lifting of these restrictions in many US states in May and early June, weekly order counts are now approaching 50% of the 2019 comparative.

Shares fell from 3,420p in mid-February to 1,310p a month later, but the stock is now back at 2,600p after an 8% surge on the back of today's update. Our companies analyst Richard Beddard backed 4imprint as a long-term investment when shares were at 1,850p last month.

- 4imprint: the Amazon of promotional materials is a long-term buy

- Stockwatch: De La Rue up 350%, what now?

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Away from the pandemic recovery, there was good news from FTSE 250 index listed biotherapeutics firm PureTech Health (LSE:PRTC) after the US Food and Drug Administration gave clearance for EndeavorRx as a prescription treatment for children with attention-deficit/hyperactivity disorder (ADHD).

EndeavorRx has been developed by 34%-owned PureTech founded entity Akili, whose digital medicine is delivered through immersive action video game experiences to keep patients engaged and immersed in the treatment. Peel Hunt said the clearance added to PureTech’s “superlative track record of driving shareholder value”. Shares rose 7% to 258p.

Elsewhere, resurgent De La Rue (LSE:DLAR) jumped another 11% to 161.6p after the Serious Fraud Office (SFO) discontinued its investigation into the group in relation to suspected corruption in the conduct of business in South Sudan. The SFO probe was first announced last July.

De La Rue's shares have now jumped by more than 300% since the start of June, when the bank note and passport printer reported a strong start to its new financial year to offset fears about the impact of Covid-19 on its operations.

There was also good news from ground engineering firm Keller Group (LSE:KLR) after it confirmed it would recommend the 27.4p final dividend announced with full-year results on 3 March.

The group, which has the potential to be one of the beneficiaries of President Trump's infrastructure spending, also said the impact of Covid-19 had been less severe than first anticipated.

Today's announcement continues Keller's record of maintaining or increasing its dividend every year since its flotation in 1994. Shares jumped 10% to 694p.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.