FTSE for Friday: the index could hit a glass ceiling here

25th March 2022 07:52

by Alistair Strang from Trends and Targets

After an incredible recovery from its low point earlier this month, independent analyst Alistair Strang sets out his major target levels for the blue-chip index in the days and weeks ahead.

The market is now in a very strange situation, one where a long position may prove fascinating. Or extremely painful!

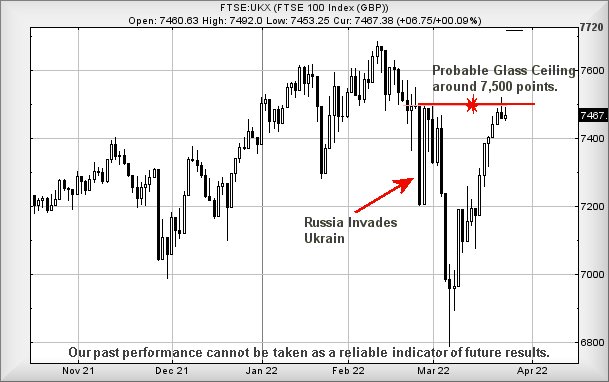

It has now been a month since the Ukraine conflict began and were we completely gullible, we’d now be proposing the FTSE 100 index intends a recovery toward 7,720 next. After all, as the chart highlights, the index has recovered to the pre-Russia level. This, we suspect, is where a glass ceiling shall come into play, if only due to a realisation the issue has not gone away.

The day before Russia invaded, the FTSE had a high of 7,550 points. To be stubborn, only market closure above this level will convince us a return to normality can be scheduled. Instead, we suspect we’re looking at a phoney recovery, possibly fuelled by a complete lack of knowledge as to what is actually going on.

Painfully obvious propaganda from both sides is tending to cloud any attempt to discover reality and, while this should be expected in any conflict, market movements, certainly from a day to day perspective, feel the opposite of trustworthy. It’s possible the stunning recovery from the 6,800 point level on 7 March shall prove completely erroneous, an amazing 700-point rise in just 14 sessions risking becoming a fond memory very quickly if anything goes seriously wrong in Europe.

- Richard Hunter: My ISA pick for Tax Year End 2022

- War, what war? The stock markets that behave like Ukraine conflict never happened

- How and where to invest £50k to £250k for income

- Why reading charts can help you become a better investor

With the market flirting coquettishly at the level before everything hit the fan, we’d be reticent in advocating any sort of long position at present. Clearly, the market has recovered, but so far has failed to exceed the high achieved prior to this mess.

Source: Trends and Targets. Past performance is not a guide to future performance

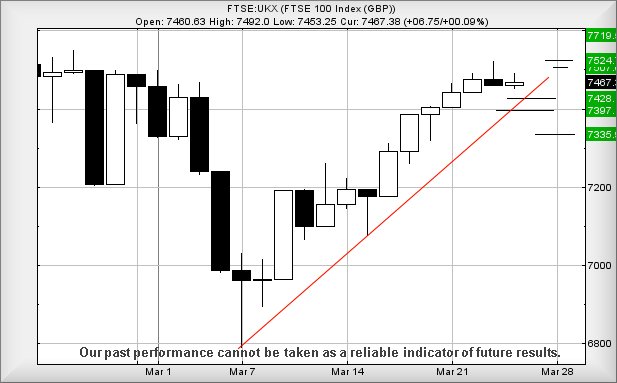

As for our popular FTSE for Friday, we’re going to start with a potential short scenario. However, it must be remembered the market is currently hovering at a hesitation level, a point in time where both Long and Short positions are liable to fizzle out around our initial target levels.

Near term, below 7,453 should apparently promote reversal to a rather tame 7,428 points. If broken, our secondary calculates at 7,397 points.

Visually, our initial target does make some sense, running into an imaginary Red uptrend since the low earlier this month. We’re not convinced about our secondary, if only due to it taking the index into a zone with a longer term attraction down at 7,335 points.

- Meet the ‘new FAANGs’ the pros are getting excited about

- Shares, funds and trusts for your ISA in 2022

Our Long position scenario is slightly less vague, suggesting movements next above 7,492 should make an attempt at an initial 7,507 points. If exceeded, our secondary calculates at 7,524 points. Both ambitions keep the index toddling around the glass ceiling level, something we shall not concede is broken until such time the FTSE 100 closes above the high, the day before Russia invaded.

Source: Trends and Targets. Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.