FTSE for Friday: how high could the FTSE 100 go in 2025?

The FTSE 100 has mostly traded a 300-point range since May, struggling to make a move above 8,400 stick. Independent analyst Alistair Strang shares his view on prospects for the year ahead.

13th December 2024 07:13

by Alistair Strang from Trends and Targets

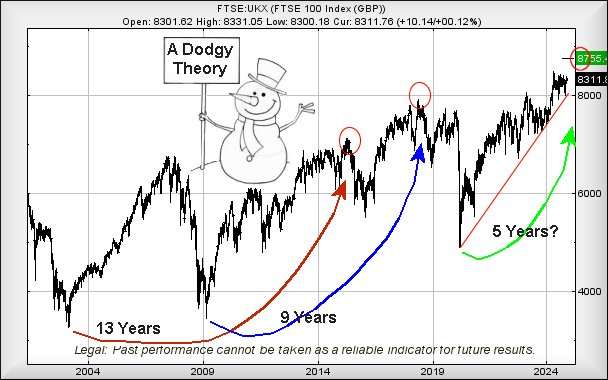

When we look back in time, the FTSE 100 has produced some interesting patterns of behaviour, creating a situation which may actually become useful.

When we review how long it took for the index to recover from its 2003 tech crash low, 13 years slithered by before our calculation proved correct. Then, we’d the financial crash of 2009, a disaster which took nine years before we could regard recovery as complete.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

While it’s always stupid to draw assumptions from a single data result, if we extrapolate using this gap between recoveries, we may embrace 2025 as the year when we should hope the market achieves a high of around 8,755 points, then invariably experience some reversals.

Another interesting facet from extrapolating data irresponsibly like this is being able to present the year 2036, this being the next point when the world should anticipate a major market crash. Our inclination is to regard such seriously long-term predictions as far from trustworthy.

We like playing with numbers but the idea of a “top” around 8,755 points next year is attractive, certainly suggesting a point where opening a short with a seriously tight stop will make some sense!

Source: Trends and Targets. Past performance is not a guide to future performance.

As for the FTSE 100 near term, we’re looking for arguments which favour market recovery above 8,334 as heading to an initial 8,376 points. If bettered, our secondary now calculates at 8,461 points, though we’re not inclined to expect both target levels to appear within a single day.

Additionally, our secondary offers the prospect of being “game changing”, taking the UK index solidly above 8,400 points, being introduced as a nonsense solid barrier. Market traders will be perfectly aware there’s no such thing as a ceiling or floor but with the FTSE, bettering the 8,400 level certainly looks like a free gift to optimistic traders.

Unfortunately, for those taking the plunge with longer-term Big Picture hopes, the tightest stop – if 8,334 is triggered – is ridiculous at 8,260 points.

Our converse scenario demands the index slip below 8,250 points, triggering reversal to an initial 8,225 points with our secondary, if broken, at 8,171 points.

Enjoy the weekend!

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.