FTSE for Friday: do the charts indicate a stock market correction in Q4?

16th September 2022 07:20

by Alistair Strang from Trends and Targets

With Wall Street within a whisker of a two-month low and markets elsewhere looking jittery, independent analyst Alistair Strang gives his weekly update on the major UK and US indices.

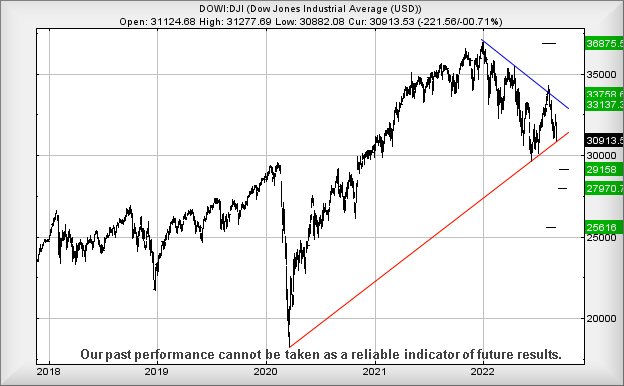

We’ve taken a look at Wall Street and the uptrend since the Pandemic Drop in March 2020, and can calculate that the Dow Jones needs to close above 30,914 points to avoid breaking below Red on the chart, destroying a pretty trend line and exposing the index to the risk of reversal, potentially to a bottom just above the 25,000 level.

This sort of thing chimes true with the virtual industry in the USA, all sagely predicting the markets are due a correction in the final quarter of this year. We’ve been quite hesitant at accepting their predictions as gospel, but now, with closure below the trend line, it’s a reason to pause for thought.

- Discover more: Buy international shares | Interactive investor Offers | Most-traded US stocks

The Big Picture (aka, not in one day) situation now suggests weakness below 30,882 points risks reversal to 29,158 points and a short-lived bounce. Our secondary, when this target level breaks, works out at 27,970 points, presenting a price level where a rebound is ‘almost’ certain. But closure below such a target level risks the index finding its way down to 25,600 points eventually!

Wall Street closed at 30,951 points, remaining in relative safety. The market does not appear ready to immolate itself just yet.

Past performance is not a guide to future performance

FTSE for Friday

If the FTSE 100 intends to throw itself off a similar cliff to that which Wall Street faces, it currently needs to close below 7,162 points to kick open the door marked winter.

However, the immediate outlook for Friday isn’t rosy, and the FTSE only needs below 7,258 points to risk triggering reversal to an initial 7,193 points.

- Why reading charts can help you become a better investor

- Growth stocks to buy for a winning 2023

- 10 quality small-cap shares with reliable profits

Should such a target level break, our secondary calculates at 7,103 points, pretty firmly in the region where longer-term trouble becomes possible. If triggered, the index needs above 7,354 points to greatly diminish the reversal potentials.

Past performance is not a guide to future performance

If the FTSE intends any form of miracle recovery, above the aforementioned potential stop loss level of 7,354 looks interesting. Perhaps it is able to provoke market recovery to an initial 7,403 points with secondary, if bettered, at an impossible (in the short term) looking 7,553 points.

Have a good weekend.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.