FTSE 100's big winners and losers in 2020 so far

After stocks soared in Q2, we name the best and worst performers, plus the best market to own.

1st July 2020 12:56

by Graeme Evans from interactive investor

After stocks soared in Q2, we name the best and worst performers, plus the best market to own.

Despite the best quarter for the FTSE 100 index in a decade, investors might be forgiven today for feeling a little short-changed at the pace of recovery on the London stock market.

A glance at the league table of global indices places the 8.8% rebound by the UK blue-chip benchmark among the weakest performances of the second quarter of 2020, trailing a long way behind the 30% bounce for the tech-laden Nasdaq and 20% rise for the S&P 500.

Wall Street had an unexpected challenger to its dominance, however, with the AIM 100 junior market restoring some of London's credibility with a spectacular 29% surge.

The underwhelming performance of the FTSE 100 reflects its weighting towards oil and banking stocks, with Royal Dutch Shell (LSE:RDSB) 10% lower after it cut its dividend by two-thirds at the end of April in the face of a slump in oil prices. Fears of rising bad debts also meant HSBC (LSE:HSBA) fell 17% in the quarter and Lloyds Banking Group (LSE:LLOY) dropped 3%.

Among other widely-held stocks, BT Group (LSE:BT.A) declined 3%, Whitbread (LSE:WTB) tumbled 15% and supermarkets Sainsbury's (LSE:SBRY) and Tesco (LSE:TSCO) failed to make headway as rising costs offset consumer stockpiling at the start of the quarter.

- BT shares receive another big vote of confidence

- Lloyds Bank shares must do this before any rise can be taken seriously

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

In contrast, the Covid-19 lockdown provided the perfect conditions for stocks including B&Q owner Kingfisher (LSE:KGF), whose shares rallied 53.4% during the three months to 30 June on the back of a DIY boom. Paddy Power Betfair owner Flutter Entertainment (LSE:FLTR) and Ladbrokes firm GVC Holdings (LSE:GVC) rose 45% and 32% respectively after benefiting from online gaming and a return of European top flight football.

Grocery e-commerce business Ocado Group (LSE:OCDO) was the best performing blue-chip stock in the quarter, with its shares rocketing 66% between April and the end of June and setting a new record high above 2,000p in the process. When including the first quarter of 2020, Ocado was 58% higher amid expectations that the pandemic will accelerate the shift towards its technology.

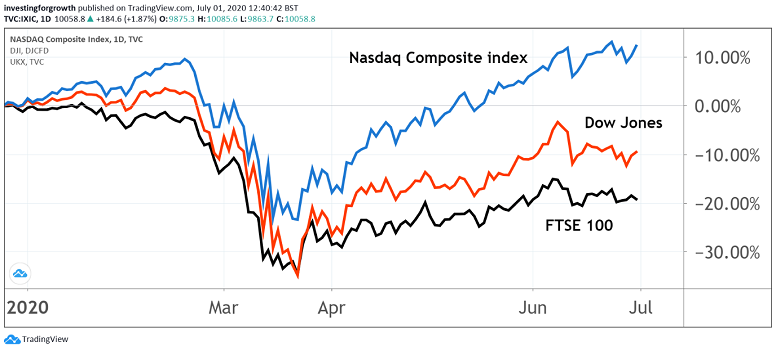

Looking across the first six months of the year, the FTSE 100 index was 18% lower following the global collapse in market confidence during February and March. The domestic-focused FTSE 250 index has fared the worst out of all major indices after falling 21.8% in the first half.

In contrast, the Nasdaq 100 has been the place for investors' cash so far this year. It's been the only major index to rise, with the surge of 16.3% aided by a record Apple (NASDAQ:AAPL)share price and the wider impact of the US Federal Reserve's emergency monetary stimulus programme.

The S&P 500 was down 5%, the Dow Jones Industrial Average dropped 9.5% and the FTSE AIM 100 declined 7%, helped by its stunning recovery over the past quarter. Areas like retail, small-cap gold, small-cap pharma, and high-growth technology have all been big AIM winners, with Boohoo (LSE:BOO) among the highest profile successes after doubling in value since early April.

Source: TradingView. Past performance is not a guide to future performance.

Meanwhile, the second quarter rebound in stock market confidence as lockdown restrictions start to ease has failed to mask the damage done to many share prices earlier in 2020.

BA owner International Consolidated Airlines Group (LSE:IAG) is the biggest FTSE 100 faller for the year to date after aviation's shutdown caused its shares to tumble 64%. Engines giant Rolls-Royce (LSE:RR.) was not far behind after declining 58% and Melrose Industries (LSE:MRO) dropped 52.5%, with easyJet (LSE:EZJ) no longer in the top flight after its relegation into the FTSE 250 index last month.

- Hot stocks: Wall Street is where the action is

- Apple: how the world’s biggest company can get much bigger

- Chart of the week: are the FAANGS finally losing their teeth?

- Want to buy and sell international shares? It’s easy to do. Here’s how

Beleaguered investors of Lloyds Banking Group started the year wondering if the lender could finally break its resistance to the 65p threshold, only to see fears of rising impairments cause the bank's share price to collapse another 50% to just above 30p.

The Royal Bank of Scotland (LSE:RBS) was down a similar level, while Barclays and HSBC are both down 36% so far this year. The crisis in retail also means landlords Land Securities (LSE:LAND) and British Land (LSE:BLND) have dived 44% and 39% respectively.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.