FTSE 100 struggles to keep up with global stock markets

Saltydog analyst explains why investing overseas has paid off for fund investors.

1st September 2020 15:34

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog analyst explains why investing overseas has paid off for fund investors.

August was a good month for most stock markets around the world.

In the US, the Nasdaq and S&P 500 set new all-time highs. The S&P 500 went up by 7%, its best August for more than 30 years, and it is now showing a gain of 8.3% since the beginning of the year. The Nasdaq did even better, gaining 9.6% in August, and it is now up more than 30% this year. Both indices benefited from the ongoing success of the giant technology companies as well as general optimism regarding the development of vaccines and treatments for Covid-19.

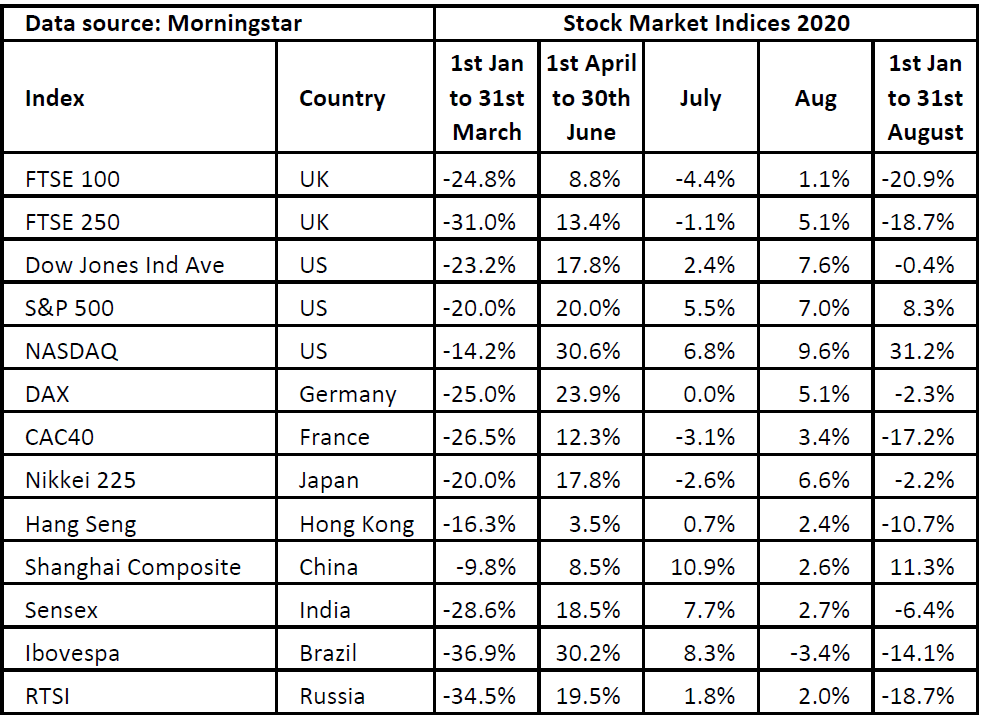

Here is a table showing the performance of some of the leading global stock market indices.

Past performance is not a guide to future performance.

Outside the US, the Shanghai Composite is the only other index that has made a gain in 2020.

The UK’s leading index, the FTSE 100, has struggled to keep up with global markets. Last month, it went up by just 1.1%, only the Brazilian Ibovespa did worse. Over the year, it is still down by more than 20%, the lowest in the table.

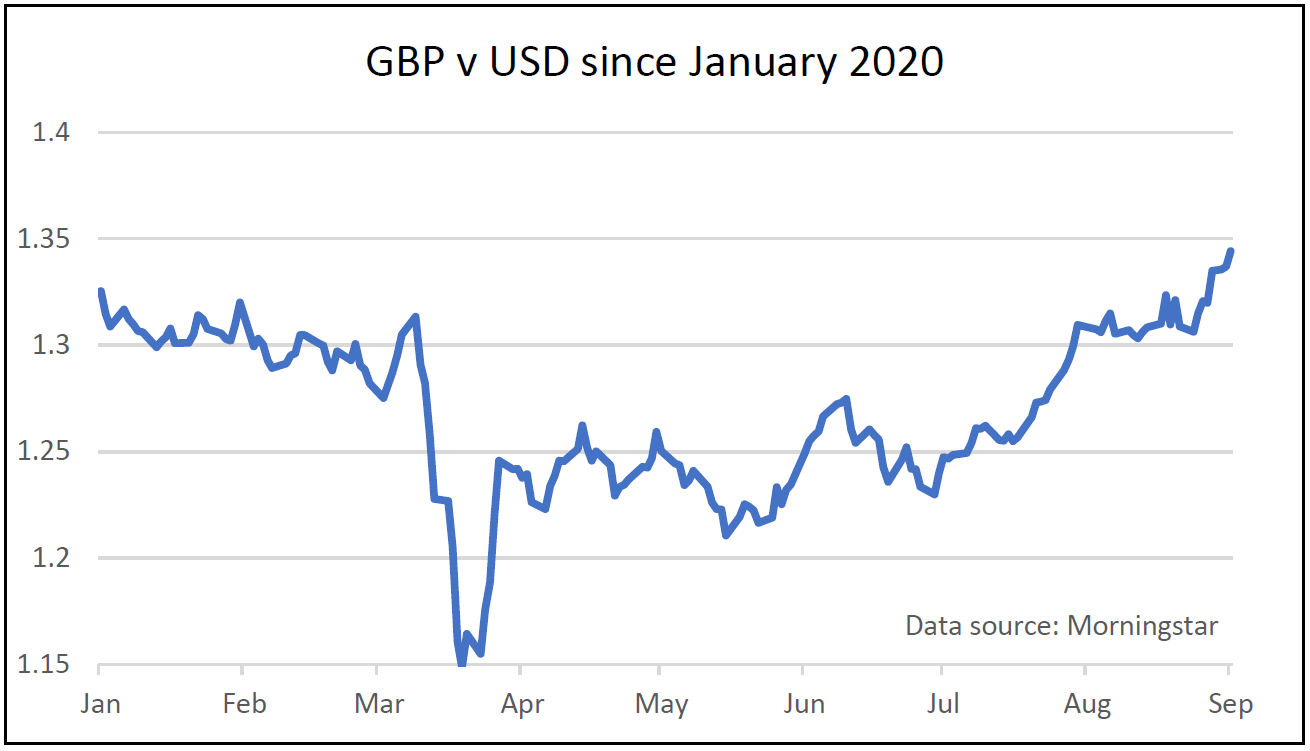

Last month, the Federal Reserve maintained its commitment to keep interest rates low and went on to suggest that it could tolerate higher inflation for longer periods if necessary. Although the US markets liked the news, the value of the dollar went down.

Part of the problem with the FTSE 100 over the past few months has been the value of the pound increasing as the dollar has weakened.

Past performance is not a guide to future performance.

Not only does it make it difficult for the FTSE 100, which is made up of large international companies with significant earnings in foreign currencies, but it also makes it difficult for UK investors.

The performance of any overseas investments will have to overcome the currency movement before generating any profits when valued in sterling.

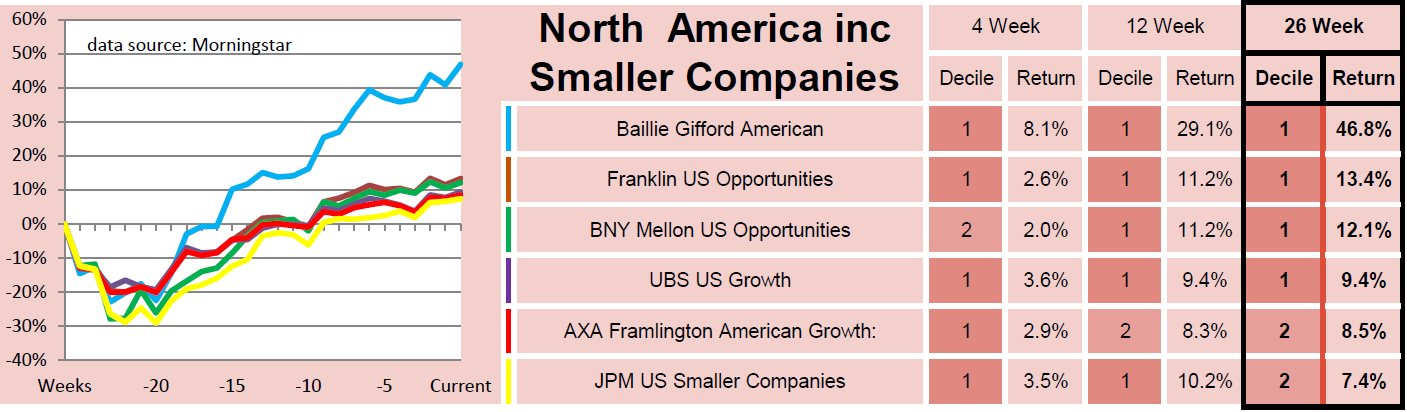

Fortunately, some funds have done sufficiently well that they have not only cleared the currency hurdle but made significant gains on top.

In our analysis last week, we highlighted six funds from the North American and North American Smaller Companies sectors that had gone up over the last six months. The one at the top of the list, Baillie Gifford American, was showing a gain of 46.8%.

Past performance is not a guide to future performance.

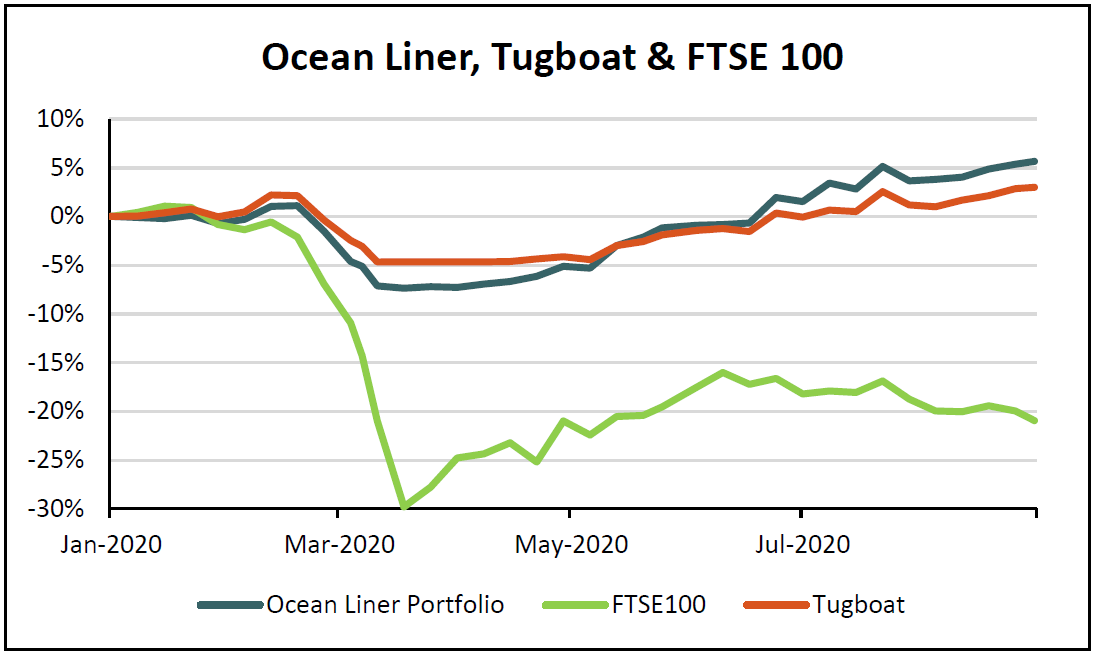

One of our Saltydog demonstration portfolios, the Ocean Liner, invested in the Baillie Gifford fund in mid-April and it is now showing a profit of 57%.

By managing to avoid the worst of the coronavirus crash and then making a controlled return to the markets, both our portfolios are up over the year.

Past performance is not a guide to future performance.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.