The four UK funds we’ve just bought

21st November 2022 13:48

by Douglas Chadwick from ii contributor

Saltydog investor spies opportunities in the UK as the new prime minister and chancellor embrace fiscal discipline.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Every week we analyse the performance of all the funds readily available to private UK investors. We start by looking at the average returns of the Investment Association (IA) sectors, and then highlight the leading funds in each sector over various different timescales.

Although 2022 has been a terrible year for investors, we have seen an improvement in recent weeks.

During September, nearly all the sectors fell in value. The worst, UK Index-Linked Gilts, fell by 16.4%. Most sectors were also significantly lower than they were at the beginning of the year.

In October, there was a noticeable improvement especially in the UK, European and American sectors.

When we reviewed the numbers last week, most sectors were showing four-week gains, including the three UK equity sectors (UK All Companies, UK Smaller Companies, and UK Equity Income). We have been watching these sectors fairly closely over the last few weeks as they have been moving up our tables.

It is not hard to see why investors would have been cautious about investing in the UK over the last few months. Boris Johnson resigned as leader of the Conservative Party in July, but stayed on as prime minister over the summer. Liz Truss then took over in early September but lasted less than two months. She will go down in history as the UK’s shortest-serving prime minister.

The mini-budget that she and her chancellor, Kwasi Kwarteng, forced through Parliament did not go down well with the markets. Their “Growth Plan” looked more like unfunded tax cuts favouring the wealthy. The fact that they had not involved all the Cabinet, or the Office for Budget Responsibility (OBR), did not really give them a leg to stand on when the criticism started mounting.

- Jeremy Hunt’s attack on private investors – what to do now

- Thousands of Brits could be breaking the law after CGT changes

- Autumn Statement 2022: who are the real winners and losers?

UK bond yields soon started to spiral out of control and at one point it looked like there would be mass defaults by some of the largest pension funds. In the end the Bank of England had to intervene. At that point, the writing was on the wall. Kwarteng resigned and the new chancellor, Jeremy Hunt, almost immediately reversed nearly all the other proposed changes. The markets settled, but the damage had been done.

On 20 October, Truss resigned as leader of the Conservative Party and less than a week later was replaced by Rishi Sunak. One of the first things that he did was delay the Autumn Statement, which was due a few days after the election. It was rescheduled to 17 November, so last week Hunt put forward the government’s tax and spending plans, along with the latest forecast from the OBR.

As expected, taxes are going up and spending is going down. In the short term it will not help the cost-of-living crisis, but it does seem to have gone down relatively well with the markets.It would be nice to think that Sunak, Hunt and the other members of the Cabinet can bring some stability to our government, which might encourage investors to have another look at the UK markets.

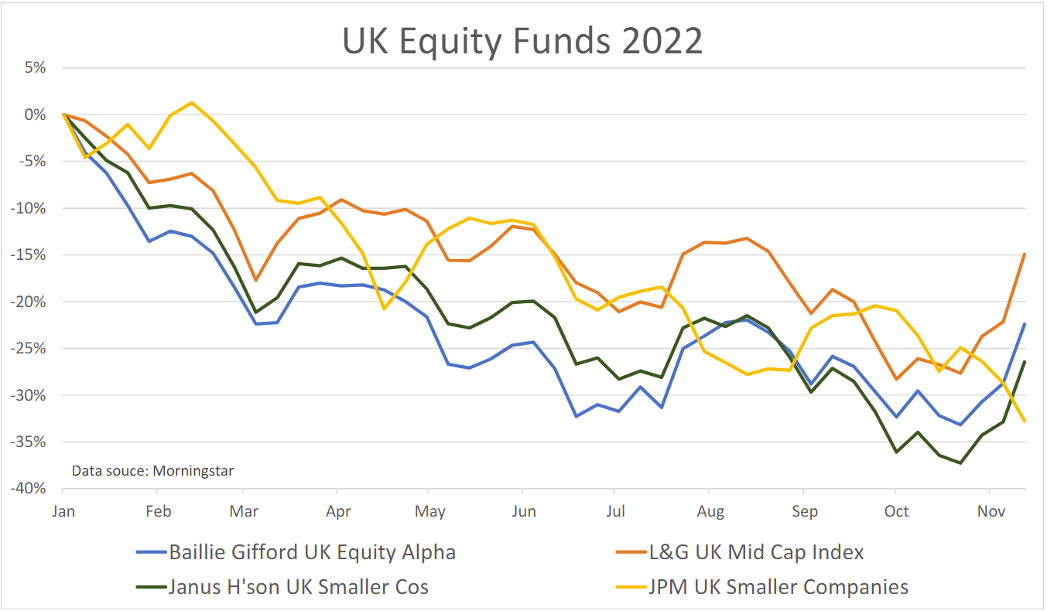

Last week, we decided to invest in two funds from the UK All Companies sector, Baillie Gifford UK Equity Alpha and L&G UK Mid Cap Index, and two funds from the UK Smaller Companies sector, JPM UK Smaller Companies and Janus Henderson UK Smaller Companies. It is early days, but they have picked up over the last few weeks and have still got quite a long way to go to get back to where they were at the beginning of the year.

We have seen the UK funds rally a couple of times earlier this year, only to drop back again and then continue their downward descent. Hopefully it will be different this time, but unfortunately there is no way of knowing.

Both our demonstration portfolios have been predominantly in cash for most of this year and even now we are only making some small initial investments. If they perform well we can always add to our positions and if they do not, then we will not lose too much. At some point the UK funds will recover and with the bond markets stabilising, sterling strengthening and UK stock markets rising, perhaps now is the time to come off the sidelines.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.