Four stocks and a best buy in this Covid-hit sector

29th March 2023 10:08

by Rodney Hobson from interactive investor

After plenty of false starts since Covid lockdowns ended, 2023 could be the year that this industry finally gets back to normal, argues overseas investing expert Rodney Hobson.

Travel has generally not got back to pre-pandemic levels, but this could be the year that the sector really returns to normal as business picks up and holidaymakers spend the cash that sat idle during lockdowns. Heavy advertising and social media comments are driving interest in holidays in particular. Investors should, however, treat this enticing sector with considerable caution.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

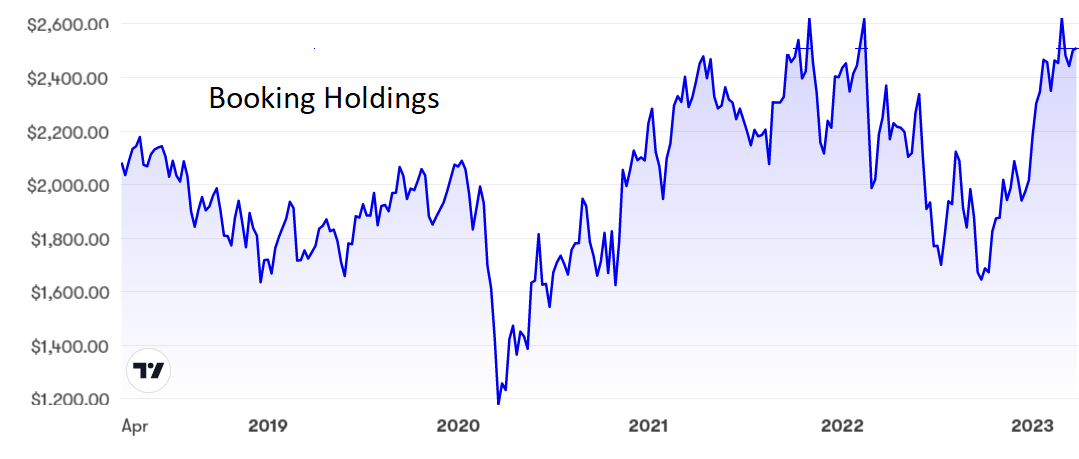

The world’s largest online travel agency is Booking Holdings Inc (NASDAQ:BKNG), which makes its revenue from charging hotels, restaurants and travel companies for online transactions. As such it has been able to extend across the globe without the accompanying cost of multiple buildings and staff.

Source: interactive investor. Past performance is not a guide to future performance.

Its best-known website Booking.com has been pushed heavily on TV as offering a wide range of hotel rooms and other accommodation booked through the site. It typically insists that hotels and guest houses rooms cannot undercut the price on Booking.com.

Bookings increased by more than 50% last year to total $120 billion, including 900 million room nights, and the company says that demand from travellers has continued into 2023.

There is no dividend but the price/earnings (PE) ratio of 32 reflects investors’ confidence that profits will grow substantially. There is also a large cash pile, $12.2 billion at year end plus $1.4 billion from the sale of its stake in Chinese company Meituan (SEHK:3690), so there is scope for a share buyback programme or even a modest dividend.

The shares have peaked at $2,600 on three occasions over the past 18 months and currently stand at $2,550.

The second-largest travel agency is Expedia Group Inc (NASDAQ:EXPE). Although it too offers air travel and car rentals it is more skewed to accommodation, which accounts for 75% of revenue. Expedia has some catching up to do in terms of diversification.

Source: interactive investor. Past performance is not a guide to future performance.

It is also struggling to produce a profit, so any dividend looks a long way off.

The shares have lost more than half their value since peaking at $209 in February last year. However, they look to have bottomed out at around $90.

Travel research publisher TripAdvisor Inc (NASDAQ:TRIP) has more of a niche market, offering more than 1 billion reviews and information on 8 million hotels, restaurant and other entertainment and leisure outlets. Revenue, which comes mainly from advertising on its platform, surged 47% year-on-year in the fourth quarter of 2022 to $354 million, but with costs also spiralling it was not enough to prevent an operating loss of $13 million.

Source: interactive investor. Past performance is not a guide to future performance.

The shares have collapsed from $60 to $18 over the past 12 months yet the PE ratio is still a ludicrously high 132.

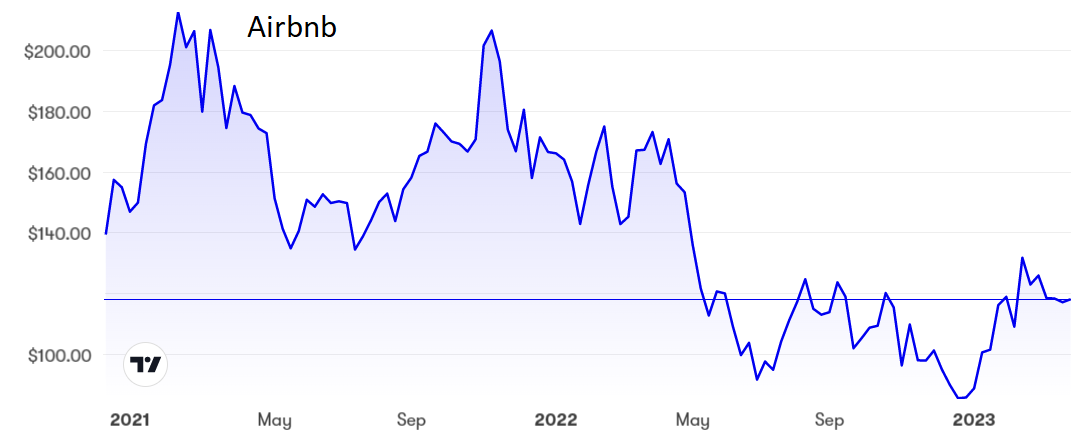

Airbnb (NASDAQ:ABNB) has also created a niche in alternative accommodation and it is hard to see any rival usurping its dominant position with 4 million hosts in more than 200 countries. All its revenue comes from fees for online bookings.

Source: interactive investor. Past performance is not a guide to future performance.

Last month it announced its first annual profit, with net income swinging from a $352 million loss to a positive $1.9 billion, helped by a record fourth quarter with strong cash flow and improved margins. Revenue leapt 40% to $8.4 billion, and the impetus has continued into this year.

The shares ran away too fast in 2021 to an unrealistic peak of $213 and even at the more sensible $116 currently the PE is a chunky 42. Again, there is no dividend.

Hobson’s choice: Booking.com shares can move erratically so this is not one for the faint-hearted. Active traders should regard this as a ‘buy’ but be ready to jump ship if the next lurch is downwards and to consider selling above $2,800. Although the worst is probably over for Expedia shareholders, the shares rate only a ‘hold’.

Airbnb looks the most likely of the four to start paying a dividend, and with profits set to continue rising is probably the best ‘buy’. TripAdvisor is the worst placed of the group and it is not too late to ‘sell’.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.