Four great US shares to buy

Our international columnist and author names the US stocks he'd buy and which is his best bargain.

1st May 2019 09:39

by Rodney Hobson from interactive investor

After reporting results, our international columnist and author names the stocks he'd buy and which is his best bargain.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Life is looking a lot brighter for American companies than anyone could have expected at the start of the year. Despite the impact of President Donald Trump's tax cuts wearing off, the rise in crude oil prices, thanks in part to his squeeze on purchasers of Iranian crude, and some stormy winter weather, several US heavyweights have produced better than expected figures for the January-March quarter.

Figures showing that the US economy picked up in the quarter to an annualized growth rate of 3.2% further helped sentiment.

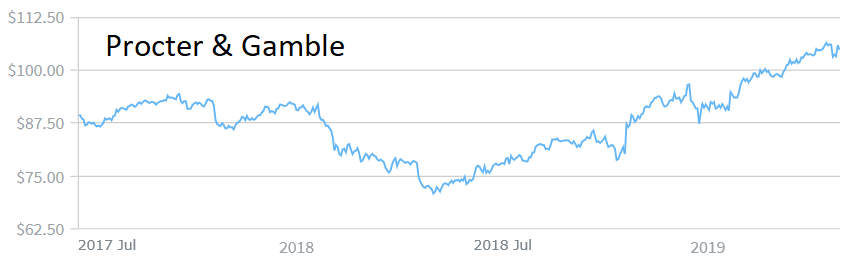

Procter & Gamble (NYSE:PG), the world's largest consumer goods company, reported its strongest quarterly sales growth in nearly eight years, with organic growth up 5% thanks mainly to a 9% rise in sales of beauty products. P&G managed to push through modest price increases despite a competitive marketplace.

Source: interactive investor Past performance is not guide to future performance

Profits increased from $2.5 billion to $2.7 billion, slightly ahead of forecasts, accompanied by a promise that sales growth this year would be at the top end of the 2-4% target range.

The shares have had a great run over the past 12 months, rising from $71 to around $105, but the unjustified fall of 2.9% when the results came out presented a short-lived buying opportunity.

Soft drinks company Coca-Cola (NYSE:KO) raised quarterly profits from $1.4 billion to $1.7 billion, again beating analysts' forecasts, as Brexit stockpiling boosted sales. It sells in 200 countries and makes nearly 70% of its sales outside the US, so it is not at the mercy of a downturn in any particular region.

Source: interactive investor Past performance is not guide to future performance

Coca-Cola will benefit from the purchase of the Costa coffee shop chain from Whitbread (LSE:WTB), which was completed in January. Many commentators feel that this was the best part of Whitbread, sold after pressure from activist investors acting for short-term gain, and that the Americans have acquired a great business with enormous potential for expansion.

The shares have been as high as $51 towards the end of last year but took quite a dive in February. It is not too late to take advantage.

Predictions that Twitter (NYSE:TWTR) would die a long, slow death as followers drifted away now look decidedly premature, as social media users react positively to its admittedly belated attempts to clamp down on cyber bullying and fake news. Improvements to the site, making it easier to use and more attractive to advertisers, also helped.

Source: interactive investor Past performance is not guide to future performance

Twitter reported its sixth consecutive quarterly profit as it attracted more new users than expected. First-quarter profits trebled from $61 million a year ago to £191 million now. The only fly in the ointment is a downgrading of expectations for the second quarter.

Twitter remains a riskier investment than most large tech companies and its share price is correspondingly more erratic, swinging between $26 and $47 in the past 12 months. At $40 currently, a lot of future good news is priced in.

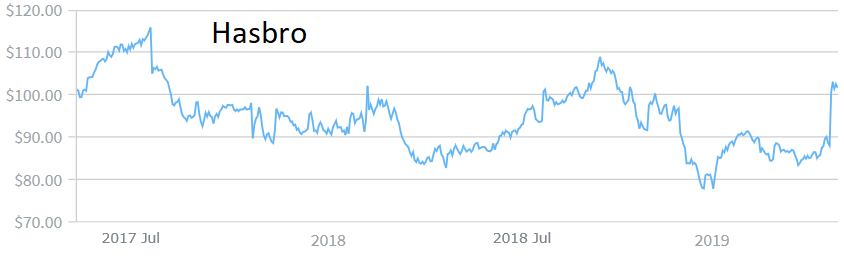

Toys and games maker Hasbro (NASDAQ:HAS) is famous for Action Man but the action at the moment is coming from a partnership with Paramount Pictures involving films with spinoff toys.

Source: interactive investor Past performance is not guide to future performance

Net first quarter earnings of $26.7 million were a welcome contrast to the $112.5 million loss in the first three month of 2018 caused mainly by the collapse of retailer Toys R Us.

The shares peaked at $116 two years ago and have performed erratically since but they reacted to the latest figures with a 15% leap.

Hobson's choice: The good quarterly figures are generally reflected in share prices but Coca-Cola looks the best bargain. Buy while the shares are still below $50. Buy Procter & Gamble below $105 and Hasbro below $100 – if you can. Twitter is for risk-takers.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.