Four funds we’ve bought, and three we’ve sold

24th January 2022 14:10

by Douglas Chadwick from ii contributor

Saltydog has been increasing exposure to cash in response to market volatility. Here are the latest buys and sells.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Stock markets have just had another difficult week. The FTSE 100, which had a reasonable start to the year, fell by 0.6%, while the FTSE 250 lost 2.1%. The Paris CAC 40 was down 1.0% and the Frankfurt DAX dropped by 1.8%.

In the US, the situation was even worse. The S&P 500 fell by 5.7% and the Nasdaq went down by 7.6% - it is now 12% lower than it was at the beginning of the year. The Chinese and Japanese stock markets are also reporting year-to-date losses.

As active investors, we believe in reacting to market conditions and we have been reducing our overall exposure to the markets for some time. In the Ocean Liner portfolio, our cash level went from 9% at the end of September to 37% at the end of December. It is now more than 60%. Our Tugboat portfolio is slightly more cautious. Cash accounted for 20% of the portfolio at the end of September and by year-end it had risen to just over 40%. Since then, it has also gone above 60%.

- Funds Fan: Terry Smith, core-satellite tips, and 2022 bond outlook

- Where to invest in Q1 2022? Four experts have their say

- Fund managers rotate out of tech and into banks ahead of rate rises

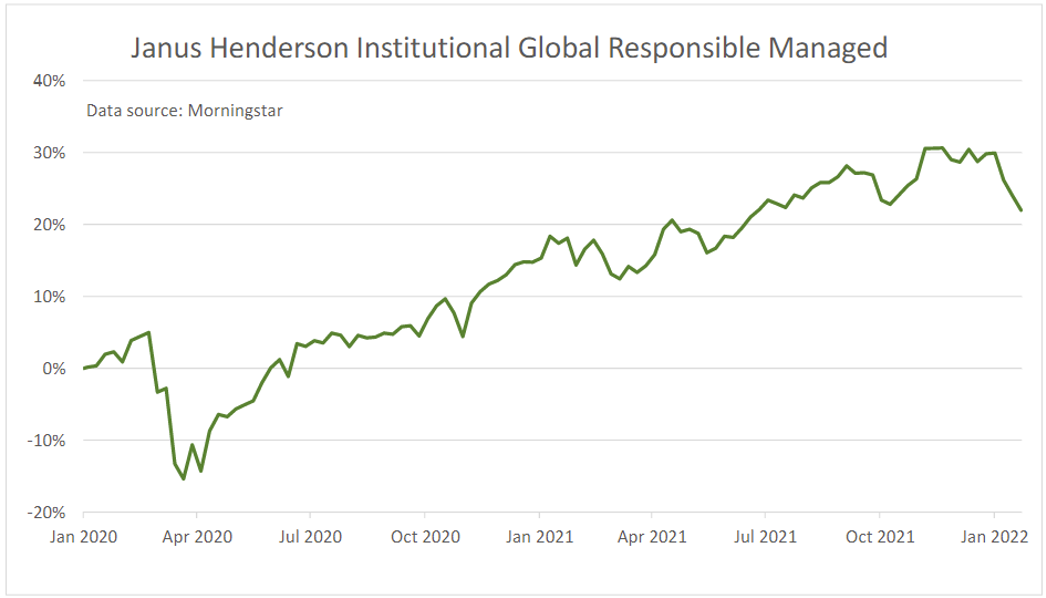

In the last few weeks, we have sold, or significantly reduced, a number of our long-term holdings including the Janus Henderson Global Responsible Managed fund. This is one of the funds, from the Mixed Investment 40-85% Shares sector, that we bought in February 2019 and held until the beginning of March 2020. We then reinvested in April 2020 and have held it ever since.

Past performance is not a guide to future performance.

We have also sold the two funds from the Technology and Technology Innovations sector that have been in the portfolios since last June: L&G Global Technology Index and AXA Framlington Global Technology.

Although most of the Investment Association (IA) sectors have been struggling this year, when we did our analysis last week there were some funds that appeared to be bucking the trend.

- Examine more articles on investment funds and trusts

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

Last week, the Office for National Statistics (ONS) released its latest inflation data, which showed that the UK Consumer Price Index was up 5.4% in the 12 months to December 2021, its highest level in almost 30 years. In the US, the comparable figure was 7%. Much of this is being blamed on increasing fuel costs and commodity prices. This is being reflected in the performance of some of the funds in the Natural Resources sector.

Last week, we invested in the JPM Natural Resources and TB Guinness Global Energy funds. They were at the top of our table of funds from the Specialist and Thematic sectors. The two India funds were also looking promising.

| Fund | Subzone (if applicable) | 4 Week | 12 Week | 26 Week | ||||

| Decile | Return | Decile | Return | Decile | Return | |||

| JPM Natural Resources | Nat Res | Nat Res | 1 | 8.3% | 1 | 8.1% | 1 | 15.3% |

| TB Guinness Global Energy | Nat Res | Nat Res | 1 | 11.1% | 1 | 6.9% | 1 | 30.2% |

| BlackRock Natural Resources | Nat Res | Nat Res | 1 | 6.8% | 1 | 8.8% | 1 | 18.9% |

| Jupiter India | India | India | 1 | 6.4% | 1 | 5.3% | 1 | 15.0% |

| Liontrust India | India | India | 1 | 7.0% | 4 | 2.4% | 2 | 14.2% |

Data source: Morningstar. Past performance is not a guide to future performance.

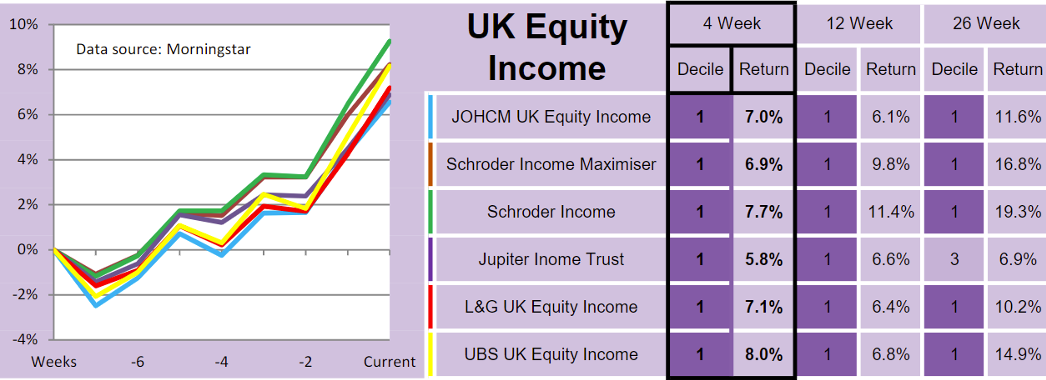

The only other sector that caught our eye last week was UK Equity Income. At the time, the sector was up 3.6% over four weeks, 4.6% over 12 weeks and 7.1% over 26 weeks. Some of the leading funds had done considerably better.

We also made a small investment into the JOHCM UK Equity Income and Schroder Income funds. If they get off to a reasonable start, we will consider adding to our holdings.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.