Fixed income: how a monetary policy tool could unsettle markets

The Federal Reserve’s Overnight Reserve Repurchase (ON RRP) facility could run out in the next few months, and worries are emerging over the potential impact on markets as the Fed maintains restrictive monetary policies to rein in Covid-era stimulus.

16th April 2024 10:29

by Andrew Fraser from Aberdeen

The US Federal Reserve’s Overnight Reserve Repurchase (ON RRP) facility could run out in the next few months, and concerns are emerging over the potential impact on financial markets with the US central bank maintaining restrictive monetary policies to rein in Covid-era stimulus.

While investors have been focused on the timing and pace of central bank interest rate cuts this year, what’s happening with this esoteric tool of monetary policy could have implications for how smoothly policymakers execute the delicate task of weaning financial markets off remaining liquidity pools from ‘quantitative easing’ measures.

The ON RRP has also been a source of funding that has supported the Treasury bill – short-tenor US government bonds – market, as the US issues new debt to fund the nation’s ballooning budget deficit. Its depletion may affect the amount and type of government bonds sold in the future, as well as bond yields in the wider market.

What’s the ON RRP?

This is a key item in the US Federal Reserve’s (Fed) monetary policy toolbox. The ON RRP, along with another policy tool called the Interest On Reserve Balances (IORB), help US policymakers control interest rates within the effective federal funds target range.

It provides a place for non-bank financial institutions to deposit their cash on a short-term basis with the Federal Reserve through a so-called ‘repurchase facility’.

What’s the problem?

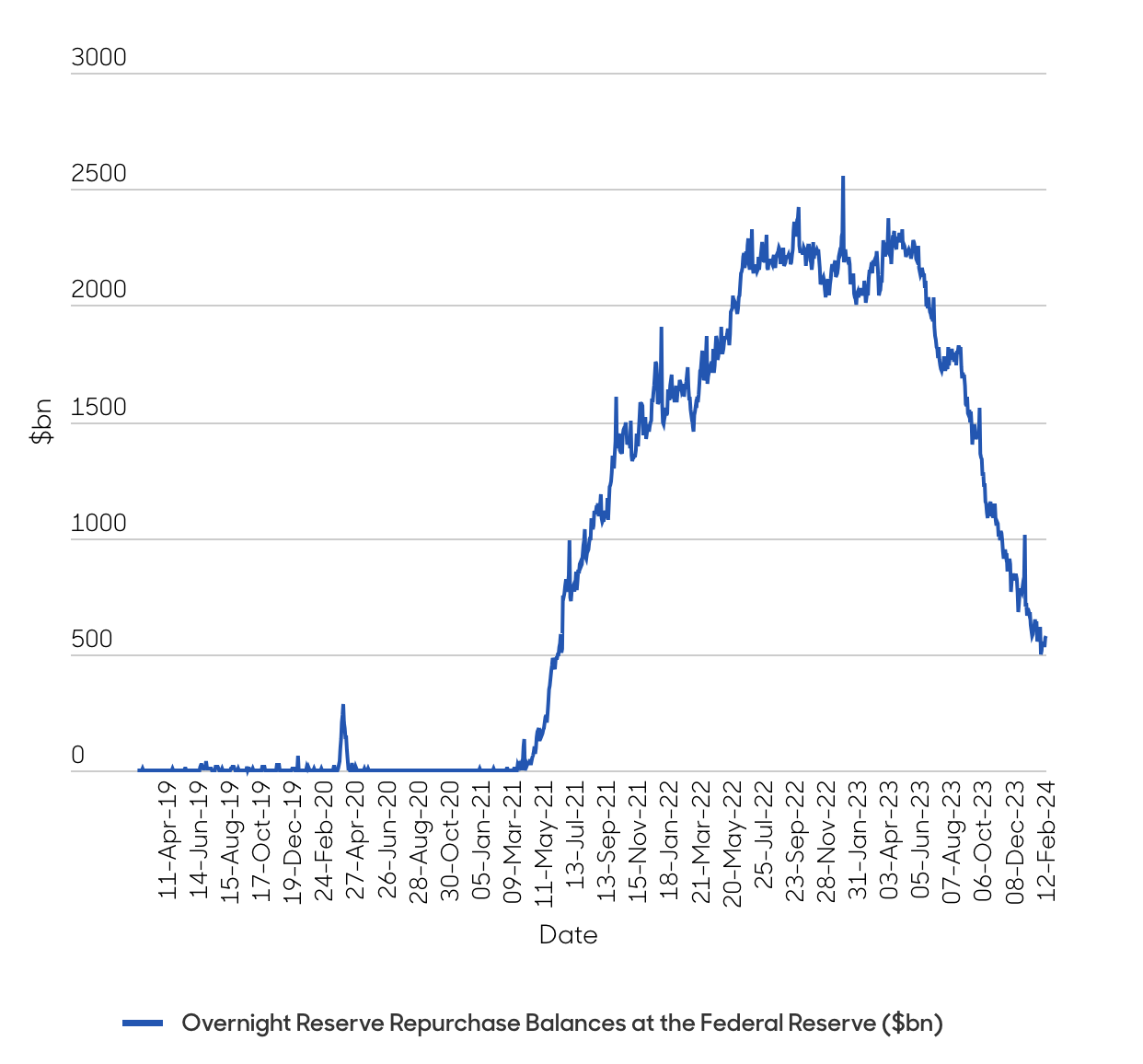

Chart 1: ON RRP balances at the Fed (US$bn)

Source: Federal Reserve Bank of St Louis, February 2024.

The non-bank financial sector, and especially money market funds, has pulled cash parked with the central bank in the ON RRP to buy Treasury bills, amid an environment of high interest rates for short-term debt, as the government seeks to issue more debt to fund public spending.

Why may this be a problem?

The ONRRP is regarded as one barometer of liquidity in the US financial market because it’s where non-bank financial firms often park excess cash.

The last time the Fed attempted QT – in September 2019 – it misread how far that process would drain banking system reserves. A combination of large corporate tax payments and the settlement of a large bond auction led banks to hoard cash. This sent short-term funding rates spiralling and the Fed was forced to inject emergency cash into the system.

The US central bank’s reading of the amount of liquidity, based on the level of reserves in the financial system, will be key to avoiding a repeat of that episode.

What’s more, money has flowed out of the ON RRP into financial markets. Its depletion, high interest rates and the Fed’s attempt to continue reducing its balance sheet, will collectively reduce overall liquidity. Throw in growing investor concerns about government debt levels and this would compound the problem.

Should you be worried?

Opinions are divided, even within the Fed. One Fed governor, Christopher Waller, reckons there’s little cause for concern, while another, Lorie Logan, has warned that liquidity conditions are more uncertain as the facility is unwound.

In a world that’s full of uncertainty, where some markets appear frothy, a liquidity shock could be one more risk that investors need to be aware of.

Even if the outcome doesn’t turn out to be as traumatic as what we saw in 2019, slowing liquidity support will create conditions that are less conducive to further markets gains.

Bond market effects?

Even if the Fed manages to implement monetary policy smoothly, there remains the question of how the US government’s budget deficit will be funded.

The unwinding of the ON RRP has solved this question in the short run – as non-financial institutions use the money to buy new issues of short-term government debt. But there will be less available to support government borrowing needs going forward. This may result in the US Treasury issuing more longer-term debt to finance its borrowing requirements.

However, amid expectations of weaker demand from potential buyers, government paper may need to pay higher yields to generate sufficient interest and bond yield curves will steepen (when longer-dated debt yields more than shorter-dated paper). Historically, periods of yield steepening have resulted in the weak performance of risk assets.

Final thoughts

Arguably, markets are closer to an inflection point. It is comforting to read in the notes from recent Federal Open Market Committee meetings that Fed members are discussing many of these issues and they have the ability to act quickly if they think risks to financial stability are growing.

The Fed could, amongst other measures, pare back or stop QT, cut interest rates, encourage the use of the Standing Repo Facility (which allows users to quickly convert Treasurys into short-term cash loans), or even restart quantitative easing.

The US central bank has steered a steady ship in relatively calm waters. The hope for markets is that this can continue, but there are likely to be choppier waters ahead.

Andrew Fraser is head of research - financials in Fixed Income Research at abrdn.

ii is an abrdn business.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.