Fixed income: FOMO and the FOMC

Consensus states the next move in interest rates will be down. But when? And by how much? We share our views.

31st January 2024 11:43

by Matthew Amis, Tom Walker, Alex Everett and Aaron Rock from Aberdeen

Back in November 2023, we wrote the article ‘Have interest rates peaked?'.

To summarise for those who missed it, we said: interest rates had reached the top of the policy mountain. Major central banks (Japan aside) would spend a short period on hold before starting their rate-cutting cycles in late-spring/early summer. We advocated an overweight position in government bonds. That was because markets had priced-in interest-rate cuts, but we thought central banks would need to go further than markets expected.

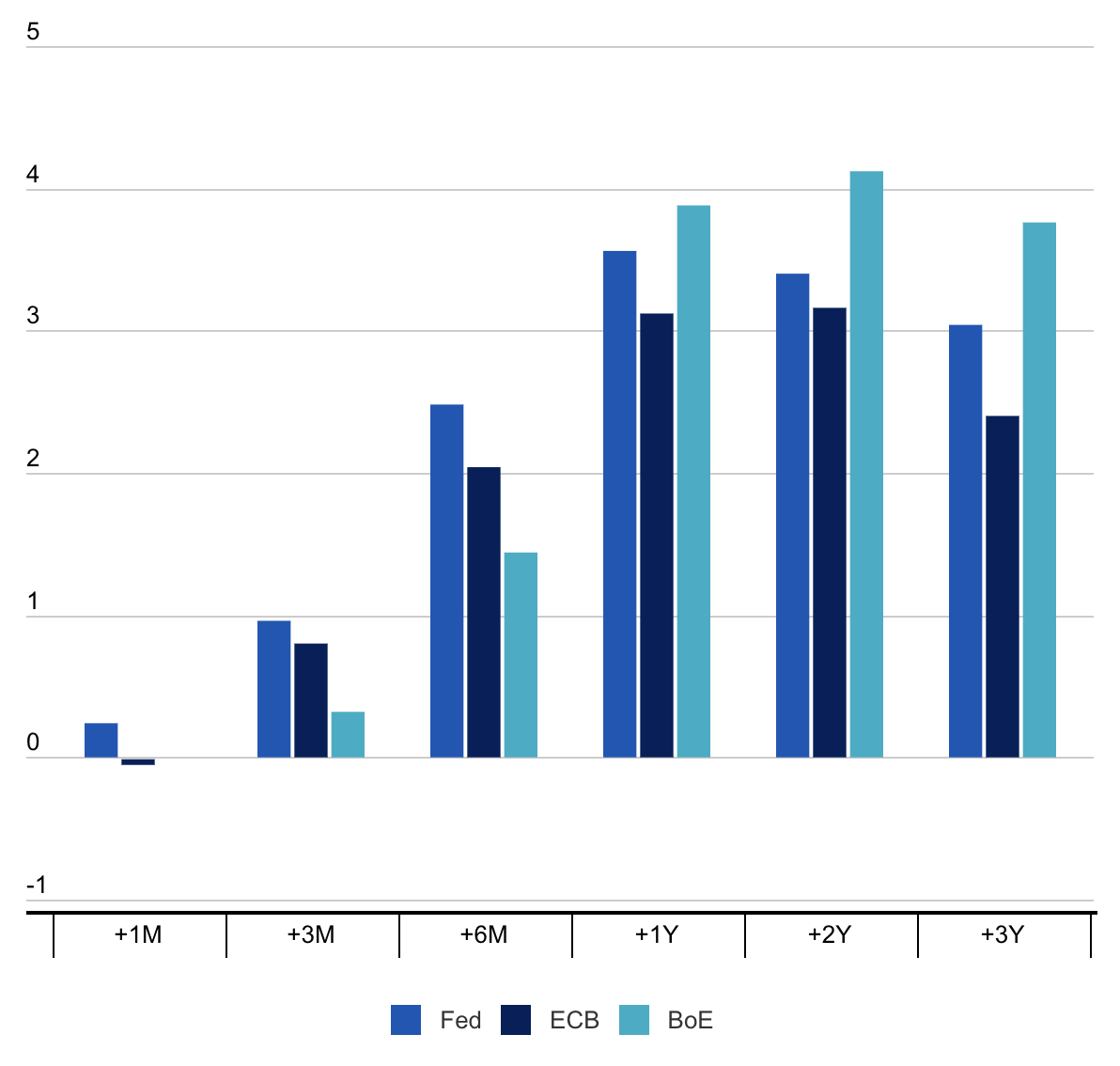

As Chart 1 shows, this has pretty much played out, with markets adding significantly to rate-cut expectations.

Chart 1: Additional 0.25% cuts priced in (End December vs Mid November 2023)

Source: abrdn, Bloomberg.

But if we’re honest, we thought this would be a four-month story, not a four-week dramatic Christmas special.

So, as January unfolds, we ask ourselves: what next?

What happened in the fourth quarter of 2023?

As the pantomime season kicked off, financial markets took part in their own tale of FOMO and the FOMC.

After the December meeting, the Federal Reserve’s Open Market Committee (FOMC) released its all-important ‘dot plot’, capturing each member’s interest-rate projections. The median outcome signalled expectations of an extra cut during 2024, bringing the FOMC in line with market forecasts. Why was that important? During the 2022-2023 rate-hiking cycle, central banks indicated that they wouldn’t increase rates as much as the market expected. And then they did. Investors now expect monetary policy to align with their expectations as central banks proceed to cut rates.

What about the fear of missing out (FOMO)? As we’ve seen, ideas can catch on quickly. When markets shift, investors often think they can’t move any further. Until they do. Then, the same investors feel compelled to join in for fear of missing out on the next big upswing. This can make market trends self-fulfilling.

US Federal Reserve Chair Powell’s dovish comments drove yields lower in December. Reams of data further reinforced the view that inflation was no longer quite the problem we all thought it was. In the UK, November consumer price inflation (released a few days before Christmas) plunged to 3.9% (from 4.6% in October), its lowest in two years. This was well below most forecasts, including the Bank of England’s. True, there was a 0.1% uptick in December, due to higher booze and cigarette prices. But there were always going to be bumps along the way. We still believe we’ve reached the mountain’s peak – and rate cuts lie ahead.

Can the move continue in 2024?

We think December’s drop in yields accurately reflected the outlook. The magnitude of the fall was also on the money. The timing, however, was off.

In our view, the momentum driving the lower-yield environment is over (for now). January’s market repricing suggests there was a little too much festive cheer in December. Global yields have moved higher to correct the end-of-year exuberance. Expectations for immediate interest-rate cuts have eased. The traditional wave of European issuance is further driving yields higher. It’s already been a record-breaking month for supply.

For those who missed out in December, we think today’s higher yields represent a prime opportunity to buy government bonds. You don’t want FOMO to kick in again!

Can the move go further than December?

For this to happen, economic data would have to progressively worsen. We’d need to see rapid job losses and lower growth. This would create conditions for the dreaded ’hard landing’. While a possibility, we don’t see evidence for this in the data. For one thing, employment and wages have been remarkably resilient.

Of course, we must mention the alternative scenario where inflation remains high. In this scenario, we’d expect central banks to keep rates on hold and for fixed income to underperform.

As it stands, hard data and market expectations point to lower inflation and a ‘soft landing’. We therefore expect monetary policy to move from ‘highly restrictive’ to ‘neutral’.

This could (should!) be the year for fixed income

Following January’s intermission, the stage is set for investors to take advantage of higher yields and to ease back into fixed income. The cutting cycle is coming. It might not be as soon as markets expect, and the pace could be more measured than many assumed. But we think yields can go as low as markets predicted in December.

If the ‘soft landing’ scenario plays out as we believe, global yields will gently drift lower. Even then, fixed-income investors will still own an asset yielding over 4%. If the ‘hard landing’ scenario starts to emerge, yields will move dramatically lower as central banks react. Both outcomes offer fixed-income investors capital appreciation.

Finally, politics will come to the fore this year. Over 50 countries, representing nearly half of the world’s population, will hold national and regional elections. Notably, the US presidential election takes place on 5 November, with Trump likely to face President Biden. A win for the former would have far-reaching implications for trade, geopolitics and markets. Meanwhile, the UK electorate will go to the polls in the Autumn. It’s odds-on we’ll see the first Labour government in 13 years. We’ll address what all this could mean for investors closer to the time.

Final thoughts…

Markets clearly got ahead of themselves in December. Investors have taken a more sober approach to the start of 2024. Yields have ticked higher. Nonetheless, with inflation (mostly) under control and economies slowing, the cutting cycle is coming. So, sit back, allow yields to move higher in January and be ready to buy fixed income.

Matthew Amis is an investment director at abrdn.

Tom Walker is an investment director at abrdn.

Alex Everett is an investment manager at abrdn.

Aaron Rock is head of nominal rates at abrdn.

ii is an abrdn business.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.