Five tips to cope in a bear market

31st May 2022 10:19

by Sam Benstead from interactive investor

Veteran investors share their wisdom on how to keep your head when everyone else is losing theirs.

American stocks are nearing a 20% drop from highs, known as a “bear” market. The poor performance of its technology giants is dragging down global indices and pension portfolios as well.

But rather than suddenly bouncing back from their lows, stocks could be in for a challenging couple of years given that central banks are unlikely to cut rates or reintroduce quantitative easing for fear of driving inflation even higher.

Managing a portfolio well when stocks keep falling is a difficult emotional and technical challenge – but incredibly important. Buying shares at lower-than-average prices is one of the foundations of long-term investing success.

- Invest with ii: Top Investment Funds | Index Tracker Funds | Super 60 Investment Ideas

We asked investment veterans for their top tips on how to cope in a bear market.

1) Don’t try and call the bottom

David Coombs, head of multi-asset investments at Rathbones, has been investing professionally for more than three decades.

He said this downturn felt like 2000/2001 – when some high-growth stocks never recovered to their former share prices and pain for market indices dragged on for two years.

One of the lessons he has taken from investing during tough markets is to not try and call the bottom and “market time”.

- A tactic to ride out the inflation storm using these funds and trusts

- Recessions are becoming more likely – here’s how to invest

He said: “You don’t know when it will end, and the odds are not in your favour when it comes to finding the bottom.

“There are lots of reasons for this market drop, such as the unpredictable war in Europe and China struggling with the pandemic. Don’t try and call what you can't understand as an investor. It is easier to relax once you’ve made that pact.”

2) Stick to your investment process

Coombs says that in a bear market, established investment processes come under a lot of pressure.

“The danger is that the emotions take over the rational conscience, even for the professionals. Investors need to avoid overtrading and chasing the latest themes or view. This adds frictional costs and detracts value,” he said.

For Coombs, as a professional, this means sticking to strict rules on maximum and minimum position-sizing, and adding to shares when they fall to new lows. For DIY investors, it means sticking to regular monthly investment plans.

Coombs said: “Investors need to crack on and keep investing. They will be fine over a long time, unless it is different to the last 120 years.”

However, he says that stocks that went up a lot during the pandemic may have further to fall and investors should review portfolios: “There was so much hype into some parts of the market that some assets may not recover, and investors may have to cut losses.”

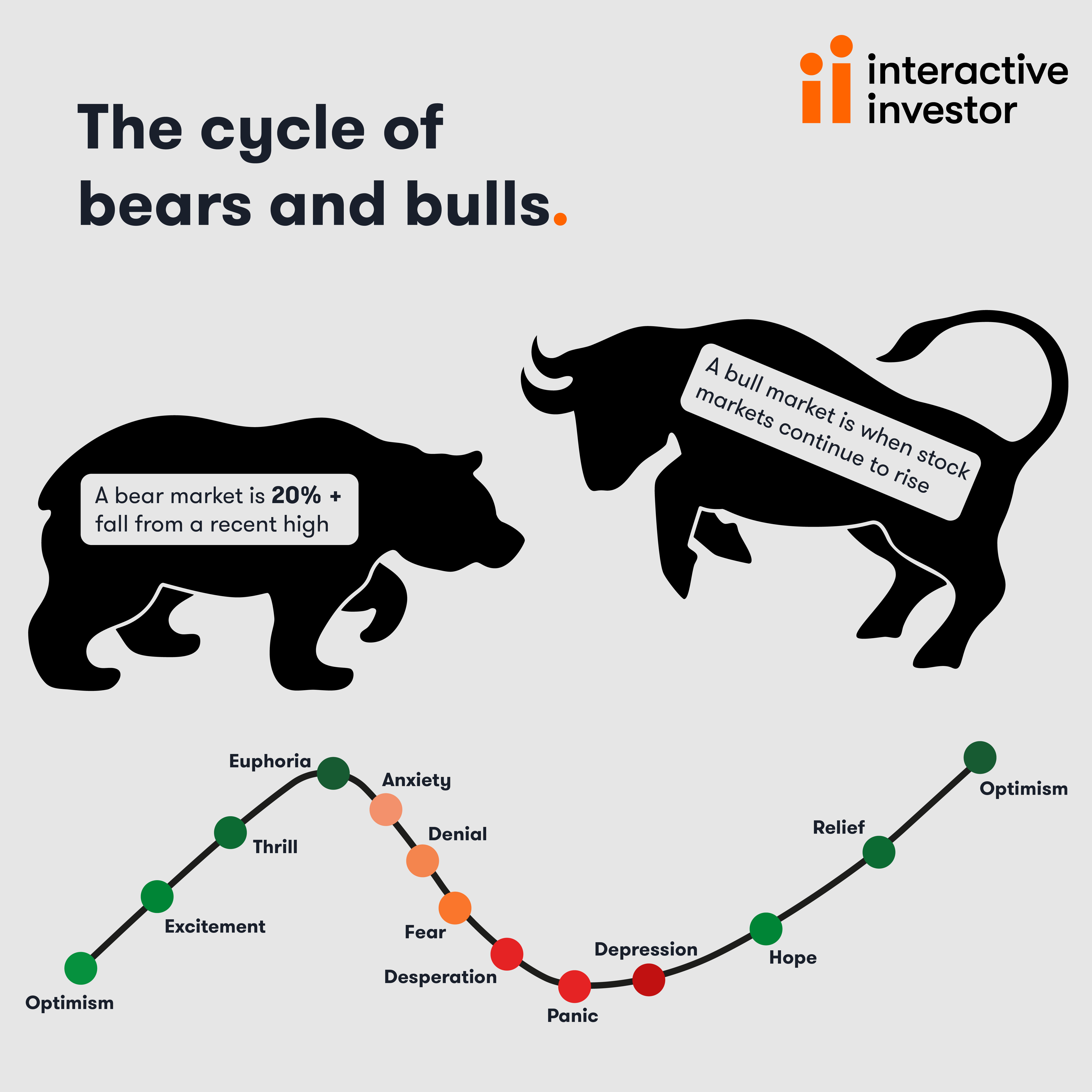

Bull and bear markets get their names from bears attacking by swiping “down”, while bulls throw their horns “up”.

Put simply, bull markets are sustained periods of market growth and bear runs are sustained periods of losses.

3) Don’t have outlandish expectations

Patrick Armstrong, chief investment officer at Plurimi Wealth and with experience investing through numerous bear markets, says that not expecting too much from stock markets over the next few years will be key.

He said: “We are in November 2001 right now. Things are going to get cheaper. Bear markets aren't times to get rich and investors should be prudent. A recession is coming, so buying boring but safe companies is going to be key.”

For Armstrong, this means buying companies that trade at price-to-earnings ratios of about 10, that are not too reliant on economic growth for profits. The US market is at about 17 times, the UK market about 13 times.

Owning dividend stocks is also key, he notes. One firm he likes is AstraZeneca (LSE:AZN). He says that it can grow even in a recession and pays a good dividend. It, however, has a low yield of 2%.

4) Be ready for a bounce back

Investors should be ready for when the market snaps back by never getting too bearish and keeping “risk” assets in a portfolio, according to Coombs.

He says: “You don’t want to miss the bounce. That happened to a lot of investors in 2009.”

Coombs now has his lowest cash level for five years, which goes against the general trend of fund managers raising their cash levels.

- Listen to our interview with Scottish Mortgage

- How to play the market rotation: fund, trust and ETF ideas

- Scottish Mortgage tops up Moderna, trims Amazon and sticks by Netflix

Armstrong says that investors should be buying firms that have pricing power and are creating profit margin squeezes for other companies. These “critical” companies are those in the agriculture and semiconductor industries and could be the first to rise when sentiment shifts.

He said: “Farmers are going to plant a lot due to higher grain prices and this is great news for farming goods companies. There has been a shortage of semiconductors, so chip prices will keep rising.”

5) Don’t listen to commentators

In bear markets, the media is packed with commentators calling for new lows and telling investors how much worse it could get.

Coombs says this is because they go into “career protection” mode, where it is safer to be too pessimistic than too optimistic.

“Investors have to ignore that and look at the facts, not the opinions. Stock markets will come back, despite what people say. In five years' time it will look like a great time to enter markets.”

Also remember...the steeper the loss, the bigger the climb to get back to even

So-called market corrections, in which markets fall between 10% to 20% over a short period of time, are relatively routine, occurring every couple of years.

What investors need to be wary of is a bear market that is associated with a recession or a crisis, which can see markets fall 30% or 40%.

- Fund and trust alternatives to Scottish Mortgage and Fundsmith Equity

- Why fund managers are trimming and not ditching tech shares

When markets fall steeply, it is harder to recover from. For example, a loss of 10% requires a gain of 11% to break even; a loss of 20% requires a gain of 25%; a loss of 33% requires a gain of 50%; and a loss of 50% requires a gain of 100%.

Recovering from big falls requires time and patience. This is, of course, an easier task for those who are young versus those at retirement, who are using their investments to supplement their lifestyle.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.