Five key advantages investment trusts have over funds

5th November 2021 14:51

The structural features help long-term investors to have confidence that it may well be the best course of action to just close your eyes and buy.

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Investors are increasingly unsure about what to do with their money, at least according to those we speak to. The reflationary rally seems to be over, and since the summer the market has gyrated between value and growth, pandemic optimism and pessimism, clean energy and fossil fuels, et cetera, et cetera…

While the general consensus is now that inflation will remain high for a considerable period of time, it is unclear yet whether this is a bullish or bearish scenario. Unfortunately, an investment decision can’t be ducked at this point in time. High inflation means that cash savings are likely to degrade rapidly. ‘Safe haven’ bonds will see their value fall in real terms. Residential property values are likely to be weighed on by rising interest rates. Risk assets seem to be the only game in town (TINA).

In our view, the structural features of investment trusts help long-term investors to have confidence that it may well be the best course of action to just close your eyes and buy.

In this article, we look at the different structural features of investment trusts that help investors with a long-term investment perspective ride out the inevitable bumps that will be experienced along the way.

Unlisted opportunities

The ultimate long-term investors, by definition, are those who have no opportunity to sell out of investments over the short term. Private equity is often decried for being short term, but we would argue the complete opposite, and most certainly by the standards of quoted equity managers who tend to have a holding period of significantly less than the three to five years that investments are typically held by private equity managers. In fact, we believe that private equity managers employ a repeatable process which drives value creation irrespective of the stage of the economic cycle. However, it takes time for managers to add value as an owner through active management. In this way, it is the complete opposite of a day trading strategy that requires the market to grind higher to make money. As such it is a potentially attractive sector into which to make long-term investments when the direction of markets is not clear. After all, the primary method of value creation is not dependent on an improving business cycle.

Investment trusts are a key way for the mass market investor to access unlisted assets, such as private equity, which have the potential to offer attractive long-term risk-adjusted returns. Even professional investors can find private equity difficult to access as it is often an exclusive club, whereby the best fund managers will heavily scrutinise their fund’s potential investors in order to ensure both that they have sufficient assets and that they remain committed for the long run. Private equity trusts offer retail investors access to this exclusive club.

As we describe in a past article, so long as investors are able to take a long-term view to investing to fully realise their potential, investment trusts offer a relatively liquid way to access such long-term strategies, with the ability to sell shares at will. That said, the share prices of listed private equity trusts can be volatile and discounts can remain extremely wide for sustained periods, which is a clear risk for investors.

Investors are spoiled for choice when it comes to private equity trusts, with a range of different strategy types available, from direct private equity to funds-of-funds. Strategies like Oakley Capital Investments (LSE:OCI) allow investors to invest directly into unlisted opportunities, with a portfolio of education, consumer and technology firms. OCI’s investors benefit from both the diversification of a highly idiosyncratic portfolio (direct private equity funds operate with a more concentrated portfolio given the cost of purchasing companies) and a highly entrepreneurial team. We note that the primary drawback of direct private equity trusts is their comparative complexity, as they carry far greater concentration risk and thus require greater scrutiny, which can be made difficult by the opaque reporting of private equity. Yet thanks to the reporting requirements of investment trusts, LPE investors gain unique insights into these strategies’ strengths – and in the case of OCI, the trust has a strong, cash-heavy balance sheet. OCI demonstrates many of the hallmarks of an attractive private equity strategy, and has generated strong performance, with an impressive NAV return of 108% over the last five years, a 31% outperformance of the MSCI ACWI.

For investors who are less confident in their ability to analyse direct private equity strategies, or who require a less stylistic exposure to private equity, a fund-of-funds or co-investment approach may be more attractive, especially for those yet to gain exposure to unlisted assets. BMO Private Equity Trust (LSE:BPET)is an example of this access route, with circa 100 investments made directly and through private equity funds. This diversification is an obvious advantage, and BPET is a way that investors can both gain access to many underlying fund managers and capitalise on BMO’s networks and reach, thus allowing them access to private equity strategies that exist outside the investment trust space. BPET’s managers focus on established smaller private equity management teams who the BPET team believe are best incentivised to hit their performance targets.

We examine the way in which listed private equity trusts offer specific advantages to those looking to access private equity strategies in this recent article, as well as illustrating a wider range of trusts available in the sector.

PRIVATE EQUITY FIVE-YEAR RISK AND RETURNS

| RETURN % | STD DEV % | SHARPE RATIO | |

| Oakley Capital Investments | 108.2 | 15.6 | 1.2 |

| BMO Private Equity Trust | 104.1 | 17.5 | 1.1 |

| Morningstar Investment Trust Private Equity ex 3i | 32.0 | 5.9 | 0.8 |

| iShares MSCI ACWI ETF | 76.8 | 19.0 | 1.0 |

Source: Morningstar, as at 29/10/2021. Past performance is not a reliable indicator of future results.

Liquidity

One of the reasons investment trusts can hold unlisted assets is the fact the managers don’t have to provide daily liquidity to investors. This is an advantage in the conventional equity space too, particularly at the smaller end of the market-cap spectrum. Miton UK Microcap (LSE:MINI)and Downing Strategic Micro-Cap (LSE:DSM) are both good examples, both of which have holdings with an average market cap of less than £150 million. An open-ended fund would likely have to hold high levels of cash to invest in this space, given that companies of this size are unlikely to offer significant daily trading volumes. MINI’s managers Gervais Williams and Martin Turner believe this in itself leads to opportunities, and that there are plenty of under-researched companies at the bottom end of the market which are eschewed by their professional peers, who are often unable to absorb the liquidity risk of holding small companies.

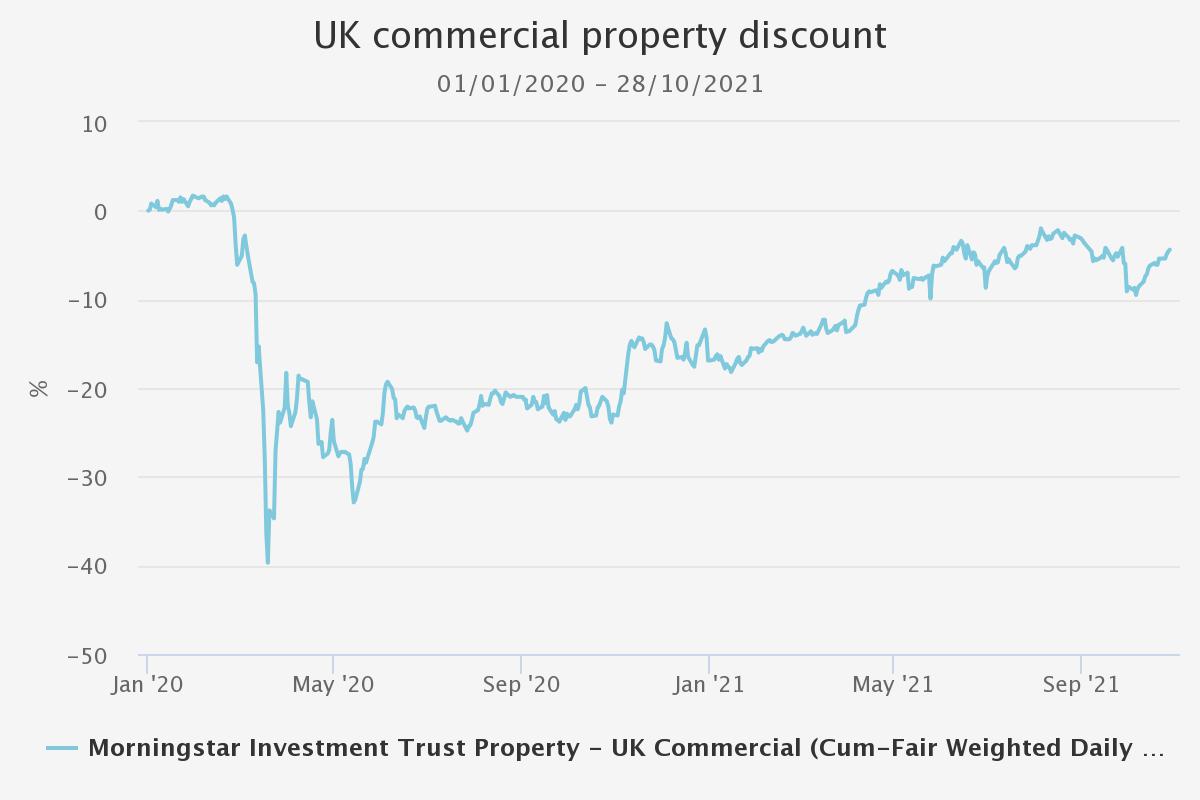

Investment trusts do, however, trade liquidity for price risk, whereby aggressive sell pressure can lead to widening discounts. While widening discounts can be frustrating for investors, they can offer very attractive entry points, as was the case for many property investment trusts during the Covid-19 lockdowns. The property sector’s discounts widened substantially over the initial lockdown, though this was not necessarily due to fears around liquidity but more about the outlook around certain property sectors. For example, the UK commercial property sector reached a discount of 40% at the depths of the initial crash, although it has since narrowed to a far narrower average of 5%.

UK COMMERCIAL PROPERTY DISCOUNT

Source: Morningstar

Gearing

For long-term investors, trusts’ ability to add gearing is another key advantage. In theory, the stock market should continue to rise over time, as long as labour and TFP (essentially technology and some intangible sources of efficiency) continue to grow. Of course the path is never smooth, and being geared means losing more in falling markets. However, for those managers or trusts that can hold on over multiple market cycles, gearing should generate higher returns.

Trusts which use structural gearing are set up to benefit from this basic dynamic. One example is Martin Currie Global Portfolio (LSE:MNP), and in November 2020 its board took out long-term debt worth 10% of NAV (currently 6% thanks to NAV growth). MNP is managed in a very similar fashion to the open-ended fund its manager, Zehrid Osmani, runs. The trust will naturally outperform the open-ended fund over the long run. We note that in certain sectors, investors may arguably do themselves a disservice by not utilising gearing, as the costs of financing gearing are currently very low. The Japan equity sector is a case in point, with Japan’s low interest rates offering low funding costs. High levels of gearing are used across a variety of different styles, with the growth-biased strategy of JPMorgan Japanese (LSE:JFJ)and the income-focused strategy of CC Japan Income & Growth (LSE:CCJI) both currently using over 20% net gearing.

Gearing also offers trusts investing in illiquid investments a way to scale up their strategies without raising equity, thus boosting returns. Strategies such as Greencoat UK Wind (LSE:UKW)and NextEnergy Solar (LSE:NESF)are prime examples of this, with both having over 30% net gearing (based on the last reported figures). UKW utilises a blend of both long-term and short-term gearing and is currently 38% net geared, with gearing being a key source of financing for its current investment commitments (amounting to over £500m in the coming years). UKW’s increased size is also an important driver of its operational efficiencies, allowing it to negotiate lower costs, such as pooling insurance and cutting costs for operation and maintenance contracts. On the other hand, NESF takes a more complex approach to gearing, utilising preferred shares and special purpose vehicles to achieve a high circa 43% level of net gearing. NESF’s gearing has been key to its expansion, with the trust now having gross assets of over £1 billion, with several new plants having been purchased over 2021. Gearing has also been key in achieving NESF’s and UKW’s attractive yields, with gearing effectively increasing the underlying revenue shareholders receive for a given nominal investment. NESF has a current yield of 7.1%, while UKW’s yield is 5.1%.

Boards

In a recent strategy article we discussed the benefits of having an independent board. Alliance Trust (LSE:ATST)is one of the more prominent examples of the various benefits of board intervention. In 2017, after a six-month review, the board appointed Willis Towers Watson (WTW) as investment manager. WTW has huge influence in the institutional market, and this is the first time its approach has been made available to retail investors. The strategy is to identify the best managers in different spheres, and then to ask them to run highly concentrated portfolios of their best ideas. WTW sets out to harvest the alpha from these strategies (some of which are not available in the UK market), while keeping basic factor exposures in line with the index. The board’s decision has paid dividends, as since the start of 2021 ATST has returned an NAV total return of 18.8%, placing it in the top quartile of global equity strategies.

BlackRock Sustainable American Income (LSE:BRSA) is a more recent example of a board’s proactive stewardship. In July of this year, the board successfully proposed a change to BRSA’s investment objective, whereby it now includes an explicit ESG objective. The board believes that by further integrating sustainability and ESG into a pre-existing US value and income strategy, it will ensure it remains relevant to current and future shareholders, given the ever-increasing need to address the world’s climate and social issues. While it is still early days for BRSA’s current mandate, it has already shown strong performance since its change, with BRSA representing the rare combination of ESG considerations and US value investing.

An independent board enables investors to ‘fire and forget’, confident that if changes need to be made to the mandate or manager, the board should deliver these for shareholders. When looking for a long-term investment, in our view this is an underappreciated positive feature of investment trusts.

Income

Investment trusts have many levers that the board can pull to ensure a dividend is maintained or grown, which for long-term investors should reduce the need to try to call the market and follow the confusing near-term signals. All trusts have the capacity to set aside 15% of the revenue they generate each year – a clear differentiator between them and their open-ended cousins – while boards can also pay from capital under certain circumstances. The AIC maintains a list of ‘Dividend heroes’, investment trusts with at least 20 years of sustained dividend increases. There are currently 18, including six which have been able to sustain their dividend growth for at least fifty years, an impressive accolade as there are very few open-ended funds which even have an operating track record that approaches 50 years in length. As we highlight in a past editorial, Covid-19 demonstrated the need for a proactive approach to dividend management, whereby the vast majority of UK equity income trusts were able to at least maintain their dividends during the pandemic, whereas all of their open-ended peers were forced to cut theirs.

The longest record of consistent dividend increases belongs to City of London (LSE:CTY), which has been able to sustain 55 years of consecutive dividend increases despite the difficulties the UK equity income sector has faced during the pandemic. CTY’s strong dividends are due in part to the careful positioning its manager Job Curtis decided on, who during the Covid-19 crisis focused on purchasing strong, reliable dividend payers rather than the higher-risk, more cyclical companies whose recovery (and thus dividend potential) was more speculative. CTY also benefits from a board that is committed to sustaining its dividend. While CTY has begun to run down its revenue reserve, the board remains open to utilising other distributable reserves to support the dividend (another unique quirk of investment trusts), including a reserve of realised capital gains amounting to over £300m, circa 18% of its NAV. BMO Global Smaller Companies (LSE:BGSC)is also another example of an incredible dividend record, with over 50 years of sustained growth. Not only is its track record impressive, but the board’s active management of the trust’s income has allowed a style of investing long associated with inconsistent dividend profiles (as smaller companies tend to focus on growth over income) to still generate a sustained level of growth.

LONGEST DIVIDEND TRACK RECORDS

| YEARS OF CONTINUOUS DIVIDEND INCREASES | YIELD (%) | |

| City of London (LSE:CTY) | 55 | 4.9 |

| Bankers (LSE:BNKR) | 54 | 1.9 |

| Alliance Trust (LSE:ATST) | 54 | 1.4 |

| Caledonia Investments (LSE:CLDN) | 54 | 1.7 |

| BMO Global Smaller Companies (LSE:BGSC) | 51 | 1.0 |

| F&C Investment Trust (LSE:FCIT) | 50 | 1.4 |

Source: The AIC and JPMorgan Cazenove, as at 29/10/2021

JPMorgan Japan Small Cap Growth & Income (LSE:JSGI)is an example of using the ability to pay from capital to fund the dividend. JSGI pays out 4% of its NAV each year as a dividend (1% of NAV each quarter). JSGI is by no means a conventional Japanese income strategy, however, with its managers focussing on Japanese small-cap growth opportunities, a style long associated with poor dividends. With the MSCI Japan Small Cap Index yielding circa 2%, JSGI’s circa 4% yield is clearly an attraction, and is only amplified when we consider that open-ended investors will get a far lower yield from Japanese growth equities in particular. However, we note that unlike CTY and BGSC, JSGI’s dividend cannot be guaranteed to be progressive, as in down-trending markets its nominal dividend will naturally fall in line with its declining NAV.

Conclusion

We sympathise with investors wondering where to put their cash right now. Are we still recovering from a pandemic or tipping back into recession? Is the current supply-side inflation going to force rates to be raised further than they would otherwise be for the health of the employment market? Diversification is always likely to be a key strategy in such a quandary, but the likelihood is that investors are going to have to take risks to preserve the real value of their capital. We have outlined above some of the key advantages which investment trusts have, and also some of the top-performing exponents of those advantages. We would argue that these key features all really take best effect over a long-term investment horizon, and that for a variety of investors closing your eyes and buying a variety of high-quality investment trusts might be the best way forward.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.