Five hard-hit AIM stocks with recovery potential

Higher interest rates, inflated costs and recession fears have triggered an exodus from small-cap shares over the past couple of years. These are high-risk stocks, but award-winning AIM writer Andrew Hore thinks they may have fallen too far.

17th November 2023 15:03

by Andrew Hore from interactive investor

It has been a poor year for AIM and there are nearly 150 companies with a share price decline of 50% or more so far in 2023. Some of these companies may be on their way out from AIM either by choice or because of insolvency.

There are other companies that have gone through sharp share price declines that may have been warranted, but the outlook is more positive.

- Invest with ii: Share Dealing with ii | Open a Stocks & Shares ISA | Our Investment Accounts

While there is no guarantee that they will fully recover, and they remain high-risk investments, there are reasons to think that they can perform much better than their valuations suggest. Here are five examples. All share prices and performance data as at end of business on Thursday 16 November.

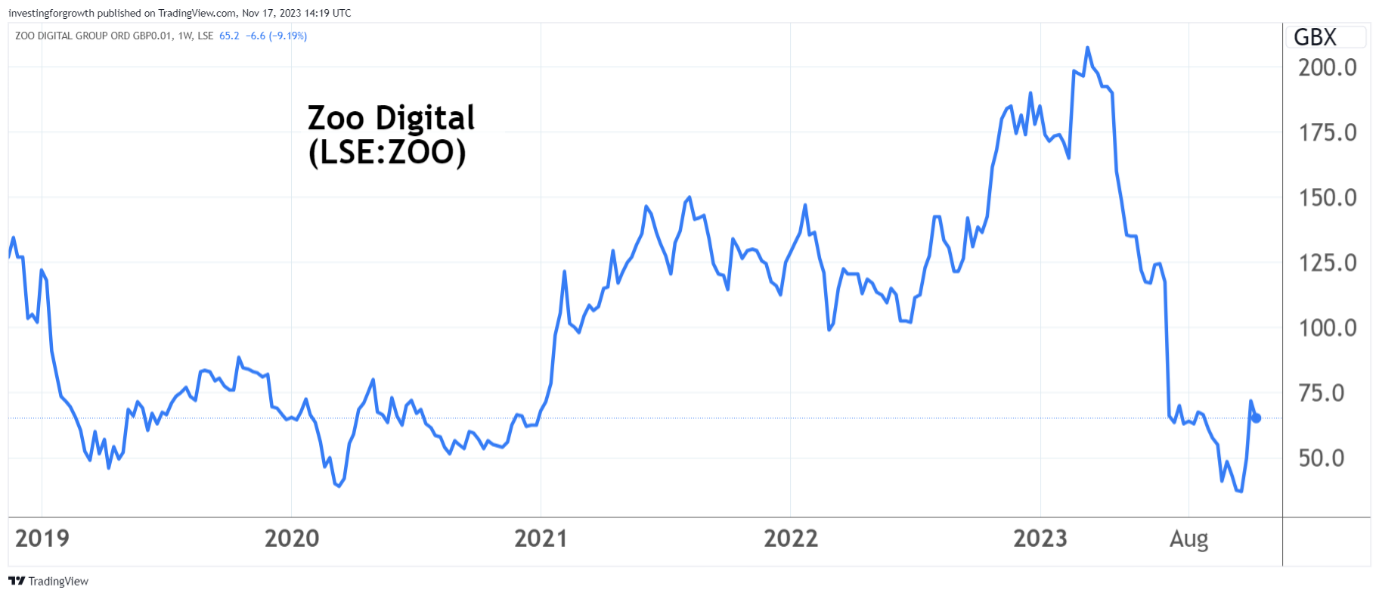

Zoo Digital (ZOO)

64p

Decline in 2023: -64%

Zoo Digital Group (LSE:ZOO) provides globalisation services to film and television companies. It provides dubbing, subtitling, metadata, audio description, scripting and media services.

Why has the share price fallen?

The strikes by writers and actors in Hollywood hit demand for the company’s services. Although, the strikes were by members of the US unions, they also had a knock-on effect on productions in other countries. This limited the work available.

Even before the strikes, there had been downgrades to expectations because of delays in work flowing through. Streaming services are being more cautious about investment. Interim revenues are expected to more than halve and little improvement is expected in the second half.

Why will it recover?

Both the writers and actors have secured agreements with the major Hollywood studios. The writers strike ended before the actors strike and that provided time to work on scripts to restart productions when the actors return to work. There will be a lag before Zoo Digital’s services are required, though.

Singer slashed its 2023-24 forecast, so it moved from a profit to a $13.8 million loss with net cash of $8 million at the end of March 2024. It is no surprise that the share price dived after that forecast change. Management has cut annualised costs by $8 million.

This should prove as bad as it will get, with potential for improvement, particularly in 2024-25 when there is likely to be a return to profitability. This should spark a recovery in the share price.

Source: TradingView. Past performance is not a guide to future performance.

Belluscura (BELL)

25p

Decline in 2023: 61.8%

Belluscura (LSE:BELL) has developed portable oxygen concentrators. The X-PLOR is designed to replace heavy oxygen tanks and it has a rechargeable battery and easy-to-use interface. The DISCOV-R weighs less than 6.5lbs but produces more oxygen per pound than any other oxygen concentrator.

Why has the share price fallen?

Just like any other medical technology developer it will take time to build up the sales of the company’s equipment and it is losing money. Belluscura is currently a cash hungry business.

It has finalised the terms of the acquisition of the standard list cash shell TMT Acquisition, which will bring much needed cash – the latest figure was £4.7 million, but it may have fallen slightly since then. The revised offer is three Belluscura shares for every four TMT Acquisition shares.

Belluscura has also raised £2.72 million from an issue of 10% unsecured convertible loan notes 2026, convertible at 40p/share, and £595,000 from a share placing at 32p/share. Management estimates that following the acquisition there should be £8 million of working capital.

Why will it recover?

The portable oxygen concentrator market could grow from $1.63 billion in 2022 to $2.76 billion in 2026. This shows the potential demand for the company’s products. Sales agreements are being secured.

An exclusive licence agreement with InnoMax in China covers both the X-PLOR and the newer DISCOV-R, which should be launched next year. There will be minimum cumulative royalties totalling $27.5 million for the first five years of the agreement with potential for extending the agreement. Belluscura has received other orders for the DISCOV-R worth $15 million.

Belluscura is expected to lose money in 2023 and 2024 before moving into profit in 2025. A forecast 2025 pre-tax profit of £10.8 million equates to less than three times prospective 2025 earnings. This may prove optimistic, but the business is undoubtedly moving towards profitability. The shares issued for the acquisition may hold back the share price in the short-term and there could be an even better buying opportunity.

- Stockwatch: takeover bids imply stock market in recovery mode

- Stockwatch: is this speculative tipple to your taste?

Gelion (GELN)

24.65p

Decline in 2023: -51.7%

Australia-based Gelion Ordinary Share (LSE:GELN) is a battery technology developer. The focus is lithium-sulfur and zinc-based technologies.

Why has the share price fallen?

It has been a bad time for quoted companies developing technology with little or no revenues and a need for cash injections. There have been three chief executives in two years and the management changes have not helped, although the current incumbent John Wood has experience in the battery technology sector.

When it floated in November 2021 at 145p/share, Gelion’s focus was on zinc-based batteries, but lithium-sulfur technology has become more important. The intellectual property in this area has been added to via acquisition.

Why will it recover?

Gelion has put together an impressive range of intellectual property (IP) for lithium-sulfur batteries. It acquired Johnson Matthey’s battery IP, and it is acquiring lithium-sulfur battery company OXLiD Ltd for up to £4.2 million. This provides lithium metal anode technology as well as existing silicon anode technology. There are uses in stationary, automotive and aerospace batteries.

The zinc battery cell proof of concept is due in the first quarter of 2024. The pilot should confirm the safety, low cost and ability of the technology to scale. This market is smaller than for lithium-sulfur batteries.

Gelion has raised £4 million through a placing at 24p/share and a retail offer could raise up to £450,000. That should provide enough cash for 15 months. Cavendish estimates at some of the parts of 88p/share.

There is an enormous opportunity. An investment is still highly risky, but the share price is at a level that makes the risk worth considering. Again, the short-term share price could be held back by the share issue.

RBG Holdings (RBGP)

18.5p

Decline in 2023: -71.1%

RBG Holdings Ordinary Shares (LSE:RBGP) is the holding company for two high-profile legal businesses – Rosenblatt and Memery Crystal. Rosenblatt is focused on litigation work predominantly with high-net-worth individuals and entrepreneurs. Memery Crystal was acquired for £30 million in April 2021 and specialises in corporate services for multinationals and smaller businesses.

There is also a sell-side corporate finance boutique Convex Capital, which has more volatile revenues. The litigation finance business has been sold.

Why has the share price fallen?

Problems with the litigation finance business and subsequent management upheaval have hurt the share price. At the end of January, the board of RBG terminated the contract of chief executive Nicola Foulston because it lost confidence in her strategy. It was recently announced that RBG had come to a £500,000 settlement with her.

Litigation finance provider LionFish was sold to Blackmead Infrastructure for up to £3.07 million. The company is writing off the £13.3 million of asset value of its remaining litigation cases, including an unsuccessful case valued at £9.3 million.

There have been significant profit downgrades during the year. High borrowings have also concerned investors.

Why will it recover?

After a problematic year, management can concentrate on its core businesses. Hopefully, it has got all the bad news out of the way.

The 2023 pre-tax profit forecast of £5 million depends on Convex Capital completing certain deals. One deal should generate £1 million in fees by the end 2023 as long as it receives regulatory approval. There should be a recovery in 2024 and that will help to start reducing borrowings.

The lawyer brands have a strong position in their markets, and this should be reflected in a share price recovery over the next two years.

Eneraqua Technolgies (ETP)

36p

Decline in 2023: -88.8%

Eneraqua Technologies (LSE:ETP) supplies and installs technology that improves energy and water efficiency in multiple occupancy social housing and commercial projects. It joined AIM in November 2021 when it raised £12 million at 277p/share.

Why has the share price fallen?

The company has a strong order book, but there have been delays in installations. There has also been uncertainty about net nutrient neutrality rules imposed on housebuilders, which has hampered the water business. These rules are designed to ensure that new property developments do not increase nitrate emissions by reducing the amount of water used. Eneraqua’s Control Flow HL2024 technology is designed to perform this service.

There are also concerns about the accrued income in the balance sheet, although management says that it has received cash since the July 2023 balance sheet. There are worries about cash generation.

- Richard Beddard: a share that’s easy to like, but should you buy it?

- Jeff Prestridge: cash is king but equities will prevail

Why will it recover?

Revenues have been downgraded, but they are still expected to grow strongly over the next two years. The overall order book was £146.3 million, including a £11.3 million contract with the NHS to replace old boilers with low carbon heat pumps. The NHS is a customer that could provide significant amounts of business. There are also opportunities in India.

This year, pre-tax profit is likely to decline from £10 million to £1.9 million, before recovering next year. There is potential upside from contract wins. Net debt is likely to be negligible.

Eneraqua Technologies has disappointed the market and paid in terms of the slump in the share price. The prospective 2023 multiple is less than nine. There is demand for the company’s services and the share price fall is overdone.

Andrew Hore is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.