Five funds where cash is king

10th August 2022 13:09

by Dzmitry Lipski from interactive investor

Given that both stocks and bonds have fallen in tandem in 2022, investors may be considering cash as a defensive asset. Dzmitry Lipski explains how to use cash in your portfolio.

It has been a challenging year so far for investors, with both equity and bond markets unusually falling in tandem. High inflation and interest rate rises have made it a challenging backdrop for the two major asset classes.

- Find out about: Free regular investing | Interactive investor Offers | ii Super 60 Investments

As a result, investors may be more cautious than usual, and therefore be wanting to protect returns earned over the years. A meaningful cash allocation can help investors with this, providing a solid buffer for a portfolio.

And, when the time is right, having “dry powder” allows for allocations to other riskier asset classes such as equities that focus on potential growth over time.

‘Cash is king’

Cash investments play an important role within a portfolio by providing greater stability and diversification.

Despite high inflation levels meaning that cash returns are negative in real terms, there are some good reasons why you should hold at least some cash other than for emergencies and liquidity.

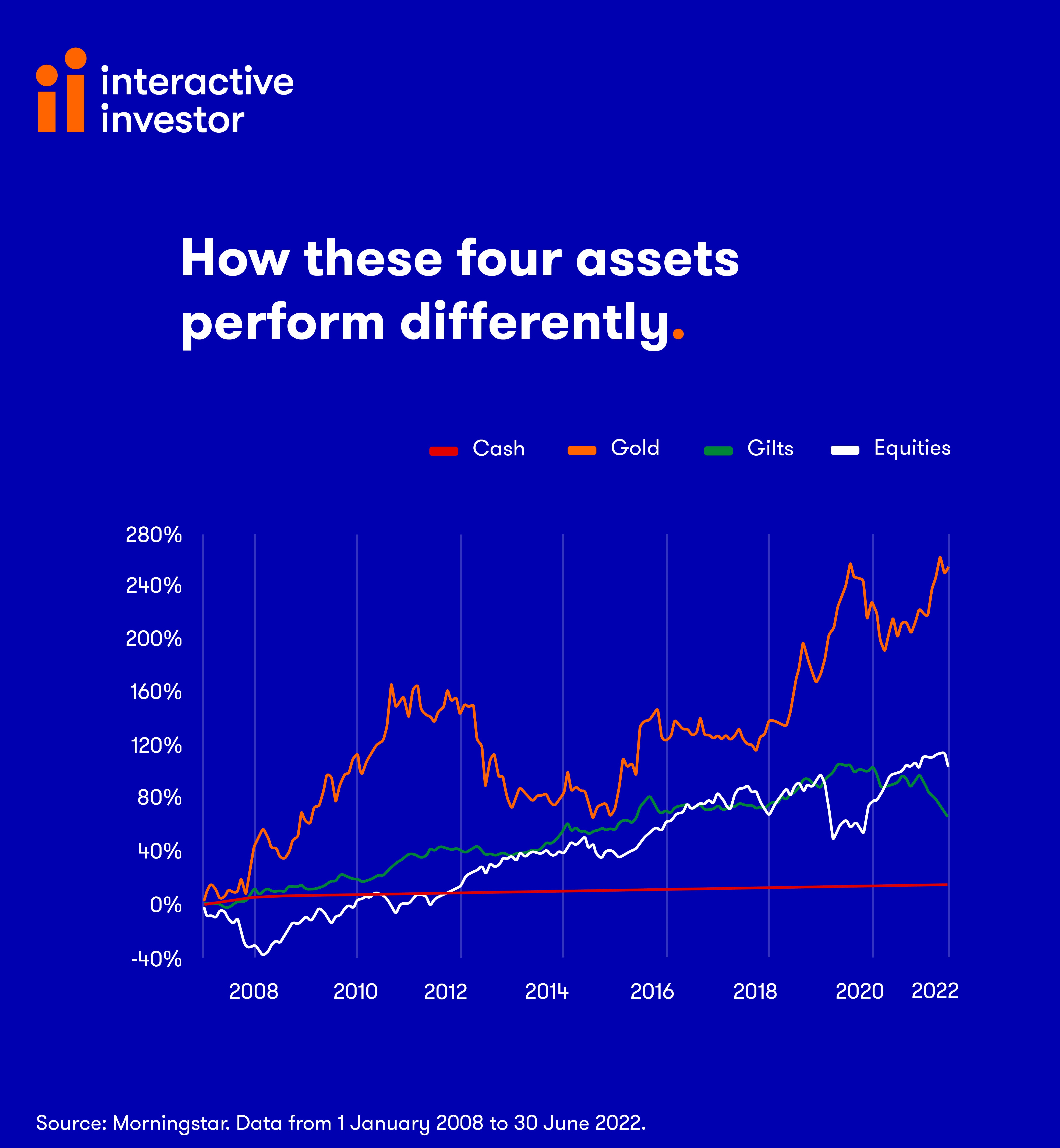

Alongside asset classes such as government bonds and gold, cash is a safe-haven asset. These assets tend to hold their value during periods of market volatility as they generally have a low or negative correlation with equities.

As interest rates increase over time, cash investments would be expected to see an increase in yield, as they have historically during rising rate environments. However, if inflation remains elevated cash returns will continue to lag in real terms.

How much should I allocate to cash?

When making cash allocation decisions, investors need to consider their investment objectives, time horizon and risk tolerance. An investor with a long-term investment horizon and high return objectives may want to hold only a relatively small cash position in their portfolio. For those with a shorter-term time horizon more cash may be appropriate.

However, as we move into a more uncertain market environment, it makes sense for investors to focus on capital preservation and limit volatility by maintaining a reasonable cash buffer within a well-diversified portfolio.

- The investments that will keep growing – even during a recession

- How the cost-of-living crisis is changing the way pros invest

Investors looking for a one-off solution should consider multi-asset funds that are able to invest across different asset classes, including equities and bonds, providing a greater degree of diversification.

Defensive multi-asset funds, often characterised by large cash allocations, are better placed to protect capital when markets undergo a downturn. But be warned, they typically lag the wider market during rally phases.

We have selected five high-quality multi-asset funds with cash allocation of more than 10%. Each fund is either in interactive investor’s rated lists, or is a member of our five model portfolios.

Fund name | Rated List | IA Sector | Asset Allocation to Cash % (Net) | Total Return - YTD | Total Return - 2021 | Total Return - 2020 | Total Return - 2019 |

Targeted Absolute Return | 15.67 | -8.7 | 7.7 | 9.6 | 11.9 | ||

£ Strategic Bond | 12.17 | -12.4 | 4.3 | 4.3 | 13.8 | ||

Volatility Managed | 9.78 | -15.1 | 6.0 | 13.1 | N/A* | ||

Mixed Investment | 9.24 | -10.5 | 2.6 | 2.9 | 11.1 | ||

9.08 | -13.1 | 13.5 | 7.9 | 21.6 |

Source: Morningstar. Total return figures to end of June 2022. * Fund was launched in December 2019. Past performance is not a guide to future performance.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.