Fight inflation ‘runaway train’ by checking your investment platform costs

23rd February 2022 13:19

by Jemma Jackson from interactive investor

An effective way to fight inflation is to start with investment platform costs, which can add up to tens of thousands of pounds over the long term, as our figures show.

Many investors are currently thinking about how they might adjust their portfolios to fight rampaging inflation.

Whether you want to review your portfolio or not, an effective way to fight inflation can start with investment platform costs, which can add up to tens of thousands of pounds over the long term, often without investors even realising it.

Myron Jobson, Senior Personal Finance Analyst, interactive investor, explains: “We all want to preserve and grow our wealth. Once-in-a-generation financial events like the current ‘hot’ inflationary environment can be a reminder to take a cold, hard look at our portfolios. But tinkering with a carefully constructed, well diversified portfolio comes with no guarantees.

“We can’t control the market, but we can control our costs. If we really are on an inflation runaway train, shopping around and getting on the right platform could save you thousands. If inflation slows down – you could still save thousands.

“interactive investor charges a flat monthly fee, which means as your savings grow, your fees stay the same. It can also help you keep track of your costs. It’s also worth thinking about regular investing – not only can it smooth out some of the highs and lows in the price of shares, but interactive investor offers free regular investing for funds, investment trusts, ETFs and popular UK shares, and it all adds up over time.”

Savings that can add up

- For £9.99 per month in ii’s core Investor plan, customers can have a trading account, ISA, and as many free Junior ISAs as they have children

- Free regular investing for funds, investment trusts, ETFs and popular UK shares

- A free trade per month, worth £7.99, in all three of ii’s service plans

- Friends and Family: for just £5 extra a month, ii customers can each giftup to five people a free subscription to ii.

Years and years – how it all adds up

Assuming a starting value of £50,000 in a stocks and shares ISA – which is lower than the UK average ISA value of £61,707*, Lang Cat data for interactive investor then assumed an annual ISA investment of £10,000 (not insignificant, but a long way short of the £20,000 annual allowance), spread out on a monthly basis.

The research then imagined a portfolio split equally between funds and shares, reflecting the mix of funds and equities in customer portfolios. The research assumes an annual return of 5%, and two trades a year. See notes to editors for the full research.

There’s no question that anyone putting this amount of money away is very fortunate – but they are far from super-wealthy. Yet over time, the differences between the percentage fee and fixed fee charging structure is striking.

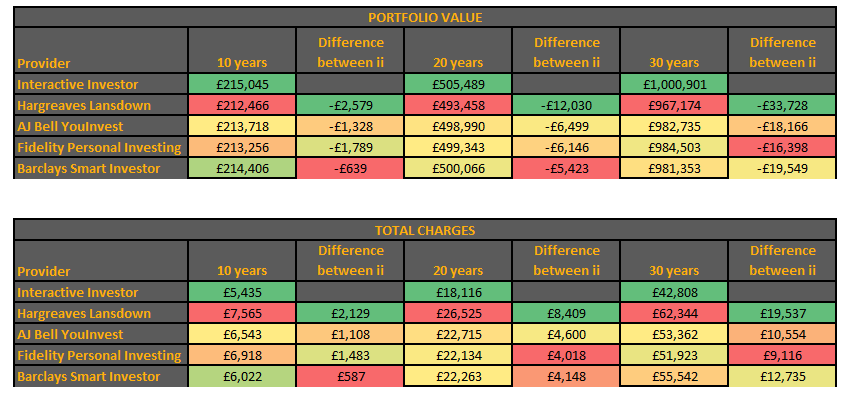

In the early years, the differences might not seem so great, but even over 10 years investors with ii’s largest competitor would have a portfolio value worth £2,579 less than the ii customer (see notes to editors with some wider platform comparisons).

But fast forward 20 years, and there’s even more of a sting: investors with ii’s largest competitor would have a portfolio value worth £12,031 less than the ii customer.

Over 30 years, ii customers would be £33,727 better off in portfolio value terms under those same scenarios, with the ii customer an ISA millionaire, with a portfolio value of £1,000,901. Customers with ii’s largest competitor would have fallen short, with £967,174.

For smaller pots, a percentage fee will often work out cheaper – in the early days at least. So investors need to bear that in mind, too. Also, these growth assumptions are scenarios only. But it is nevertheless thought provoking.

Interactive investor is also currently running a ‘recommend ii’ offer for existing customers.

Notes to Editors

The lang cat data:

Lang Cat assumed a starting value of £50,000 in a stocks and shares ISA.

Then assumed an annual ISA investment of £10,000, drip fed on a monthly basis.

The research then imagined a portfolio split equally between funds and shares, with an annual return of 5%. An inflation rate of 2.00% throughout the period. Inflation is applied to regular contributions and to instances of fixed fees, but not used to adjust final projected values.

It assumed 2 trades a year.

Returns are scenarios only. The value of investments can go down as well as up and you may not get back the full amount invested.

Ongoing Charges Figure (OCF)

The analysis assumes a typical portfolio of active funds, with an average OCF of 0.66%.

Each provider shown may offer a different range of investments.

Investment returns

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.