Fear, greed, and opportunity: how to handle market swings

The prospect of a trade war and other economic uncertainties have investors on edge and volatility running hot. Here's how to handle it all.

21st March 2025 08:58

by Theodora Lee Joseph from Finimize

- Market volatility comes with the territory when you’re investing. While uncertainty can feel overwhelming, history shows that corrections and other dips happen regularly and are often followed by periods of recovery and growth

- Panic selling can lock in losses, and blindly chasing safe-haven assets can mean missing out on recovery opportunities. The best investors stick to a disciplined strategy that balances risk and reward, even when the market feels unpredictable

- Rather than making extreme moves, opt for thoughtful adjustments – such as diversifying into stable sectors, holding some cash for opportunities, or rebalancing to match your risk tolerance. They can do more to help you stay on track. The goal isn’t to avoid volatility altogether, but to be positioned to face it with confidence when it comes along.

If it feels like there’s a new reason to worry about the stock market every day, you’re not wrong. Between the constantly changing trade policies, stubbornly quick inflation, and the Federal Reserve’s (Fed's) mixed signals about interest rates, uncertainty seems like the only thing that’s…certain. It’s no wonder investors are feeling skittish.

The question is what to do about that. When markets are volatile, it doesn’t pay to react to every market swing. Instead, you want to position your portfolio to handle whatever comes next. Here’s how.

Hello, volatility, my old friend

With investors on edge lately, stocks have been reacting in kind. So the volatility index (VIX) – often referred to as the market’s "fear gauge" – has been running higher than it has in a while.

The CBOE’s volatility index (VIX) over time. Source: TradingView.

But here’s the thing: market volatility is completely normal – it’s the context that matters.

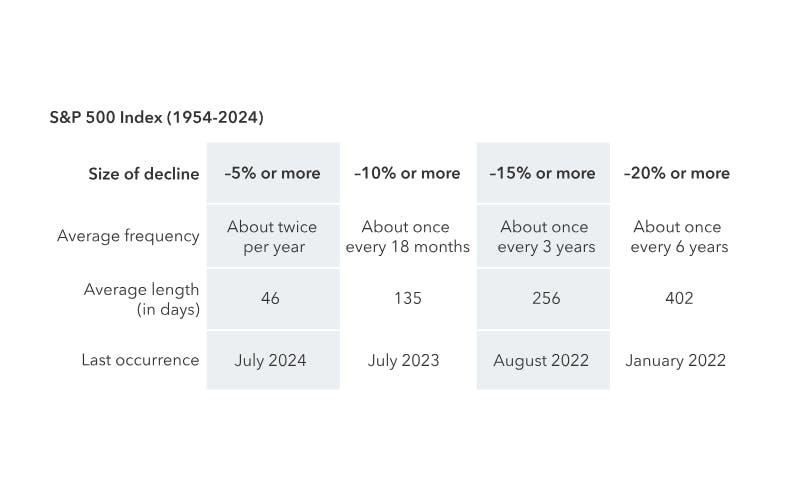

History tells us that market corrections happen more often than people think. A 10% pullback (correction) occurs roughly every 18 months, while 5% dips happen about twice a year. The important thing is to distinguish between temporary market noise and a real downturn.

Market declines are a normal and frequent feature of investing. Sources: Capital Group, RIMES, Standard & Poor's.

To spot the difference, you have to know what to look for.

And one of the biggest indicators is corporate earnings. When companies continue to report strong profits, volatility is usually short-lived. On the other hand, when earnings expectations start falling across multiple industries, it could indicate that a broader slowdown is afoot.

Another major factor is the Fed. It’s been planning to cut interest rates – and while it might still do so, loftier inflation expectations are complicating the central bank’s decision-making. If the Fed is forced to maintain higher rates for longer to keep inflation from spiraling out of control, that could extend the market’s period of instability.

Finally, liquidity flows tell a story. Investors have been shifting money into short-term US Treasuries and gold, signaling worries and a strong desire to retreat to the market’s quieter havens. When they start leaving those safe spaces and moving back into stocks, you’ll know their confidence is on the mend.

In the meantime, the best thing you can do is take a step back and gain some perspective on your portfolio.

Three mistakes to avoid when markets are choppy

No question about it: those erratic market swings can be unsettling. And they just might lead you to make knee-jerk moves that can hurt your long-term returns. Here are the most common pitfalls:

- Panic selling. Letting your assets go during a market dip can lock in losses and make it harder to recover when markets rebound. Historically, some of the best market days occur right after the worst ones, so bailing when things get rough is rarely a good move

- Chasing safe havens. Gold, bonds, and cash are attractive when uncertainty rises, but going all-in on defensive assets like those can lead to missed opportunities when markets recover. Striking the right balance is key

- Ignoring the opportunity side of volatility. Market downturns often present buying opportunities, but many investors sit on the sidelines out of fear. The best long-term gains often come from buying quality assets when they’re temporarily undervalued.

Avoiding these mistakes is about more than just staying calm – it’s about having a strategy that prepares you for turbulence before it happens.

Adapt your portfolio (without overreacting)

Before making any big moves, ask yourself: Am I comfortable with my current level of risk? If your portfolio has become more aggressive than you intended – maybe because stocks have outperformed bonds and cash holdings – it could be a good time to rebalance.

That doesn’t mean panic-selling or going all-in on defensive assets. Instead, think about making small, thoughtful adjustments. If you’re heavily invested in high-growth tech stocks, consider shifting some money into more stable sectors like healthcare or consumer staples, which tend to hold up better in uncertain times. When you’re feeling uneasy, adding bonds or dividend stocks to your portfolio can provide a sense of stability.

Holding some extra cash can also be a smart move, not to use as an escape hatch but to throw into new opportunities as they come alone. If the market drops further, you’ll be in a great position to scoop up quality stocks at discounted prices.

Adopt volatility strategies that match your investing style

How you handle volatility depends a lot on your personal approach.

If you’re investing for the long haul, the smartest thing is often to do nothing at all. Downturns come with the territory, and historically, those who stay invested tend to do better than those who try to time the market.

One of the best ways to take advantage of volatility is through dollar-cost averaging – investing a set amount at regular intervals. It ensures you’re buying more shares when prices are low and keeps you from making decisions based on emotion.

If you like to be more hands-on with your investments, though, now might be the time to make tactical shifts.

That could mean:

- Rotating into more stable assets while maintaining some exposure to growth

- Using hedging strategies, like options or inverse ETFs, to manage downside risk

- Looking for undervalued stocks in sectors that have been oversold.

But be careful – trying to time the market is a losing game. Instead of making extreme bets, focus on adjusting your risk levels while staying invested.

And if you’re retired or nearing retirement, double-check your risk exposure. The last thing you want is to be forced to sell stocks at a loss to cover living expenses. Instead, keep enough cash in reserves to get you through a year or two, along with a mix of dividend-paying stocks and bonds that can help keep your portfolio steady without sacrificing too much growth.

Market ups and downs can be unsettling, but remember: you don’t have to react to every swing. Stay focused on your long-term goals, keep a balanced portfolio, and trust that volatility is just part of the journey. The best investors aren’t the ones who predict every move – they’re the ones who stay the course.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.