A fashion trailblazer worth watching

In the unforgiving world of online retail, our industry commentator highlights a US-based stock to watch.

27th February 2019 11:53

by Rodney Hobson from interactive investor

In the unforgiving world of online retail, our industry commentator highlights a US-based stock to watch.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Investors can be forgiven for thinking only of Amazon (NASDAQ:AMZN) when it comes to online retailing. Amazon has a grip across the spectrum of goods, apparently leaving room only for established retailers diversifying into bricks and clicks. It would be prohibitively expensive to try to take on this giant head to head.

It is possible, though to find a niche in online retailing, as UK company ASOS (LSE:ASC) has done by copying celebrity fashions for a mass market in women's clothing. Across the Atlantic, Stitch Fix (NASDAQ:SFIX) has been carving out a market in mail order fashions – or as a "personal styling service" as it prefers to call itself - since it was founded in 2011 by Katrina Lake, who was attending Harvard Business School and is still the chief executive officer.

It is worth remembering that Amazon itself started as a niche player, selling books in competition with established High Street book chains. Stitch Fix is targeting a clothing market that is worth an estimated $350 billion a year in the US alone and it already has 2.9 million active customers, up 22% on a year ago.

What is attractive about Stitch Fix is that it is already profitable at a comparatively early stage in its history, quite a feat for an online venture. One reason for its success is its use of data: Stitch Fix employs 100 data scientists to analyse data and feedback from customers to tailor clothing offers to individuals.

The company is also expanding its range. While the original women's clothing side continues to prosper, Stitch Fix has added shoes and accessories, less popular sizes and, more recently, men's and children's clothing. Stitch Fix works with more than 1,000 brands including Levi Strauss, Rag & Bone and Tommy Hilfiger, in addition to its own lines.

There was a bit of disappointment with fourth quarter figures for the financial year to the end of July, though that was a little unfair. Revenue was near the top of management's guidance, up 23% year on year to $318 million, but investors were hoping for even better, as the figure for the previous quarter was 30%. Similarly, EBITDA topped expectations at $11.1 million but fell short of the $12.4 million recorded in the third quarter.

Results for the first quarter of the current financial year were better received, with net revenue up 24% year on year and EBITDA rising to $14.3 million. Earnings per share at 10 US cents were twice the level that some analysts expected.

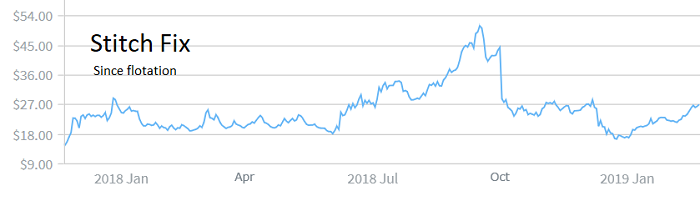

Source: interactive investor Past performance is not a guide to future performance

The rest of the current financial year to the end of July could be tougher going. Stitch Fix is expanding into the UK and many retailers on both sides of the pond have found that crossing the Atlantic is expensive and hard to get right. However, growing at an annual rate of at least 20%, which is clearly achievable for the foreseeable future, would be the envy of most companies. We shall have a clearer idea when the next earnings figures are released in a couple of weeks' time.

Stitch Fix went public in November 2017 with the shares priced at $15, valuing the company at $1.6 billion. It has been quite a ride since then. They bounced between $19 and $29 until June last year before soaring above $50 three months later. When the bubble burst they fell back to $17 just as rapidly. That is not a reflection on the company so much as an indication that the shares ran ahead of themselves before retreating to a more realistic level.

Although the shares have now picked up to $27, valuing the company at $2.6 billion, they are clearly not for the faint hearted. There is no dividend and probably won't be for several years as cash is ploughed back into growing the business so the shares are not suitable for investors looking for income or who like a regular return to offset any fall in the share price.

Hobson's choice: Speculative buy below $30 but consider taking profits if they top $50 during the course of 2019.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.