eyeQ: inflation fright and policy risks

Experts at eyeQ use AI and their own smart machine to analyse macro conditions and generate actionable trading signals. This time, it studies threats to markets in the coming weeks.

9th October 2024 11:46

by Huw Roberts from eyeQ

"Our signals are crafted through macro-valuation, trend analysis, and meticulous back-testing. This combination ensures a comprehensive evaluation of an asset's value, market conditions, and historical performance." eyeQ

- Discover: eyeQ analysis explained | eyeQ: our smart machine in action | Glossary

Although eyeQ’s smart machine employs some very clever maths, when it comes to writing these notes, we try to keep it as simple as possible. But sometimes it’s worth digging into the model and the macro stuff in a bit more detail.

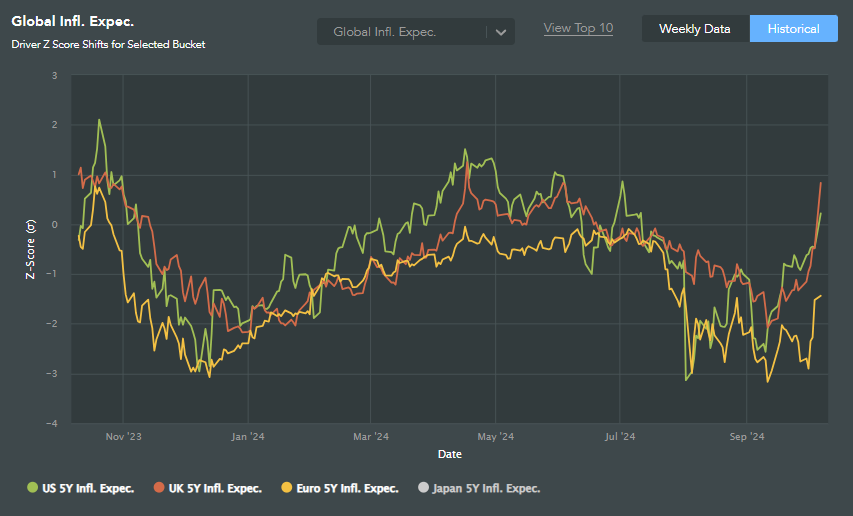

The chart below is from our sister company’s portal. Quant Insight is used by the world’s biggest fund managers in their investment process.

Professional money managers need to keep a sharp eye on shifts in macro developments, and this chart shows inflation expectations in the US, Europe and the UK in Z-score terms. Forget the scary jargon, it simply shows the market’s best guess on where inflation will be in five years’ time in those three regions.

Zero is the trend for inflation over the last year, so when it’s a negative number, inflation is expected to be falling below the recent trend. When it’s positive, it’s expected to be above trend.

The pattern is the same everywhere. Over the summer, we saw increased fears of a recession which prompted a sharp fall in inflation expectations. Slower economic growth, it was believed, would drag inflation everywhere back to target, and possibly below.

These worries about a hard economic landing were one of the reasons for the Federal Reserve’s large 50 basis point (bp) rate cut a few weeks back and the Bank of England’s 25bp rate cut at the end of July.

But since those rate cuts, inflation expectations have turned sharply higher. In the UK especially, inflation expectations are now back above the recent trend.

This is the inflation market taking fright. It could reflect fears about conflict in the Middle East pushing crude oil prices higher. Last week’s strong jobs report in the US points to a robust American economy. Stronger economic growth could mean that the last mile of getting inflation back to the 2% Fed target is harder.

There’s also the implication that maybe big rate cuts like that 50bp from the Fed wasn’t necessary. In the jargon this is called a potential policy mistake. Cutting rates when inflation is still a problem risks making the problem worse.

In the UK we have the upcoming Budget. The fallout from the Liz Truss Budget in 2022 came about because it was unfunded and highly stimulative. In short, it was inflationary. There could also be an element of the market fearing that Chancellor Rachel Reeves’ Budget in a few weeks’ time could repeat that error.

All this could, of course, correct. Energy markets could settle down. Economic data could soften. The Fed and Bank of England might persuade us that measured rate cuts are indeed the prudent thing to do given how high interest rates are and economic data that is softening. And, of course, the Labour Budget could be well received.

eyeQ pulls these inflation expectations as one of the factors in our models. So the smart machine is constantly monitoring these developments and keeping you updated. This will be especially valuable in the next few weeks.

These third-party research articles are provided by eyeQ (Quant Insight). interactive investor does not make any representation as to the completeness, accuracy or timeliness of the information provided, nor do we accept any liability for any losses, costs, liabilities or expenses that may arise directly or indirectly from your use of, or reliance on, the information (except where we have acted negligently, fraudulently or in wilful default in relation to the production or distribution of the information).

The value of your investments may go down as well as up. You may not get back all the money that you invest.

Equity research is provided for information purposes only. Neither eyeQ (Quant Insight) nor interactive investor have considered your personal circumstances, and the information provided should not be considered a personal recommendation. If you are in any doubt as to the action you should take, please consult an authorised financial adviser.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.