Ethical ETFs: there's never been a better time to put your money where your morals are

Falling fees make ethical exchange traded funds robust investment propositions. Kenneth Lamont writes.

9th January 2019 13:34

by Kenneth Lamont from interactive investor

Falling fees make ethical exchange traded funds robust investment propositions. Kenneth Lamont writes.

Investors have historically paid for the privilege of incorporating ethical or environmental, social and governance (ESG) factors into their portfolios, in the form of higher management fees. However, this is changing. The average ongoing charge for an ETF that applies ESG values and/or screens in Europe has fallen year-on-year since 2012 from 0.55% to 0.36%, making them more attractive.

At the same time, the market for such funds has grown tenfold, attracting progressively lower-cost fund launches. Last year was particularly fruitful in this regard. The launch of ethical and sustainable ETF suites by X-trackers, iShares and L&G represents something of a milestone. For the first time, ETF investors can buy a range of ethical and sustainable portfolio building blocks without having to pay a premium for the privilege.

- Sustainable investing doesn't hamper returns, say investors

Affordable screening

The iShares range offers European, US, Economic Monetary Union (EMU), Japanese, emerging and world equity markets exposure for an ongoing charge of between 0.07% and 0.2%, making it cheaper than some non-screened ETFs.

These funds filter out companies involved in activities such as arms, tobacco and thermal coal production as well as firms that violate United Nations Global Compact principles. This constitutes a relatively light screen. For example, the iShares MSCI USA ESG Screened ETF currently shuns 7% of the broader MSCI USA index. Exclusions include tobacco heavyweight Phillip Morris International and a string of arms manufacturers, including Boeing and Lockheed Martin.

The Xtrackers ESG ETF range, launched in May 2018, seeks a larger ESG footprint. In addition to making ethically based exclusions, these funds apply best-in-class ESG and carbon emissions screens.

The results are more striking. For example, one of the Xtrackers ETFs tracks the MSCI Japan ESG Leaders Low Carbon ex Tobacco Involvement 5% index, which holds only around 40% of its parent MSCI Japan index. The Xtrackers suite charges between 0.15% and 0.20% for world, Japan, US and European equities.

In November, L&G became the latest financial services company to throw its hat into the ring, with the launch of its ESG-screened core equity ETF range. Six equity offerings take advantage of L&G’s ESG scoring system to over- and underweight holdings, and exclude companies such as weapons and coal mining firms as well as those that are perennial violators of United Nations Global Compact principles.

The fact that L&G has chosen to integrate ESG into its core ETF building blocks demonstrates its belief that ESG considerations should be included in the investment process by default.

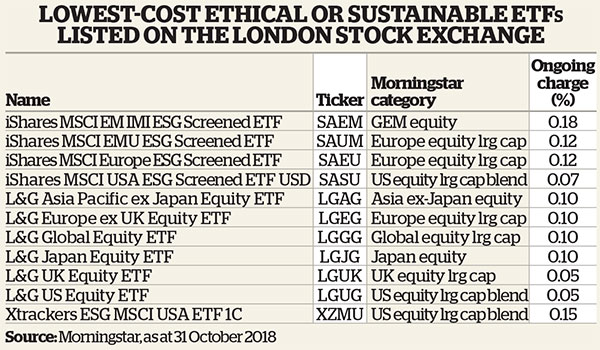

Eight of the 10 cheapest ethical and sustainable ETFs were launched in 2018. This wave of low-cost launches is a welcome development. As I write, all of the funds listed below have already racked up £100 million in assets. Moreover, as assets flow into these cheap ETFs, we expect other providers to follow suit. Of course, in-depth and accurate sustainability research doesn’t come free, but as assets grow and economies of scale kick in, fixed costs can be largely offset by rising revenues.

Knock-on-effect

As the biggest indicator of future performance, fee cuts are good news for ETF investors, but they also have a second-order effect in turning up the heat on other providers of both passive and active funds, prompting them to revaluate or at least justify higher management fees.

Beyond the broad sustainable offerings that incorporate environmental, social and governance concerns into core portfolio holdings, some ETFs take a more focused approach by tackling one specific sustainability issue.

For example, Lyxor has teamed up with Equileap, a social enterprise specialising in gender equality, to offer the Global Gender Equality (DR) ETF [ELLE]. It tracks the 150 companies that score the highest on metrics such as gender balance in leadership and workforce globally.

The iShares Global Water ETF [DH2O] is suitable for investors for whom environmental issues are key. It invests exclusively in companies operating in the global water industry. With around 60 holdings, the fund’s exposure is relatively narrow, so it is most appropriate as a satellite holding in a broader portfolio.

With costs falling and a growing selection of options becoming available, there hasn’t been a better time to consider incorporating ethical and sustainable funds into your portfolio.

Kenneth Lamont is an analyst, passive strategies manager research, at Morningstar.

- Thematic ETFs: accurate predictors of the future or false prophets?

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.