Enhanced dividends: how can investors benefit?

The growth of this strategy is an emerging trend in the investment trust industry, with more than 20 now offering some level of enhanced dividend. A Kepler analyst examines what it means for shareholders.

8th November 2024 14:14

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

The growing prevalence of enhanced dividend strategies has been one of the investment trust industry’s low-key emerging trends in the past few years. Pioneered byEuropean Assets Ord (LSE:EAT) in 2001, this typically involves taking a contribution from the trust’s capital to top up the portfolio’s underlying revenue in order to boost the income paid out to shareholders. A tweak to the UK rules in 2012 has led to a steady increase of trusts adopting this approach, with over 20 now offering some level of enhanced dividend. With this approach growing in popularity, we look at what it offers boards and managers, how investors can benefit, and whether there are implications for a trust’s discount.

The case for an enhanced dividend

The enhanced dividend strategy works by using a portfolio’s capital reserves to supplement the underlying income a portfolio generates and then paying this combined amount out to investors. It’s important to note that neither capital nor revenue reserves are pots of cash, a point that is often misunderstood. What we are talking about is accounting identity. Portfolio income is, in an equity investment trust, typically reinvested in the portfolio, and an amount is added to the revenue account. When a dividend is to be paid, the manager will sell some investments to raise the actual cash to be paid out, and then write down the revenue account. It’s the same process when paying from capital, meaning investments are sold to raise funds, except there is no requirement for the cash to be ‘raised’, or debited, from the revenue account.

To provide clarity to investors, many trusts implementing an enhanced dividend policy will set out an income goal for the year, such as Invesco Asia Ord (LSE:IAT)which adopted a policy in 2021 to pay out 2% of NAV every six months. In the years since its adoption, IAT’s dividend per share has been on average just over double the earnings per share, showing that investors are receiving an income of almost double what they would have if such a policy wasn’t in place.

Whilst the income benefits for shareholders may seem obvious, an enhanced dividend policy also provides some perks when it comes to capital returns. With the trust’s income effectively taken care of, the managers have more freedom to invest in what they believe are the best opportunities from a total return perspective, without being beholden to income targets. This helps reduce the conflict managers may find themselves in when deciding whether to invest in stocks with high future growth potential or those offering high yields today. This could help improve the overall performance of the trust in the long term, as managers are under less pressure to generate income in the near term which may come at the expense of future capital growth.

With several trusts now offering attractive yields, despite investing in asset classes that are not typically high-yielding, income hungry investors have a wider range of asset classes to choose from. This not only creates opportunities for better portfolio diversification but also means investors are less reliant on traditional income asset classes such as bonds or value equities. JPMorgan has been one of the biggest adopters of enhanced dividend policies, which have been implemented in five trusts in their range. This includes trusts investing in China and UK smaller companies, not areas famed for their income potential. However, the enhanced dividend strategy has meant that these trusts could be useful for income investors and enable them to create a more diverse portfolio.

Moreover, this could provide style diversification benefits too, as several trusts with enhanced dividend policies are run with a growth mindset, meaning their portfolios will consist of very different companies to the value-orientated ones typically in an income portfolio. One example is JJPMorgan Global Growth & Income Ord (LSE:JGGI). Through a series of mergers and strong performance, JGGI has grown to one of the largest trusts in the global sector and is managed with a strong growth bias. This has led to top ten holdings including Microsoft, Nvidia, and Meta, which are unlikely to populate income portfolios. Despite this, the trust’s enhanced dividend policy of paying out at least 4% of the NAV per annum has meant it could have appeal to both income and growth investors. It also means income investors can balance JGGI’s growth bias with more traditional income assets in a portfolio, whilst still generating a good income.

Some trusts, such as JPMorgan UK Small Cap Growth & Income (LSE:JUGI), use the NAV at the end of the previous financial year to set the amount for the next four quarterly dividends, meaning investors can be more certain of what they will receive in absolute terms, although as the NAV may rise or fall throughout the year. On the other hand, some trusts, such as IAT, will calculate the dividend amount based on the NAV at different points in the year, meaning the amounts can fluctuate.

CT Private Equity Trust Ord (LSE:CTPE) has a slightly different approach, with dividends set through a strict formula which has been consistently applied since 2012. The dividend formula gives shareholders a highly predictable and secure income stream, with the annual dividend set at a rate equivalent to 4% of NAV, based on the average of the last four quarterly NAVs. However, if in any quarter this figure implies a reduction in the dividend, the quarterly dividend payable will be maintained. A result of this approach is that CTPE is now a ‘next-generation dividend hero’, having increased its dividend for ten or more years.

For trusts that follow any of these approaches, it is not hard to see that the dividend itself is not as reliant on the prevailing dividend environment, as is the case in more traditional income portfolios. This was best demonstrated in the early days of the COVID pandemic, when many companies suspended their dividends which put a strain on many income-focussed mandates, particularly in the open-ended space. However, almost all equity income investment trusts managed to maintain or grow their dividend. This was either by using revenue reserves or in the case of trusts with enhanced dividend policies, capital reserves. As such, enhanced dividend strategies can also support income resilience which may be particularly attractive during periods of market weakness.

The case against

One of the criticisms of an enhanced dividend strategy is that it arguably comes at the cost of long-term growth. By selling shares to pay out to investors as income, enhanced dividend strategies are effectively just returning capital to investors in another form. The argument goes that by doing so, it means managers are clipping profits and not allowing their best positions to run. This effect is particularly troubling during periods of market weakness, where managers are in effect compounding capital losses by selling assets at depressed valuations to pay dividends. Whilst the outcome of maintaining a dividend may provide comfort in the short term, it arguably damages the long-term growth potential.

Furthermore, returning capital to shareholders in the form of a dividend may have tax implications for investors. This is especially true of individuals or retail shareholders as the dividend allowance of £500 is considerably less than the capital gains allowance of £3k (as of the time of writing). However, we note that this is not an issue for those holding these assets in a tax-efficient wrapper such as a SIPP or ISA.

Do dividends determine discounts?

Despite the potential drawbacks, adopting an enhanced dividend policy can help differentiate a trust and potentially increase its appeal to a wider pool of investors. As such, one of the reasons often touted for adopting an enhanced dividend policy has been as a way of narrowing a trust’s discount. It is a tool often used as an alternative to share buybacks which might have negative effects such as reducing the size of the trust. One might argue that a narrower discount could be seen as a judgement on the debate above by the market as a whole: if the discount narrows, the pro argument has won.

To see whether enhanced dividend policies influence discounts, we have looked at the discounts of trusts using an enhanced dividend policy against the average of their peer groups. We have concentrated the analysis on trusts operating in publicly-listed equities due to the complications of other structures. Of these trusts, just over half trade at a premium to their peers, with an average discount of 1.6% narrower than the average for the peer group. This basic analysis suggests to us that an enhanced dividend policy may have a small positive impact on the trust’s rating.

ENHANCED DIVIDEND EQUITY TRUST’S DISCOUNT

Source: Morningstar, as at 31/10/2024

However, looking at one data point is just a snapshot and can be easily affected by specifics. Therefore, to assess the change in the market’s judgement over time, we have looked at several examples of strategies that have adopted these policies and studied what has happened to their discounts in the period before and after the announcement of a new policy.

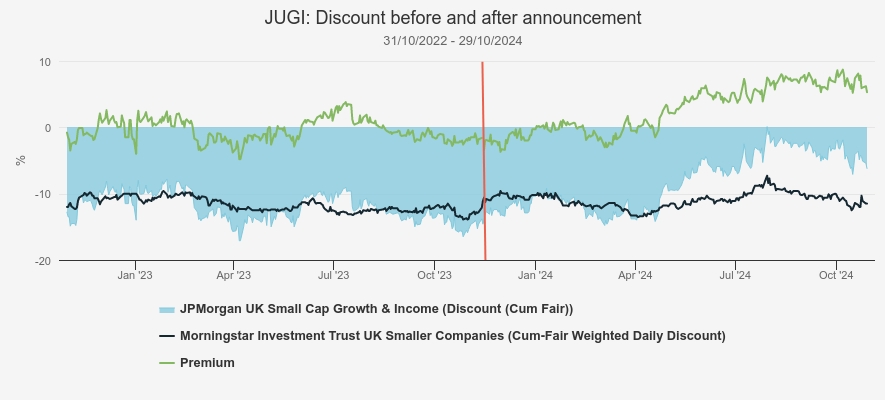

One of the most recent adopters of this policy has been JUGI. This trust is the result of a combination between the firm’s UK small-cap and mid-cap trusts in the first quarter of 2024. As part of this corporate activity, a new enhanced dividend policy was announced that sees the trust pay c. 4% of NAV per annum in four equal payments. This began in August 2024.

In the chart below, we have shown how the discount of JUGI has changed in the year leading up to the announcement on 14 November 2023 and the period since. Following the completion of the corporate activity, JUGI’s discount has narrowed significantly, leading the trust to trade at a notable premium to the sector average, and close to NAV for the first time since the market highs of 2021. In the year before the announcement, JUGI (at the time, JMI) traded at an average discount of 12.1%, at an average 0.4% discount to the peer group. In the period since, the average discount has narrowed to 8.3%, which is an average 2.7% premium to the peer group.

JUGI: DISCOUNT VERSUS SECTOR

Source: Morningstar

This has arguably come at a fortuitous time for JUGI. The enhanced dividend policy was one of a series of announcements as part of the combination, which brought benefits such as better liquidity and lower charges. It has also coincided with a period of strong performance for the trust, following a rare period of weakness as the managers’ investment style fell out of favour. However, whilst it may have coincided with a number of positive factors, the discount has narrowed following the announcement and implementation of an enhanced dividend policy.

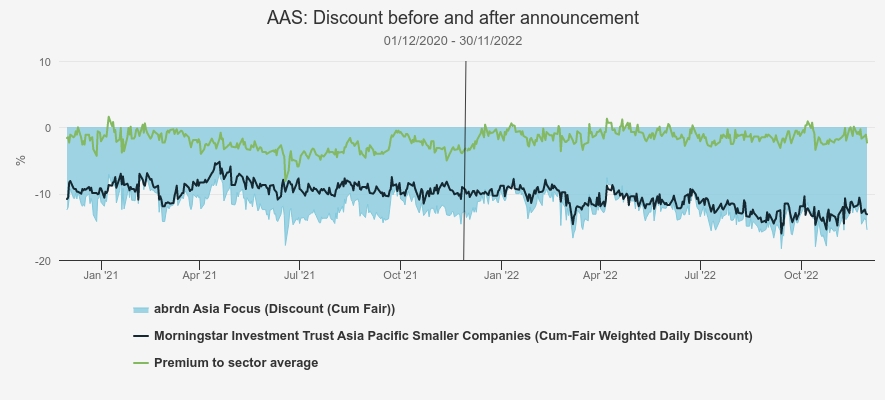

Looking further back, we have also looked at the history of abrdn Asia Focus plc (LSE:AAS), an Asian smaller companies trust managed by the three-strong team of Flavia Cheong, Gabriel Sacks, and Xin-Yao Ng. The board introduced an enhanced dividend policy in 2021 to provide a higher yield to investors from an asset class not typically associated with high income. The trust already had a strong history of either maintaining or increasing its ordinary dividend, having done so every year since 1998, as well as regularly paying out special dividends. For the 2024 financial year, the trust has paid out 7.42p per share, equivalent to a yield of 2.6% based on the share price as of 30 October 2024. This is an 18% premium to the most recent published yield of the trust’s benchmark, as well as the wider MSCI ACWI Small Cap Index which yields 2.1%.

In the year leading up to the announcement of the dividend policy on 30 November 2021, AAS had an average discount of 11.6%. This was at an average discount to the sector average of 2.5%. In the year following the announcement, AAS’s average discount was actually wider at 12.6%, though this was closer to the sector average at -1.2%. This suggests that whilst the enhanced discount policy did not lead to the trust trading at a narrower discount in absolute terms, it may have improved the trust’s rating versus its peers.

AAS: DISCOUNT VERSUS SECTOR

Source: Morningstar

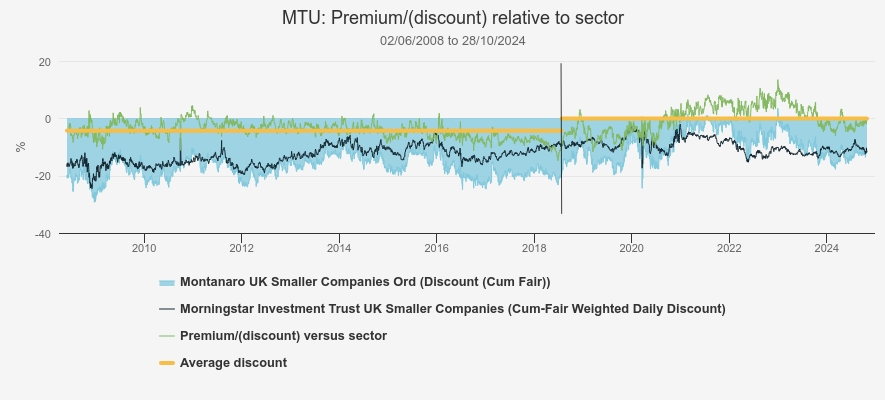

To see if this has had a similar effect over a longer time period, we have looked at the discount history of two trusts that have had enhanced dividend policies for many years and analysed how their discounts have fared versus peers. Firstly, there is Montanaro UK Smaller Companies Ord (LSE:MTU). This trust adopted a quarterly dividend equal to 1% of NAV in 2018, with the explicit goal of trying to increase the appeal to retail investors and therefore narrowing the discount.

Here, the impact is very stark. In the ten years before the enhanced dividend policy was declared on 25 July 2018, MTU traded at an average discount to the peer group of 4.3%, but in the six-plus years since, this has narrowed significantly, with the average discount since just 0.1%. In fact, the trust traded at a premium to the sector for much of the period, including several periods where this premium was in the double digits relative to the sector. More recently, some short-term weakness in the share price has meant the trust’s rating is currently trading in line with peers, which we would argue could be seen as an opportunity. Furthermore, as is the case with many trusts using an enhanced dividend policy based on NAV, it means the yield investors may receive is actually a little higher than the headline rate because of the discount. Whilst MTU pays a dividend equivalent to 1% of NAV per quarter, the current historic yield is 4.6% due to the trust’s double-digit discount.

MTU: DISCOUNT VERSUS SECTOR

Source: Morningstar

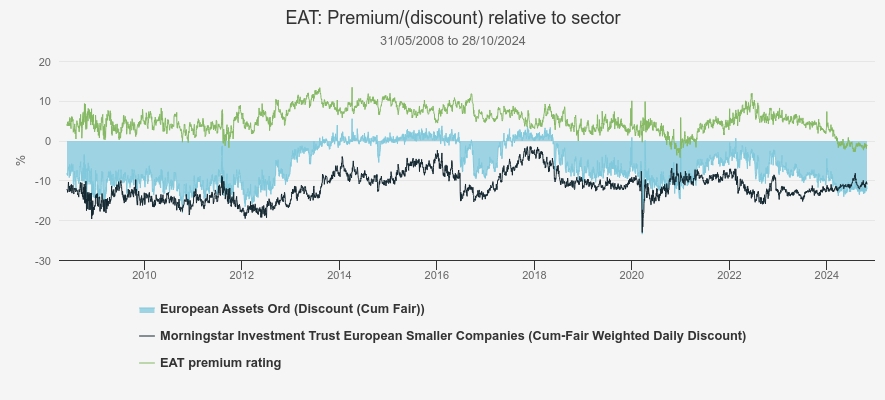

Our final example is EAT. As the pioneer of the approach, this trust has the longest track record available. The trust first started paying dividends from capital in 2001, which was allowed due to its dual listing in London and the Netherlands. At the time, HMRC had a rule against paying dividends from capital reserves, though this was removed in 2012, opening up the strategy to others. EAT’s management team primarily focus on mid- and small-cap European equities, though the dividend policy is to pay annual dividends of 6% of the closing NAV of the preceding financial year in four equal payments. This headline rate is nearly double that of the index at 3.1% as of 30 September 2024 and vastly ahead of its peers which range from 2.83% to 0.78% according to Morningstar.

We have shown EAT’s discount track record going back to May 2008 in the chart below. This shows that the trust’s discount has traded at a premium to the sector average for almost the entire time. Only a short period in late 2020, soon after the COVID vaccine was announced, did the sector trade at an average discount narrower than EAT. We believe this is a strong indication that enhanced dividend policies do have a positive effect on narrowing discounts. This is particularly impactful in the European smaller companies sector as there are no other trusts operating a similar approach, meaning EAT is a clear differentiator in this regard. That said, we note that EAT has slipped to a wider discount than the peer group in the past few months. This is one of the longest sustained periods of relative weakness in the past 16 years. Whilst this arguably reflects some performance headwinds, it could be seen as an opportunity for long-term investors, especially as it has pushed up the historic yield to over 7%.

EAT: DISCOUNT VERSUS SECTOR

Source: Morningstar

Conclusion

The practice of boosting the natural yield of a portfolio by paying dividends from capital is a clear demonstration of the flexibility and benefits of the investment trust structure. It increases the appeal of several asset classes to a wider range of investors and can make for useful tools for blending uncorrelated income streams as part of a wider portfolio.

Furthermore, over the long term, as we have shown it can prove useful in helping narrow a trust’s discount, especially versus peers, although it is not enough on its own to prevent wider macro factors affecting a trust’s discount.

However, the wide discounts seen across the investment trust sector at present mean that the yields on offer look even more attractive due to many of them being calculated on a trust’s NAV.

Moreover, the challenges seen in the wider economy have meant that many trusts are trading at wide discounts and several trusts with enhanced dividend policies are not trading at the premium rating they historically have done. This arguably creates an opportunity for long-term investors.

With interest rates beginning to come down, those on a wider discount could soon benefit from improved optimism, while their elevated and reliable yields will only look more attractive on a relative basis.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.