The economies set to benefit most (and least) from AI, ranked

A new study scopes out which countries will see the biggest boost and which will be left behind. Here's what it means for stocks and bonds.

23rd February 2024 09:48

by Reda Farran from Finimize

- Not all economies will benefit equally from AI. The US, the UK, Hong Kong, Singapore, Taiwan, South Korea, and parts of the Nordics are expected to fare best. But emerging markets (particularly those not in Asia) are expected to benefit the least.

- The economic boost from AI will most likely lead to higher bond yields. This means bond prices will initially decrease, but as yields stabilise at those elevated levels, investors will be able to reap the rewards of better bond returns.

- Meanwhile, those higher bond yields would likely put downward pressure on stock market valuations, all else being equal. However, that’s expected to be more than offset by faster growth in corporate earnings, fuelled by the economic boost that comes from AI-driven productivity gains.

It’s not just tech firms that will find ways to harness AI to improve their bottom line. In fact, it’s not just firms at all. Entire economies are poised to benefit. But, as research group Capital Economics reveals in its latest report, they won’t all prosper to the same extent. Here’s a look at the study, and what it might mean for stocks and bonds.

What’s this study?

Broadly speaking, economies have two ways to grow: make the workforce bigger or improve its productivity (that is, the output per hour worked). The latter is where AI can help: improving productivity to spur economic growth. So that’s what the research focused on.

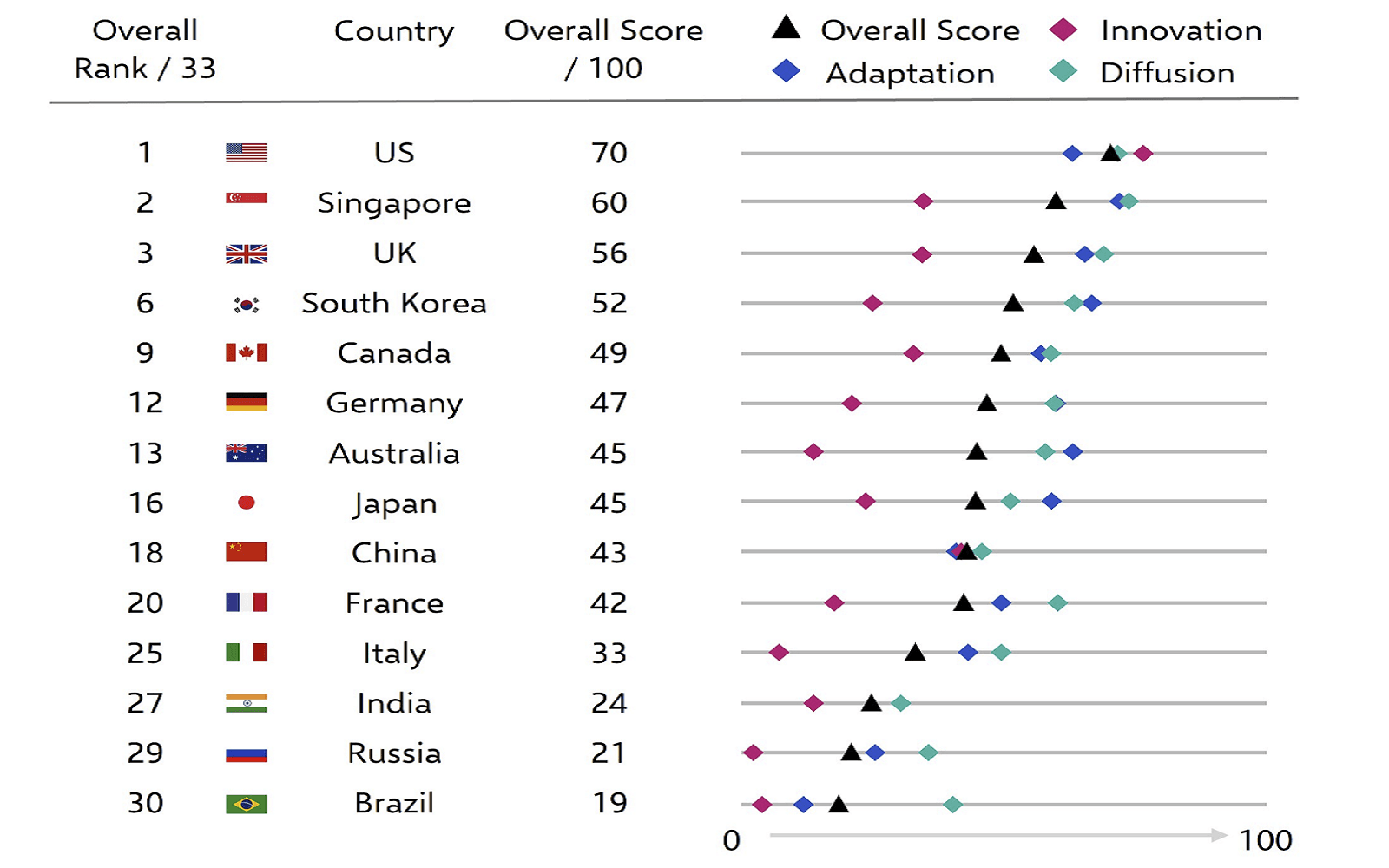

See, productivity gains from AI are by no means guaranteed: they’ll depend on whether countries have the factors in place to help them get the most out of the technology. And that means three things: developing waves of complementary advancements (innovation), spreading the tech across industries (diffusion), and making changes that allow displaced workers and capital to be redeployed (adaptation).

The researchers at Capital Economics used 40 indicators to score 33 countries based on these three factors, and then combined those into a composite score to rank the countries.

So what did they find?

This table, taken from their research, shows the composite scores of different major economies.

Here’s how different major economies are expected to benefit from AI. Source: Capital Economics.

And from that, you can draw a few conclusions:

First, the US will lead the AI revolution, with the “Asian Tigers” (Hong Kong, Singapore, Taiwan, and South Korea), the UK, and parts of the Nordics also well-placed to benefit. The US tops the chart and is expected to hold court as the global tech leader, as it has for much of the past 100 years. Capital Economics forecasts that productivity growth in the US will average 2.3% a year in the 2030s – slightly stronger than during the 1990s internet boom.

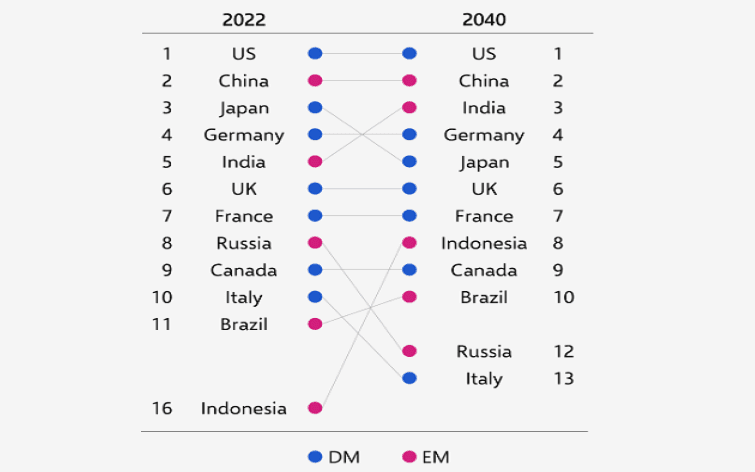

Second, China ranks around the middle of the group of 33 countries, with its strong innovation capacity and large investment in AI offset by a strict regulatory approach that’ll likely slow the spread of AI technology. That, coupled with the point above, suggests that AI is likely to help the US economy extend its size advantage over China – a gap that’s already been widening.

AI is expected to bolster the size of the US economy, safeguarding its position as the world’s biggest economy until at least 2040, according to Capital Economics’s forecasts. Source: Capital Economics.

Third, AI is likely to hamper growth in India in the near term, partly because it will slow the growth of business outsourcing from developed countries, the researchers said. You can already see some of that happening with the proliferation of customer service chatbots, and it’s gradually picking up in other areas too. This whittling away of business process outsourcing could reduce India’s economic growth by 0.3 to 0.4 percentage points a year over the next decade, Capital Economics said.

Fourth, and speaking of emerging markets, their economies – particularly those outside Asia – are expected to benefit less from AI compared to developed ones. That comes down to, as Capital Economics puts it, “limited dynamism” in the private sector, small and less-advanced tech sectors, relatively low investment in research and development, and the migration of top talent to wealthier places. It means these countries will likely fall behind across all three points: innovating, adapting, and diffusing. And as a result, average incomes in these countries will likely take even longer to catch up with those in richer countries.

Fifth, AI will also have big impacts within economies, the report predicts. It has the potential to increase wealth inequality. That’s because the financial rewards of AI are expected to go more to business owners and investors, especially in the tech sector, than to the vast majority of people.

Sixth, (and on a positive note), AI likely won’t lead to permanently higher unemployment, the report says. As in previous eras of tech advancement, displaced workers will likely be employed in new occupations that emerge either directly from AI or as a result of the stronger economic growth it produces. If you’re skeptical, consider this: a recent MIT report estimates that 60% of workers in the US are now employed in occupations that did not exist in 1940.

So what’s the opportunity here?

Let’s break this down into two big asset classes: bonds and stocks.

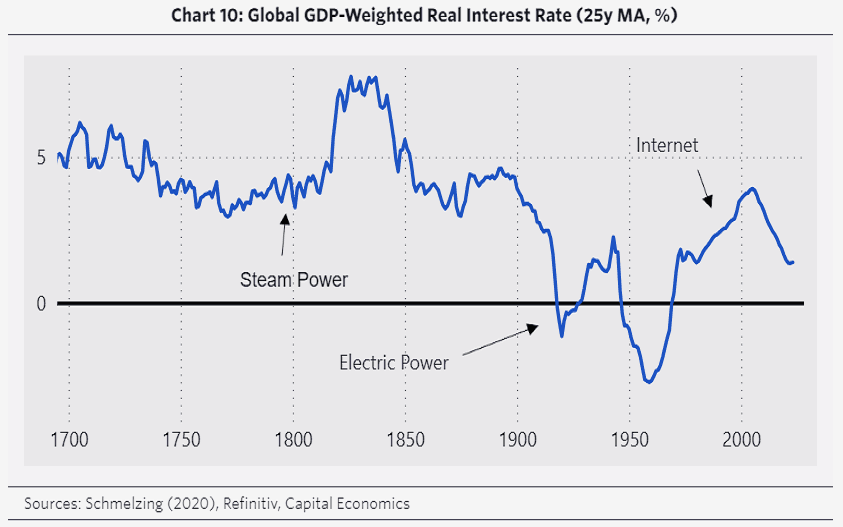

First, bonds. Higher economic growth tends to stir up increased borrowing and spending, as businesses invest more in growth and consumers spend more on stuff. The heightened demand for funds pushes up the equilibrium interest rate (sometimes called the natural or neutral rate of interest, or simply “r-star”). That’s the rate at which the amount of money supplied in the economy equals the amount of money demanded. Think of it as the sweet spot that keeps savings, investments, employment, growth, and inflation in harmony.

So the logical conclusion here is that the economic boost from AI will most likely lead to higher equilibrium interest rates, mirroring trends that played out during previous tech revolutions. Records from the Bank of England show that “real” (that is, adjusted for inflation) long-term interest rates typically climbed after major technological breakthroughs, as the advantages of the innovations gradually spread through the economy. (Although in the case of the internet, the relationship was obscured by other events, like the global financial crisis.)

Long-run real interest rates generally rose in the aftermath of tech breakthroughs. Source: Capital Economic

Naturally, countries poised to gain more from AI are likely to experience a bigger increase in interest rates and, as a result, higher bond yields. In the US, for example, Capital Economics forecasts that the 10-year Treasury yield will rise from an average of 2.4% in the 2010s to above 4% in the 2030s. This rise in yields means that bond prices will initially decrease, since the two move in inverse directions. However, as yields stabilize at those elevated levels, investors will be able to reap the rewards of those higher bond returns.

Next, stocks. Now, those higher bond yields would typically put downward pressure on stock valuations. However, that’s expected to be more than offset by faster growth in corporate earnings, fueled by the economic pick-me-up that comes from higher productivity. Those gains will filter across many industries, because of all the ways AI can be used. So that’s good news for stocks: it means faster earnings growth, which should lead to higher returns. And stocks from the economies that are expected to benefit most from AI will see the biggest boost.

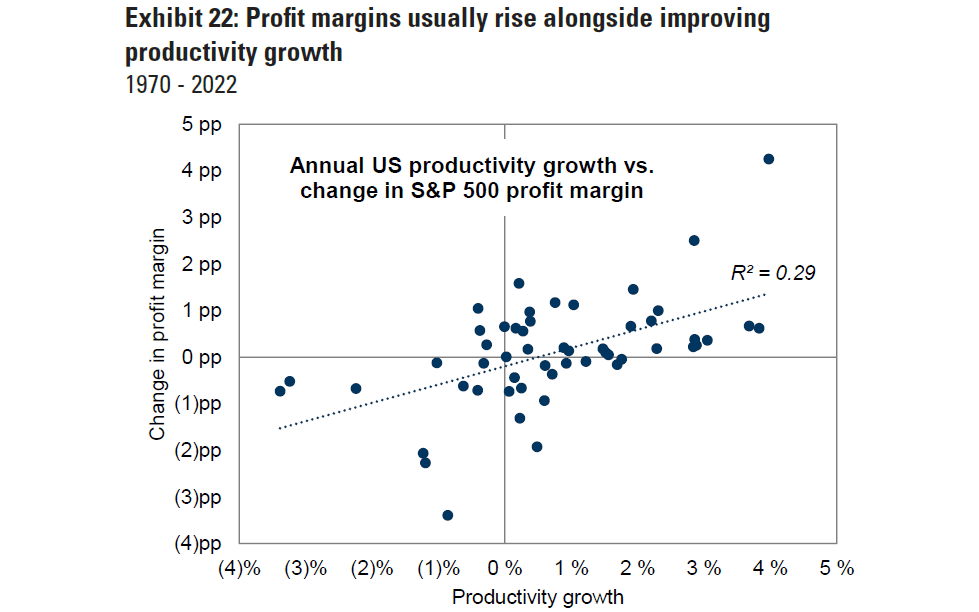

For a slightly closer look at that, consider the following analysis by Goldman Sachs. Its economists estimate that generative AI could lift US productivity growth by roughly 1.5 percentage points per year over the next ten years. And based on the historical relationship between productivity growth and corporate profitability, this boost could lift S&P 500 profit margins by roughly four percentage points over the next decade, all else being equal.

Profit margins usually rise alongside productivity growth. Source: Goldman Sachs.

That would take S&P 500 profit margins from around 12% today to 16% in a decade – an increase of a third. On an annualised basis, that would represent a 3% boost to earnings growth, which alone could push up stock market returns by a similar amount. Further bolstering this positive outlook, the US stock market is home to many of the firms that are at the forefront of developing AI-focused software and hardware.

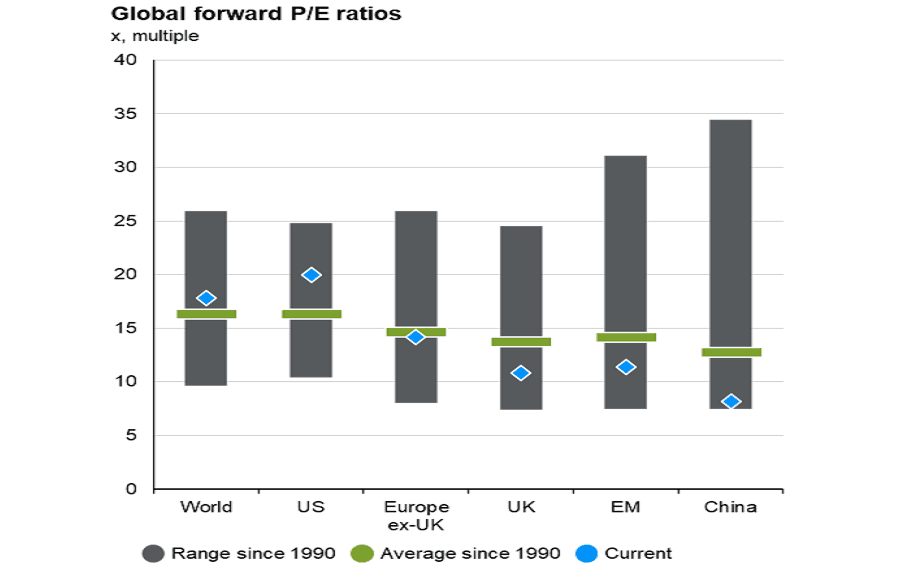

Having said that, the buzz surrounding AI has driven US shares to record highs, leaving their valuations way above historical averages. This suggests that exploring some of the other economies that are set to benefit from AI could unveil more attractive, affordably priced investment opportunities.

The idea here is to invest in a stock market brimming with potential for AI-induced profit growth at a time when it presents a lower price per $1 of those earnings. The UK stands out here. It’s expected to get the third-biggest uplift from AI, according to Capital Economics. Its stock market valuation, meanwhile, is currently below its historical average.

Comparing the current forward price-to-earnings (P/E) ratio to historical averages shows that US stocks are expensive while UK ones are cheap. Source: JPMorgan.

Reda Farran is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.