A drug giant to own that’s not about Covid

Pandemic research grabs the headlines, but companies like this one are doing great work.

24th March 2021 09:53

by Rodney Hobson from interactive investor

Pandemic research grabs the headlines, but companies like this one are doing great work.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Amid all the controversy about Covid-19 vaccines, it is easy to overlook other less exciting but seriously promising drugs companies. Investor could do worse than consider Amgen (NASDAQ:AMGN), a health group that has found several niches to operate in.

Amgen discovers, develops and manufactures a range of drugs, originally specialising in treatments for renal diseases and cancer care. It has widened its scope to include red blood cell boosters, immune system boosters and treatments for inflammatory diseases. Other drugs in its portfolio include treatments for strengthening bones, lowering cholesterol and easing migraine.

- A cheap pharmaceutical stock with potential

- Your 50 most-popular US stocks

- Read more from Rodney here

- Open an ISA with interactive investor. Simply click here to find out how.

Having several irons in the fire is vital for pharmaceutical companies, whose new products must clear several hurdles before they are licensed for use. Testing on human beings is very expensive and time-consuming. The rushed approval of vaccines for Covid-19 is very much the exception.

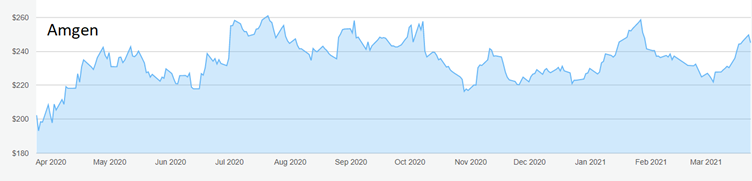

Source: interactive investor. Past performance is not a guide to future performance

Amgen has inevitably had its share of disappointments. For example, in December Amgen and partner AstraZeneca (LSE:AZN) reported disappointing phase III trials for one possible use for their tezepelumab asthma drug.

Before that, in October, omecamtiv mecarbil, a treatment for heart failure, also fell short of hopes in tough phase III tests.

However, in both cases there were positive results for some aspects of treatment and neither drug has been abandoned. Both did better than a placebo, tezepelumab produced a reduction in severe asthma cases and omecamtiv mecarbil results are being analysed further. We have not heard the last of either.

It seems odd for a drugs company, but Amgen has been adversely affected by the pandemic. Despite not being directly involved in Covid-19 treatments, it has managed to increase sales of its products. However, this has been done by reducing prices, so that profits have suffered a little.

So, in the three months to 31 December, the California-based biopharmaceutical firm recorded net income down 5% from $1.7 billion to $1.62 billion, despite a 7% rise in total revenue from $6.2 billion to $6.63 billion. This continued the trend from the third quarter, when revenue rose 12% but pre-tax profits slipped 3.1%.

The good news is that Amgen kept its production lines rolling throughout 2020 despite the pandemic disruptions, and sales of key products increased. Inevitably, there were sales declines in mature products where patent protection has ended and generic competition was stepped up, but that is another bane of pharmaceutical companies’ lives and something they all have to cope with.

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Amgen chair and chief executive Robert Bradway has sounded increasingly optimistic as 2020 drew towards its close, although he warns that recovery will vary from quarter to quarter, depending on how the Covid-19 vaccinations are rolled out and how rapidly treatment for other ailments bounces back.

The first quarter could be the worst, since a year ago there was $100 million worth of stockbuilding among customers panic buying in the face of the looming pandemic, a phenomenon that will not be repeated this time.

Bradway forecasts that total revenue will rise from $25.4 billion to around $26 billion with earnings per share at $12.12 to $13.17. He is sufficiently confident to promise a quarterly dividend of $1.76 compared with $1.60 in 2020, a repeat of last year’s 10% increase. He also proposes $3-4 billion of share repurchases.

Well done anyone who bought stock in February 2017, following an article on this website, when the shares were around $170. They have since topped $260 and shareholders have enjoyed solid dividends in the meantime.

At $245 they are below their peak and offer a yield of 2.6%.

Hobson’s choice: Buy up to $250. The shares could push higher during 2021.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.