Downbeat Nvidia reaction fails to cloud AI outlook

As the dust settles on a rare results-day setback for Nvidia, what’s the outlook for the semiconductor giant and Wall Street’s AI growth wave?

29th August 2024 13:07

by Graeme Evans from interactive investor

Nvidia results that beat hopes but were not quite as eye-popping as previous quarters were today viewed in a calmer light amid relief that Wall Street’s AI growth story remains intact.

Pre-market dealings showed NVIDIA Corp (NASDAQ:NVDA) shares down 3%, an improvement on the 8% reverse seen in the minutes after the semiconductor giant reported a 122% year-on-year jump in revenues to $30 billion and 152% rise in earnings per share to 68 US cents.

- Invest with ii: US Earnings Season | Buying US Shares in UK ISA | Cashback Offers

Nvidia surpassed consensus estimates on both metrics, but the revenues outperformance was the smallest relative to expectations in six quarters. In terms of the current quarter, Nvidia’s revenues guidance of $32.5 billion was within the range of analysts’ views.

Even though the results failed to excite investors in the way they have in the past, the figures offered encouragement on the AI theme that’s driven Wall Street’s 2024 outperformance.

Futures trading today pointed to a robust start for the S&P 500, having risen 17% this year. Nvidia shares were forecast to open near $122, still 23% higher in the past three weeks.

The growth prospects for Nvidia hinge on the potential of its new and more powerful Blackwell platform, which is expected to unlock generative AI for more organisations.

- Ian Cowie: it’s not too late to profit from tech

- The tech funds with low volatility and top returns

- Funds light on ‘Magnificent Seven’ that have delivered top returns

The new architecture features six technologies for accelerated computing in data processing, engineering simulation, electronic design automation, computer-aided drug design, quantum computing and generative AI — all emerging industry opportunities for Nvidia.

Despite the imminent Blackwell launch, Nvidia saw no slowdown in demand for its existing Hopper family of products. That fuelled record quarterly data-centre revenues of $26.3 billion, up 16% from the first quarter and 154% higher than a year ago.

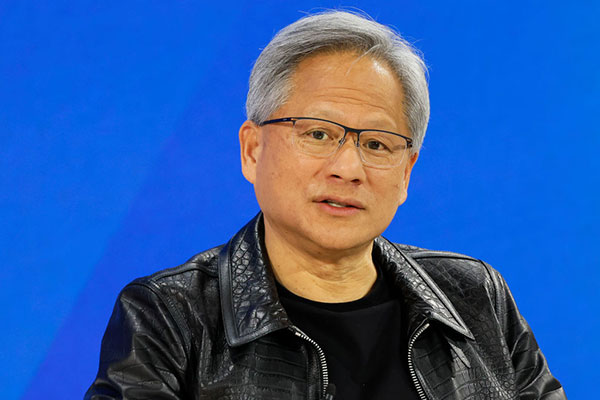

Founder and chief executive Jensen Huang, pictured above, said: “Hopper demand remains strong, and the anticipation for Blackwell is incredible.”

He added that global data centres were “in full throttle” as they look to modernise the entire computing stack with accelerated computing and generative AI.

Looking ahead to the rest of the financial year, Morningstar today increased its forecast for Nvidia’s fourth-quarter data centre revenues to $33.8 billion.

It added: “Nvidia’s key AI customers still intend to invest heavily in AI capital expenditure, and we still expect Nvidia to reap most of the rewards of such spending.”

- Top-10 Scottish Mortgage stock plunges 30%

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- A stock with considerable upside potential and limited downside?

In response to the Nvidia results, UBS Global Wealth Management said today it expects further progress in global tech stocks to be more gradual after the quick rebound since stock market turmoil at the start of August.

It warns of potential headwinds from US macroeconomic data and further news on semiconductor export controls that could contribute to further volatility.

However, the bank added: “We continue to hold a positive structural view on the broader AI theme, and see ways investors can manage their exposure to the technology that we think is set to drive growth in the years to come.”

Its analysis shows that big tech’s capital expenditure could grow by as much as 25% in 2025, auguring well for AI enablers in the semiconductor space.

In addition, UBS said evidence from companies as large as Walmart Inc (NYSE:WMT) pointed to rising AI adoption. It also expects markets to focus on improving monetisation trends from next year.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.