Doubts are starting to creep up about AI’s $600 billion bet

And they're not unfounded. Russell Burns had a look at the colossal corporate AI spending and what it will take to make it all worth it.

26th July 2024 09:30

by Russell Burns from Finimize

- The AI boom cycle is stuck in phase two, with applications that use the technology still very limited.

- Nvidia is likely to remain a core player in this revolution, even if its growth rate slows from the recent breakneck pace. And with its high stock valuations, there won’t be much forgiveness for any negative surprises.

- The hyper-scalers have made massive investments to build out AI infrastructure but have so far failed to drum up enough revenues and returns to justify all the spending that’s gone into them.

AI may not have reached world domination (yet), but it certainly dominates the stock market. Nonetheless, some folks are starting to wonder whether all the corporate spending on this new technology is worth it when you consider the amount of profit it’s actually generating. And that’s a reasonable question.

To answer it, I had a look back at Goldman Sachs’ four phases of AI and a model from venture capital giant Sequoia. And, well, it didn’t go great for the bots.

First, I revisited the four phases of the AI boom.

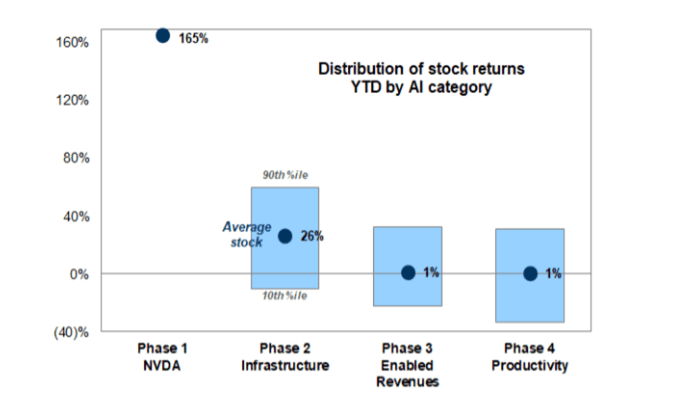

I’ve written about Goldman’s four phases before: it gives you a great sense of where we are in the AI boom and what’s next. The TLDR is that we’re still in the earliest phases.

Phase 1. NVIDIA, at this point, is the clearest AI beneficiary, with its AI-powering computer chips suddenly seeing explosive demand.

Phase 2. AI infrastructure – including semiconductor firms, cloud providers, data -entre REITs, hardware and equipment companies, and utility companies –are starting to draw the investing spotlight.

Phase 3. AI enablers – meaning, companies with the potential to monetise AI by generating incrementally higher revenues, primarily in software and IT services – will become the next big thing.

Phase 4. Companies with the biggest potential profit boost from widespread AI adoption and productivity advances will command investor attention.

Right now, spending on AI data center construction is strong – and that’s helped NVIDIA Corp (NASDAQ:NVDA) especially, along with those Phase 2 stocks. But the adoption of AI has been slower than the initial hype suggested, and that’s undermined share prices for companies in Phases 3 and 4. Disappointing forward-looking commentary during the most recent earnings season and a still unknown timeline for live applications make for some fuzzy projections.

The performance of the phases of the AI trade. Source: Goldman Sachs.

And, let’s be honest, skepticism is growing. Goldman recently conducted a survey and found that only 5% of firms are using generative AI to produce goods and services. Still, Nvidia and the companies in Phase 2 continue to enjoy strong earnings growth, thanks to massive spending by hyper-scalers like Microsoft Corp (NASDAQ:MSFT), Amazon.com Inc (NASDAQ:AMZN), Meta Platforms Inc Class A (NASDAQ:META), and Alphabet Inc Class A (NASDAQ:GOOGL). Those four mega-firms have shelled out around $357 billion over the past year – on Nvidia’s processors and the roll-out of data centres – and their outlay on this stuff is expected to increase for the rest of this year.

So, maybe it’s no wonder doubts are growing about whether the big spenders will achieve enough sales and profits to justify the huge tab they’re racking up.

Next, I checked in with Sequoia’s model to see just how deep this hole is.

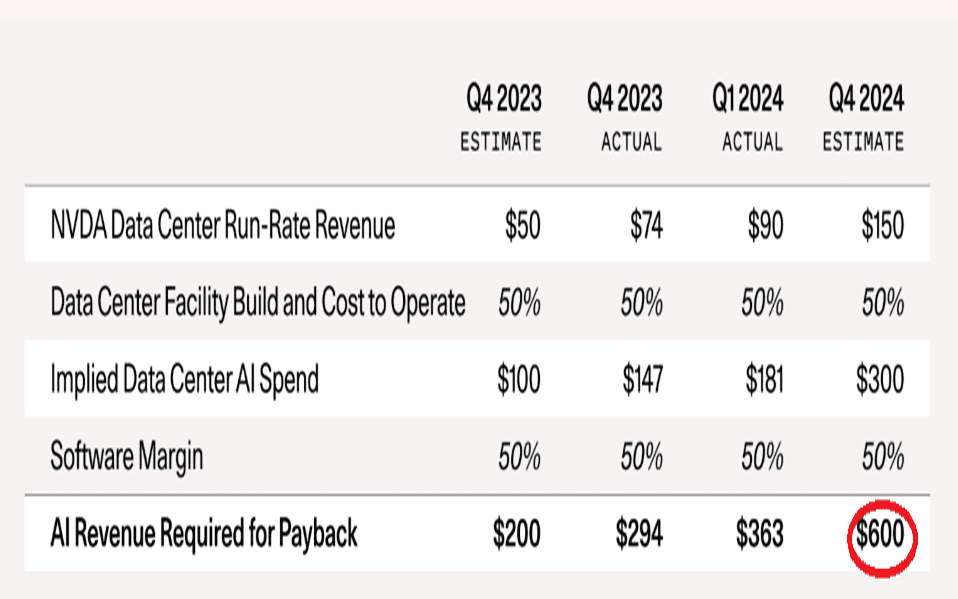

Now, Sequoia Capital is one of the biggest and most respected technology venture capital houses in the world. The firm analysed the enormous worldwide AI spend and calculated that you’d need to produce $600 billion in AI revenues to justify the global outlay on this stuff.

Nvidia's data centre run-rate revenues, the cost of data centre building, and AI revenues required for payback – in billions of dollars. Source: Sequoia Capital.

The team’s method was quite straightforward: Nvidia’s graphics processing units (GPUs) account for about half of the total cost (50%) of an AI data centre – the other half pays for energy, buildings, backup generators, and so on. So, if you multiply Nvidia’s revenue forecast (top row) by 2, you get the total outlay/cost of data centres (row 3). Assuming a 50% gross margin (row 4) for the end-user of the GPU, (e.g., the start-up or business buying AI-powered computing services from Microsoft Azure or Amazon’s AWS), you multiply the data centre AI spend total by 2 again, and you get the total AI revenue needed to breakeven. And that’s $600 billion (row 5) by the end of 2024. That’s pretty soon.

Sequoia notes that OpenAI is leading the industry in generating revenue, making about $3.4 billion a year, and a handful of other start-ups have AI revenues just shy of $100 million. It estimates that Alphabet, Microsoft, Apple, and Meta, will each be able to generate around $10 billion in new AI revenues a year, and that the likes of Oracle Corp (NYSE:ORCL), ByteDance, Alibaba Group Holding Ltd ADR (NYSE:BABA), Tencent Holdings Ltd (SEHK:700), X, and Tesla Inc (NASDAQ:TSLA) might generate something like $5 billion each. You could add a few more into the mix, but the firm figures that would produce only around $100 billion a year – leaving a roughly $500 billion revenue hole. (Because $600 billion minus $100 billion is still a half-trillion bucks.)

So, the bigger question then is: opportunity or bubble?

There are always successes and flops during periods of excess infrastructure building, and the AI build-out is probably no exception. A lot of people lose a lot of money during speculative technology waves. It’s hard to pick winners, and easy to pick losers.

Nvidia probably will remain AI’s biggest victor, with analysts expecting it to maintain a critical role in the revolution for years to come. The firm’s planned next-generation GPU B100 will produce 2.5x better performance for just 25% more cost and that’s likely to produce another jumbo boost to its bottom line.

Now, Nvidia’s profit growth is set to slow from the rapid pace of the past couple of years – it's hard to expand with any kind of gusto when you’re a $3 trillion company. Consensus estimates have Nvidia trading around a 30x price-to-earnings ratio for the year ending in January 2027, versus the current year’s 45x. That’s not cheap, by any means, but it still marks some pretty impressive growth, thanks to expectations of continued production of better next-generation chips. If the firm meets expectations, there’s likely upside to its share price from there.

Of course, things can always go wrong: news this week of further trade restrictions on China sent a shiver across the AI and tech supply chain, reminding folks of just how vulnerable these high-growth stocks are to disappointment. For AI believers, though, a piercing selloff like that – the kind driven by headlines alone – probably smelled like opportunity. Fortune favours the brave, and all.

For another dose of reality, try to remember that the expected improvement in the cost efficiency of GPUs is a double-edged sword. It’s good news for startups and long-term innovation, but it will speed the rate of depreciation for those firms that have already spent billions on chips – and that’s mainly the hyper-scalers. In the upcoming earnings season, those mega-giants will need to show that AI-related sales are coming through.

And on that note, Microsoft, with its OpenAI partnership, arguably looks best placed at the moment. Goldman’s research shows that Alphabet and Amazon are also headed in the right direction. They need to be for this rally to continue – as that $600 billion revenue number is getting the pessimists excited.

Article written 7 days ago.

Russell Burns is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.