Don’t be shy, ask ii...is there a risk-free investment with a guaranteed return?

Whether you want to find out how to start investing or how the stock market works, don’t be shy, ask ii.

2nd September 2021 10:39

by Kyle Caldwell from interactive investor

No question is a stupid one, so whether you want to find out what you need to do to start investing or how the stock market works, don’t be shy, ask ii.

Email your questions to: ask@ii.co.uk

Kerry asks: I have just turned 60, taken my tax-free 25% lump sum, and started drawing circa £800 a month (for the next five years) from my circa £50,000 ii self-invested personal pension (SIPP), which is sufficient for my income needs.I want a risk-free investment with a guaranteed return. I am comfortable with a low return, but need enough to cover the SIPP fees of £20 per month and inflation.

Kyle Caldwell (pictured above), collectives editor, interactive investor, says: the reality is that when it comes to investing, as in life, there’s no such thing as a free lunch. Every investment has an element of risk and there are no guarantees a return will be achieved. Remember, too, the lower the risk, typically the lower the return.

This is a key concept that needs to be weighed up by those who take advantage of the pension freedoms. Investing your money at retirement gives you much more flexibility, but annuities offer something investments cannot promise – income security.

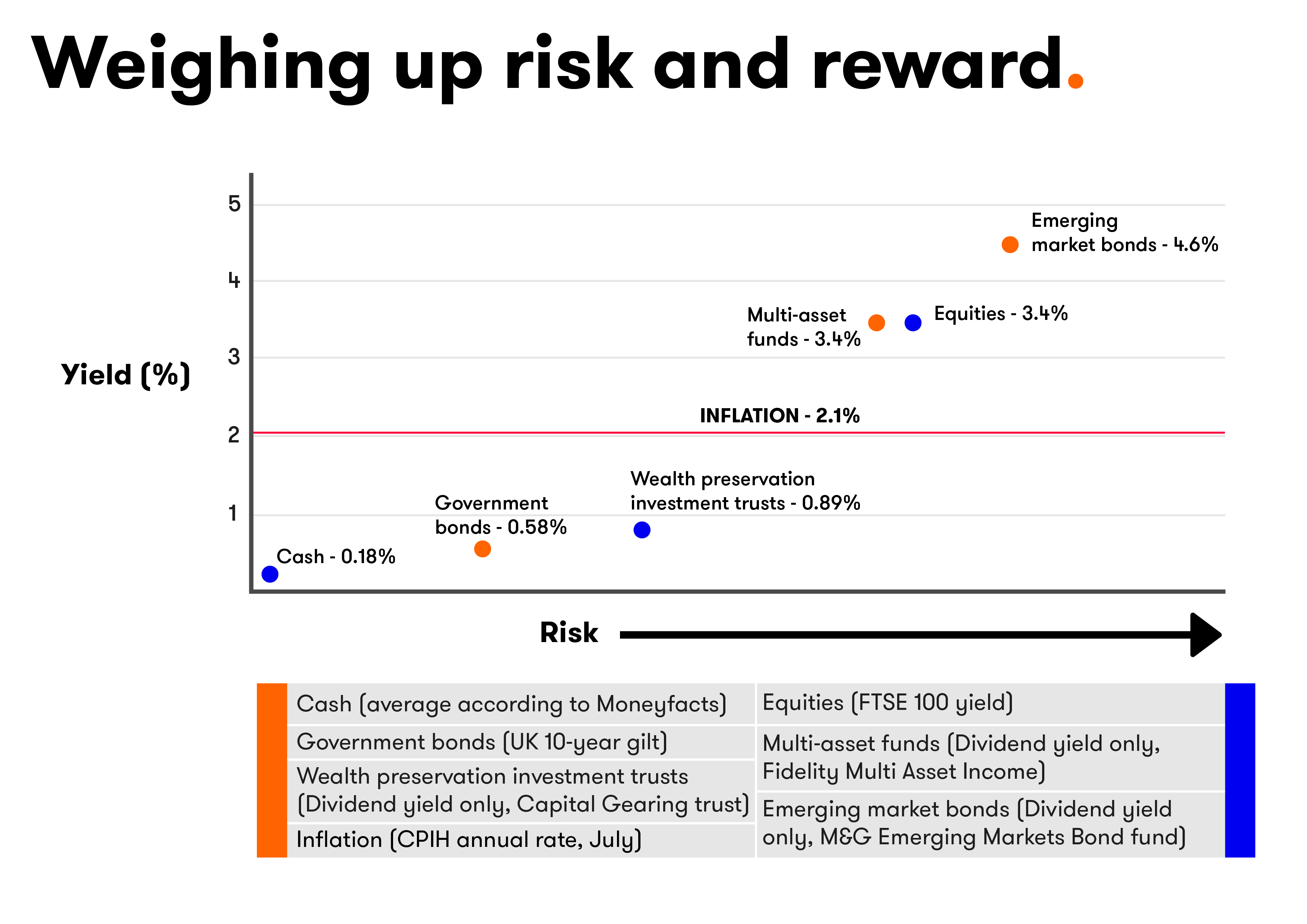

In investing, there are different levels of risk. If there was a scale, cash would sit at the lower-risk end and Latin American, or so-called Frontier shares, at the other. Bitcoin is another level.

But, even with cash, it would be a mistake to think that it is risk-free, due to the effects of inflation. The cost of living is currently running at 2%, but is forecast by the Bank of England to hit 4% by the end of this year. Such high inflation levels are expected to be temporary due to the impact of the pandemic as the economy recovers, but savings rates are pitifully low and have been for several years now. The average rate available this month is just 0.18%, according to the Moneyfacts UK Savings Trends Treasury Report.

- Here’s how inflation slowly but surely erodes your wealth

- Inflation watch: relief on price rises likely to be short-lived

- ii Top Ten: things to keep in mind when managing your own SIPP

Historically, government bonds have been seen as the lowest risk part of the fixed-income asset class. But with government bond yields at historic lows, they are unattractive in terms of the amount of income they pay and, if yields were to rise, investors’ will suffer capital losses.

In terms of equities, an established large company with a reputation of being a consistent dividend payer is viewed as ‘less risky’ than most. But there are no guarantees, with one example being Royal Dutch Shell (LSE:RDSB), which cut its dividend last April for the first time since the Second World War.

Capital at risk. Past performance is not a guide to future performance.

Collective investments, in which a fund manager invests on your behalf, offer investors much greater diversification. Again, there are no guaranteed returns. Some funds specify a return that they are aiming to achieve, but there are no consequences if such a target is not met.

An example of a fund type that would be towards the lower-risk end of the risk scale is multi-asset funds. But first, care needs to be taken. Some funds invest in a conservative manner, while others are more adventurous.

Funds aiming to give investors a smoother ride, with the trade-off being the likelihood of lower returns, will limit their exposure to shares to typically less than 50%. Such funds invest across various asset classes: shares, bonds, property and alternative investments (such as commodities, infrastructure and private equity). Owing to their greater levels of diversification, such funds should be better equipped to weather a market storm than equity funds that either invest globally, or focus on a particular region.

- Are you saving enough for retirement? Our pension calculator can help you find out

- Don’t be shy, ask ii...how do I choose which funds to draw down?

Defensive fund options to consider include wealth preservation investment trusts, which prioritise protecting investor capital and invest on the principle that they would sooner keep £1 rather than risk losing it to try and win £2.

The four trusts that meet this description are Capital Gearing (LSE:CGT), RIT Capital Partners (LSE:RCP), Ruffer Investment Company (LSE:RICA) and Personal Assets (LSE:PNL). Each has a low weighting to shares and plenty of defensive armoury, such as low-risk inflation-linked bonds and small weightings to gold.

Absolute return funds are supposed to offer a steady and decent return, while avoiding substantial losses. The trouble is some funds in the sector take excessive risks, such as by shorting companies (selling shares that they don’t own in the hope that they can buy them at a lower price in the future). Therefore, it is a sector in which investors looking for a ‘Steady Eddy’ should tread very carefully.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.