Dogs of the Footsie still beating the pack

5th September 2018 11:08

by David Budworth from interactive investor

Despite uncertain financial markets, total returns for the Dog stocks have remained reassuringly firm, reports David Budworth.

When we last looked at Money Observer's 2018 Dogs of the Footsie back in May, it was at the end of a rocky period for stockmarkets. The past three months have been much more stable, despite the ongoing threat of a global trade war.

Stability, though, has not been much help to the portfolio of unloved companies that we lined up in February. As a reminder, our Dogs strategy involves investing equal amounts into the 10 FTSE 100 companies with the highest yields and holding them for a year. Over time, it has been one of the most successful investment approaches, beating the FTSE 100 index over three, five and 10 years.

Back in May, the portfolio was comfortably ahead of the index. Now, at the halfway stage, our Dogs are looking a little less perky, although they are still in the race. In share price terms, the Dogs have risen by 2.1%, slightly behind the 2.2% return for the index. However, on a total return basis, taking dividend payments into account, the Dogs are still winning, having returned 5.7% over the six months to 1 August, compared with 4.6% from the index.

Telecoms disappoint

As usual, the performance of individual firms has been mixed: six of our Dogs fell in share price terms over the six months. Our two telecoms fims, BT and Vodafone, have been particularly disappointing, with their share prices falling by 10.2% and 14% respectively. Both have been long-term laggards, being among the worst performers in the FTSE 100 over the past five years (as have Centrica and Marks & Spencer). Fierce competition, rising expenses, high levels of debt and ageing infrastructure have hobbled the telecoms giants.

A saving grace, however, has been their high dividend yields. One factor underlying the success of the Dogs strategy is that income is a crucial part of investment returns.

Vodafone's ability to sustain its generous dividend has become the subject of concern recently. However, past payments mean that, in total return terms, its performance does not look quite as terrible, although at -9.2%, it is still pretty awful.

Meanwhile, dividend payments by SSE, Marks & Spencer, National Grid and Imperial Brands helped these Dogs turn a share price loss into a positive total return.

So which companies have done well over the six months from a share price and total return perspective? GlaxoSmithKline has been the stock to beat, having produced an impressive return of 23%, when dividends are included. An innovative and diverse new product line-up and sharpened focus under boss Emma Walmsley have put it in an investment sweet spot.

The oil stocks in the portfolio have continued to benefit from a higher oil price and improving profits. BP was up 12% over the six months and Royal Dutch Shell climbed by nearly 8% in share price terms. Even better from our perspective, BP recently increased its dividend for the first time in four years.

Sticking the course

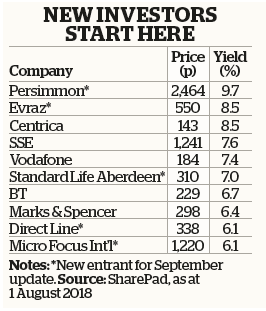

It is important to hold your nerve if you have been following our Dogs strategy and feel discouraged by its first-half performance. The approach requires investment for a full year. However, the beauty of the strategy is that it can be started at any time. Those who want to start now can select the 10 companies with the highest historic yields based on past dividend payments, using screening tools on websites such as interactive investor and SharePad. Alternatively, use the companies listed in this box:

There have been quite a few changes from the February 2018 portfolio that we are following on this page. Newcomers include EVRAZ, Persimmon and Standard Life Aberdeen – you can read more about them in the previous Dogs update. This month also sees the introduction of Direct Line, whose chief executive, Paul Geddes, recently announced that he is leaving the insurance giant. The news came as the owner of the Churchill, Privilege and Green Flag brands reported a 14% fall in halfyear pre-tax profits.

Our other new entrant is Micro Focus International, which specialises in IT management services. In July Micro Focus revealed that the integration of Hewlett Packard Enterprise's software business, bought last year, was a year behind schedule. The company's shares tanked in March after it cut its revenue forecast and its chief executive resigned.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.