Dogs of the Footsie review: no hiding place for our 10 stocks

We assess the strategy’s performance in the first half of the year as dividends disappeared.

19th August 2020 09:00

by Kyle Caldwell from interactive investor

We assess the strategy’s performance in the first half of the year as dividends disappeared.

Of the various stock-market strategies that have differing degrees of success, the Dogs of the Footsie strategy has historically been one of the more consistent.

Money Observer magazine, which closed at the end of July 2020, first began tracking the Dogs in 2001 and the portfolio has beaten the benchmark in 12 of the past 19 years.

Last year, however, proved to be a disappointing result, and at the halfway point in 2020, the Dogs are set to underperform for the second year on the spin.

This time, though, it is not down to a couple of mutts dragging down the 10 stocks, which were chosen for the portfolio at the end of January because they had the highest dividend yields in the FTSE 100 index. Instead, the black swan event that is the coronavirus pandemic has sent all the Dogs heavily into the red over the six-month period from 31 January to 31 July.

- Invest with ii: Top UK Shares | Super 60 Investment Ideas | Open a Trading Account

As the table below shows, on a price-return basis only one of the Dogs – Evraz (LSE:EVR) – is ahead of the FTSE 100 index (-18.2% versus -19.1%). In terms of total returns, which includes dividends, Evraz has comfortably outpaced the index (-9.5% versus -17.6%), due to paying a dividend March. However, it may not keep on outperforming the index, as in early August the firm announced a dividend cut. The other Dog ahead of the FTSE 100 index on the total-return measure at the halfway stage is Standard Life Aberdeen (LSE:SLA).

- Five income stalwarts fund managers have been selling

- Insider: Centrica bosses turn up the heat on share purchases

- Terry Smith says no one should invest in equities for income. Is he right?

The majority of the Dogs have either cancelled, suspended or cut dividends in the six-month period. They are far from alone, as the vast majority of UK businesses have taken action on the dividend front to shore up balance sheets in response to the pandemic.

A total of 445 companies listed on the London Stock Exchange have either cancelled, cut or suspended dividend payments between 1 January and 24 July, according to research from ETF fund manager GraniteShares. Of these, 50 were FTSE 100 companies and 108 housed in the FTSE 250 index. The second quarter’s 57% dividend decline was by far the biggest ever recorded, according to Link Group’s Dividend Monitor.

Gordon Shannon, a portfolio manager at TwentyFour Asset Management, notes “equity income investors are becoming increasingly reliant on a small number of healthcare and consumer defensive stocks for dividend payments”.

He adds: “Oil and gas majors – traditionally stalwart payers of dividends – are likely to continue disappointing with low commodity prices keeping cashflows under pressure. Alongside this, banks remain forced into a capital retention mode by regulators and they are unlikely to ease on this before the peak in defaults.”

In terms of the biggest fallers, Royal Dutch Shell (LSE:RDSB) was the worst-performing Dog in both price and total-return terms over the six-month period. At the end of April, the firm cut its dividend for the first time since the Second World War, reducing its quarterly dividend for 2020 by two-thirds, from 47 cents to 16 cents. At the time, its dividend yield declined from more than 10% to around 3.5%.

The second worst performer was Centrica (LSE:CNA), the owner of British Gas, followed by another stock in the utility sector, BT (LSE:BT.A).

At the halfway stage: the tale of the tape

| Name | Price return over six-month period* | Total return over six-month period* |

|---|---|---|

| Evraz | -18.2 | -9.5 |

| Centrica | -42.5 | -42.5 |

| Imperial Brands | -34.6 | -29.8 |

| Persimmon | -21.3 | -21.3 |

| BT | -38.7 | -38.7 |

| Standard Life Aberdeen | -16.9 | -12.2 |

| Aviva | -33.8 | -33.8 |

| Royal Dutch Shell | -46 | -43.5 |

| HSBC | -38 | -38 |

| Glencore | -21.5 | -21.5 |

| FTSE 100 index | -19.1 | -17.6 |

| Dogs average return | -31.2 | -29.1 |

Source: SharePad. *31 January 2020 to 31 July 2020

Coronavirus has, to an extent, thrown fundamentals out of the window, with some businesses in healthy-enough positions to continue paying dividends opting against doing so given the challenging economic backdrop.

But, in the case of the Dogs, the market was already questioning the future sustainability of their dividend payments, which is why the 10 stocks made this year’s Dogs of the Footsie portfolio. Therefore, given that dividends already looked vulnerable, it is not surprising that only one Dog - Standard Life Aberdeen - has kept its payout to shareholders.

A high dividend yield looks attractive on paper, but it should be treated with a healthy dose of scepticism. As share prices and yields have an inverse relationship, a high yield more often than not is a sign that a stock, for whatever reason, is out of favour.

It is therefore crucial to do some digging to check whether the yield on offer is sustainable, including scrutinising the firm’s dividend track record, the dividend cover, debt levels and the return on capital employed.

- Seven big risks keeping fund managers awake at night

- Best and worst-performing UK equity income funds revealed

- You can also invest in UK equities via ii’s Super 60 recommended funds. Click here to find out more

Commenting on the performance of the Dogs of the Footsie strategy at the halfway stage, interactive investor’s head of markets Richard Hunter notes: “Wider market weakness emanating from the economic impacts of the pandemic has unsurprisingly led to a poor first half of the year for the ‘Dogs of the Footsie’, not only with negative returns across the board, but also in many cases where the dividend has been reduced or scrapped entirely.

“This, in turn, removes a major part of the plank of the ‘Dogs’ strategy and it will be interesting to see whether the turn of the new year represents anything like a return to normality in dividend terms.

“The strategy itself has, rightly or wrongly, generally been successful. There are always caveats around investing on such a straightforward basis, however, which is why many investors also choose to examine dividend cover to see whether the payouts are sustainable in comparison to profits.”

Dogs of the Footsie strategy explained

Investors simply build a portfolio of the 10 highest-yielding FTSE 100 stocks, put equal amounts of money in each and hold them for a year. The process is then repeated the following year with the new highest yielders. Money Observer magazine ran the portfolio from 31 January each year for 12 months.

The Dogs of the Dow strategy became popular among US investors in the 1990s, when Wall Street veteran Michael O’Higgins included it in his book Beating the Dow. The Dogs of the Footsie is simply an adaptation for UK investors.

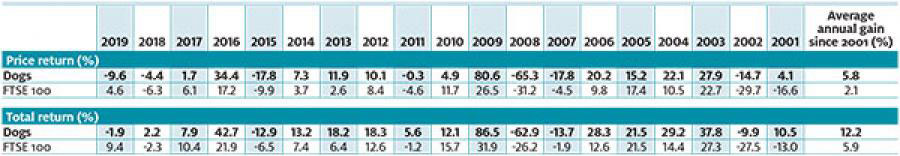

Dogs vs the FTSE 100 index: discrete annual performance over the past 19 years

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.