Dogs of the Footsie: 10 highest-yielding shares revealed for 2022

14th February 2022 09:44

by Faith Glasgow from interactive investor

We name the 10 shares in the 2022 line-up. Will the dogs outperform the wider market this year?

After 2021’s dramatic dividend recovery following the corporate ravages of the pandemic in 2020, the coming year is expected to be less of a giveaway for income investors.

The latest Link UK Dividend Monitor reports that overall dividends rose 46% last year, strongly led by mining companies, which paid a huge slew of special dividends. However, the rebound was strongest among mid and small-cap companies. The value of FTSE 100 underlying dividends rose much less dramatically, by just 20%.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

For 2022, Link forecasts underlying dividend growth of 5%. However, special payouts are likely to be much lower, so the expectation is for a 7% fall in total dividends, with a more evenly spread return to payments across sectors and an average yield of 3.5% across the board.

Moreover, uncertainty prevails this year, given the potential impact on corporate earnings of inflation, Omicron and tax hikes.

- Dogs of the Footsie: how did the 2021 kennel shape up?

- Here’s why UK shares will pay lower dividends in 2022

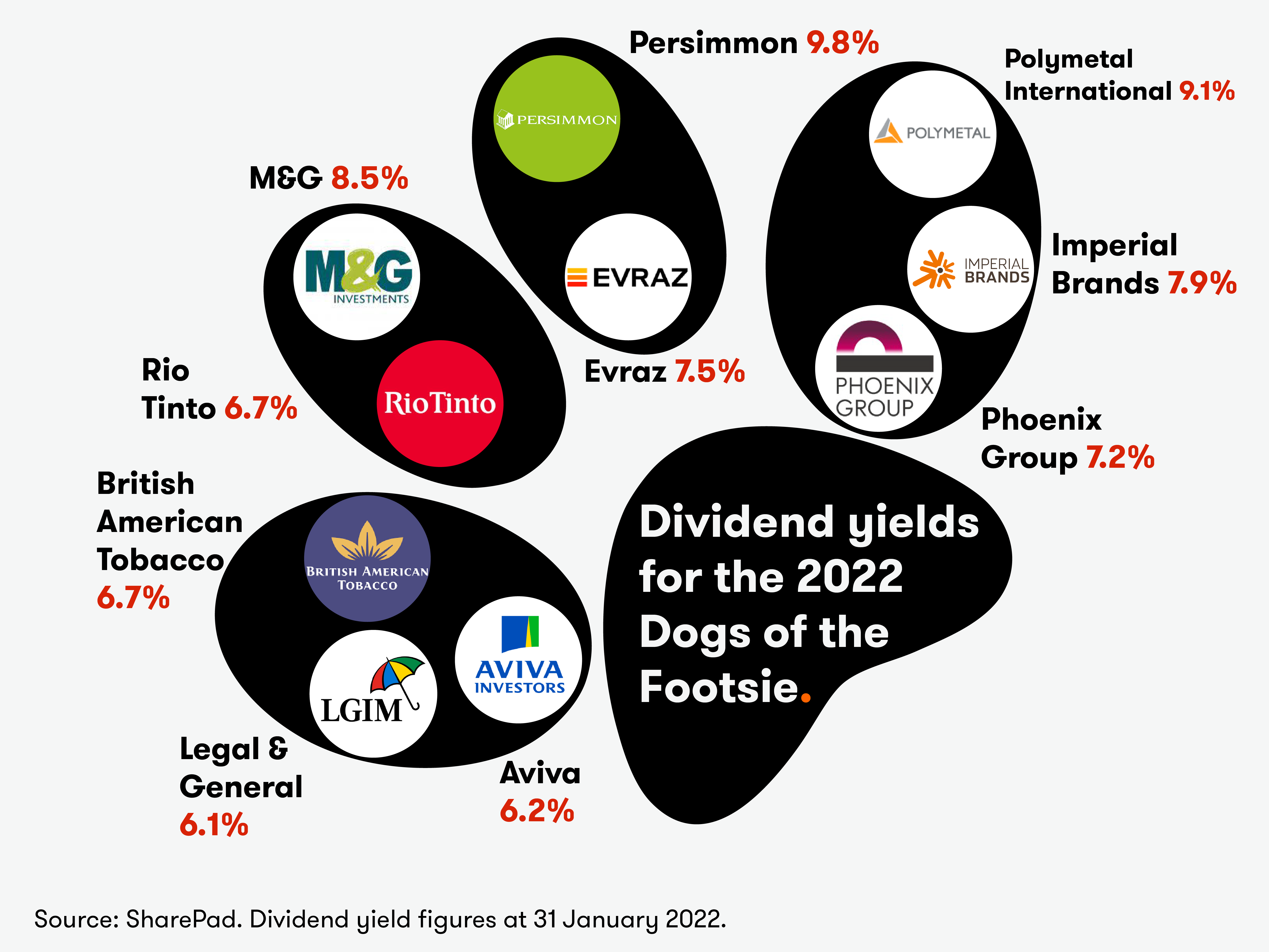

The table of 10 highest-yielding FTSE 100 shares that constitute this year’s Dogs features many familiar kennel residents: miners, housebuilders, finance companies, tobacco firms. Some are there despite strong performances over 2021; others are back after falling valuations pushed yields back up. Let’s take a closer look.

Persimmon

The housebuilder tops the Dogs table with a meaty 9.8% yield; but although dividends across the sector are attractive, valuations face the headlines of rising interest rates (which could deter prospective buyers from borrowing), inflationary build costs and government policy challenges.

So far, though, consumer demand remains strong. Moreover, as Richard Hunter, head of markets at interactive investor, points out: “Higher build completions and average sale prices brightened Persimmon (LSE:PSN)’s recent trading update, and cost inflation is being countered by higher selling prices and prior moves to manufacture its own raw materials.” He anticipates special as well as regular dividends this year.

Polymetal

As we’ve seen, the surge in commodity stocks early last year enabled miners, including new Dogs entrant Polymetal International (LSE:POLY), to increase regular dividends and throw in some one-off payouts too. The company beat its production targets last year, but valuations have been dampened by wider challenges including concerns around global growth.

However, it says the lag between December’s strong silver production figures and sales will come through in the coming months, while 2022 should see another step-up in “output at competitive costs”. Meanwhile, a 9.1% yield helps to compensate for the struggling share price.

M&G

M&G (LSE:MNG)’s share price rose almost 23% in 2021; yet as Hunter observes, “it still boasts one of the cheapest valuations and one of the highest yields in its sector at 8.5%, while the current investing environment has been to the benefit of financial stocks as a whole.”

Imperial Brands

Another strong performer in 2021, and Hunter believes prospects look promising for the coming year. “The recent rotation out of growth stocks and into value plays, coupled with the company’s attractive defensive qualities, have led to renewed interest in a sector that had been shunned mainly on the grounds of changing tastes and for ethical reasons,” he says.

The group rebased its dividend back in May 2020 with a view to accelerating debt reduction, but it is growing again under Imperial Brands (LSE:IMB)’s progressive dividend policy. Its yield is 7.9%.

Evraz

Last year’s table-topper showed a flat share price performance despite the global economy, but the Russian-based mining and steel business could have a better year if the construction boom takes off again, suggests Hunter. As things stand, EVRAZ (LSE:EVR) offers a welcome 7.5% yield.

- 10 shares to give you a £10,000 annual income in 2022

- 12 funds for the £10,000 income challenge in 2022

- 11 investment trusts to earn £10,000 income in 2022

Phoenix Group

Although some sales by institutional investors have weighed on the share price recently, this insurance business has a strong track record of growth through acquisitions. Phoenix Group (LSE:PHNX) completed four bulk purchase annuity transactions in the second half of 2021, which it believes will be key to driving organic growth. Additionally, it is focusing on growing the Standard Life brand and investment management services acquired in October last year, which Hunter says “should help generate sales”. Its yield is 7.2%.

Rio Tinto

Iron ore demand boomed as the global economy hauled itself back to life last year, and the resulting rocketing prices meant big payouts for shareholders in miner Rio Tinto (LSE:RIO). However, fourth-quarter production was mixed, and Hunter warns: “The mining giant is unlikely to pay as much in 2022, based on current prices.” Its yield is 6.7%.

Against that, he adds, guidance for iron ore in 2022 matched expectations. “Also, hopes for increased demand from China this year and concerns about supply from Australia have pushed up iron ore prices to multi-month highs.”

British American Tobacco

“Like Imperial Brands, British American Tobacco (LSE:BATS) has fallen back into favour not on ethical grounds but from an investment perspective,” observes Hunter. The company’s strong dividend yield and protection from inflationary pressures (cigarettes are considered “price inelastic”, meaning smokers will buy them almost regardless of rising prices) are clear attractions, as is the potential for further shareholder returns.

Importantly, BAT, with a yield of 6.7%, is also making inroads into alternative ‘non-combustibles’ such as vaping products – crucial in improving market sentiment.

Aviva

The financial services giant Aviva (LSE:AV.) has seen record flows to its Savings & Retirement business and progress in its ambitions to streamline and refocus the business. That’s reflected in a 36% increase in total returns over the past year; yet the yield sis still high, at 6.2%.

Hunter says: “The possibility of a £5 billion up-front capital return at the full-year results in March is supportive for the share price, with the insurer having raised £7.5 billion from selling eight businesses as part of a shift in focus towards its strongest and most strategically advantaged businesses in the UK, Ireland and Canada.”

Legal & General

Insurer Legal & General (LSE:LGEN) has its eye on pastures further afield, including US and Canadian markets, to build growth prospects. In more general terms, the company is well positioned in the long term and ever-growing savings market, across products such as annuities and equity release. A 25% total return in the year to 31 January 2022 reflects a strong financial performance and expected “double-digit growth in operating profit” as outlined in the interim results for 2021. Its yield is 6.1%.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.