Does Warren Buffett’s sell order signal end of this sector rally?

America’s most famous investor has made a big profit on this trade, but he’s just bailed out. Is this a bad sign for the sector? Overseas investing expert Rodney Hobson gives his view.

6th March 2024 08:45

by Rodney Hobson from interactive investor

Whatever Donald Trump and his supporters may claim, President Biden has not trashed the American economy. While it is not for this column to take political sides, it is obviously essential for investors to have a grip on economic reality, and the reality is that the United States has come out of the pandemic in better shape than the UK or Europe, with clear implications for the housing market there.

This is a very different situation to 2008, when US housing was at the sharp end of the financial crash and repossessions were the norm, leaving swathes of the country depressed. Although rising interest rates have had an inevitable impact on those with or taking out mortgages, the US labour market remains strong, leaving many families with sufficient income to ride out the difficult times.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Housing starts rose 7.6% year-on-year in December. Pending home sales and building permits issued were both well up on November, so the improving trend is set to continue for now.

However, there is no getting away from the fact that higher interest rates are here to stay after a decade of ultra-low rates, and the Federal Reserve Board is unlikely to rush to start to reduce the current level in an election year. The Fed has a reputation for tardiness in moving rates up or down. It was slow to react to heightened inflation and it is likely to be reluctant to start cutting before its members are satisfied that interest rate reductions are sustainable.

In any case, interest rate changes are slow to feed through into the economy and any borrowers on low fixed rates will be forced to remortgage at higher rates for the foreseeable future, while newcomers will pay more from the start.

In addition, home sales slumped during the pandemic, so part of the rebound is due to two years’ worth of pent-up demand. Yet shares in the sector have continued to power ahead.

Ashtead Group (LSE:AHT), the UK plant hire company with most of its business in North America, sounded an ominous note this week with results showing higher revenue but lower profits, not what investors want.

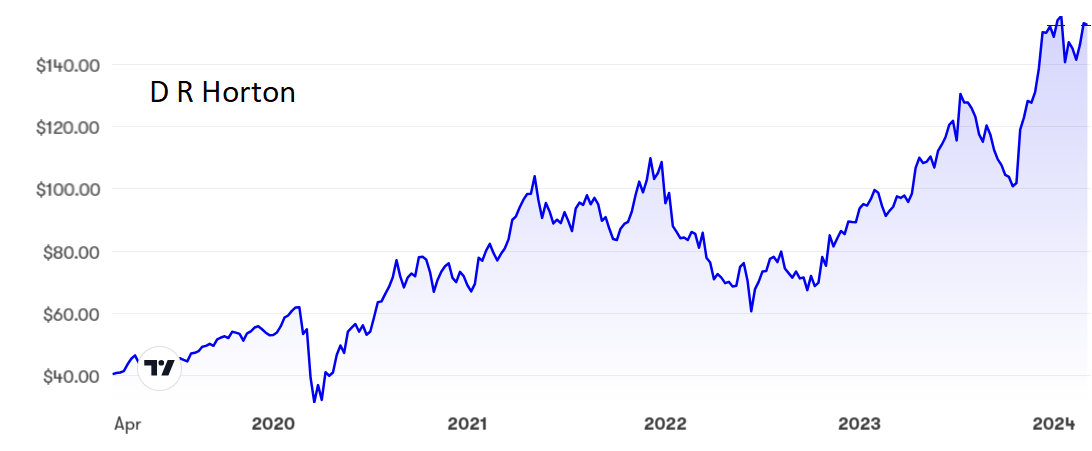

D.R. Horton Inc (NYSE:DHI) is the largest housebuilder in the US. Its most recent results, published in January, showed revenue in line with expectations at $7.7 billion in the first quarter of its financial year but earnings per share (EPS) were disappointing at $2.82.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- What you can learn from how ISA millionaires made their fortunes

- Upvote or downvote: what you need to know about the Reddit IPO

Analysts could be disappointed again as 2024 progresses. They hope that revenue will increase by about 4% in the current quarter to easily top $8 billion. While that is certainly achievable, their hopes of a double-digit improvement in EPS to above $3 looks rather more problematic.

Horton shares have quadrupled over the past four years to top $150. The price/earnings (PE) ratio is still only 11 but the dividend is a measly 0.7%.

Source: interactive investor. Past performance is not a guide to future performance.

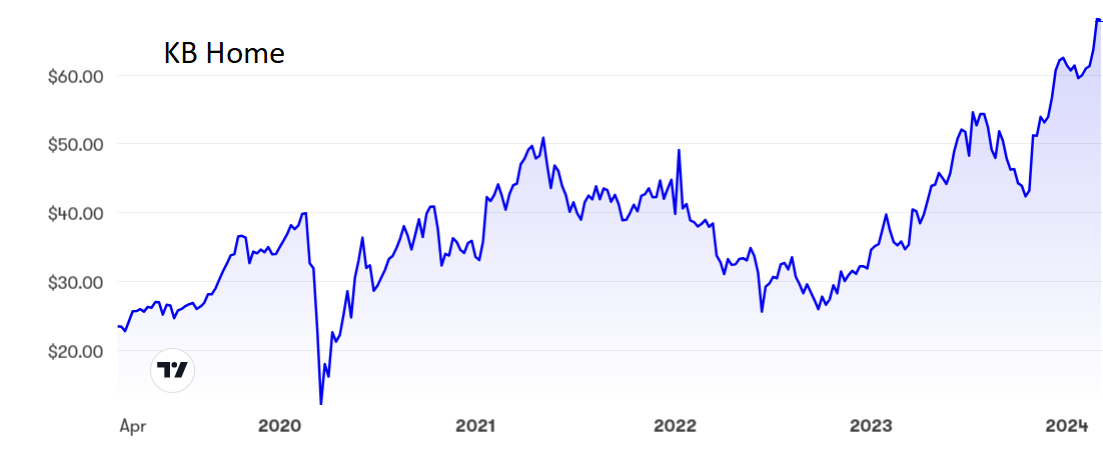

KB Home (NYSE:KBH) has also hit a new high at $68, where the shares are slightly more attractive than Horton’s with a PE just under 10 and a yield marginally better at 1.11%. Its earnings are expected to grow at 7.8% but, as with Horton, that could well be scaled back as higher interest rates bite.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: Along with other housebuilders, I tipped Horton at $71.50 nearly two years ago after an overdone correction, but later turned less enthusiastic. Berkshire Hathaway Inc Class B (NYSE:BRK.B), the vehicle of fabled investor Warren Buffett, has just sold its entire stake in Horton. I think another correction is well overdue. Follow his lead and sell. I prefer KB Home, though cannot rate the shares better than a ‘hold’ at this stage.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.