Do big trust discounts mean big opportunities?

2nd June 2023 15:02

by Alan Ray from Kepler Trust Intelligence

What would make property discounts start to narrow? Kepler Trust Intelligence considers the sector.

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

The word ‘cliché’ is very often used with a slightly pejorative edge and, if one is being forced to listen to one’s friend’s tired old blues licks played slightly out of tune on guitar, then we’d be right there using it pejoratively, too. But we also think clichés are a useful way of communicating ideas efficiently and one of our personal clichés is ‘it’s a cliché for a reason’.

- Invest with ii: Buy Investment Trusts | Top UK Shares | Open a Trading Account

One of the laziest clichés going is ‘markets hate uncertainty’. Lazy it may be, but it doesn’t mean it’s not true and it can be a very useful starting point for understanding what’s going on. The lazy bit is the shoulder shrug that often comes with it, possibly with the additional clarifier ‘it is what it is’, which is a great way to convey so much and so little at the same time.

UK commercial property trusts have, in one version of the narrative, seen their share prices plummet over the last 12 months due to great uncertainty regarding property valuations. As a result, most trade at very wide discounts and continue to do so, even after significant markdowns to their net asset values in the December 2022 quarterly valuation round. This being due to uncertainty seems like quite a neat summary, doesn’t it?

A few weeks ago, we wrote a piece about how understanding why the market has moved a share price is the starting point to understanding whether one can take a contrary view. One cannot, after all, contradict something one doesn’t really understand. The following line of thinking is a somewhat related idea. Let’s go through all the things that the market might be uncertain about and see how uncertain they really are.

Oh, you mean interest rates?

The first element of this uncertainty is, it seems to us, rising interest rates. Well, we would argue that the stock market was very certain about what that would mean for property valuations, and share prices moved very swiftly to reflect that certainty. Nothing really uncertain at all, one might say.

At this point, we could just say ‘case closed’, as this does seem like quite a big certainty that the stock market got right without the benefit of hindsight. As an aside, the stock market ‘getting something right’ seems like quite an unusual phrase to see written down, doesn’t it? Perhaps there will be another article in the future on that topic?

Wait, maybe it’s more than just that…

Let’s think through some of the other uncertainties within the property sector. Property touches everyone’s lives, so it’s a relatable asset class in many ways. Let’s take one of the most relatable uncertainties: traditional retail assets. This is really a very mature uncertainty and, really, we think there are a couple of certainties: the sector is chronically oversupplied, often with assets that won’t easily meet evermore demanding ESG standards, and consumer behaviour has moved on from ‘a day out to the shops to see what’s available on the shelves’. In writing that sentence, we aren’t telling anyone anything they don’t already know, with high streets up and down the country showing all the signs of too much supply and too little demand. Again, does this really seem like a big uncertainty?

In fact, our universe of listed REITs has, largely, taken the same view. There will always be individual examples of retail assets with a unique or local characteristic that makes for a good investment. There’s also plenty of opportunity, for the right investor, for a change of use. It’s not that cheap to turn a shopping centre into a residential development, though, and our income and steady-return REITs are, and have been for some time, significantly underweight this part of the retail space. As a group, they are all quite certain about this.

Hold on - have you been to the office lately?

Let’s take one of the most polarising uncertainties: offices. Clearly, in a post-pandemic world, there is a tug of war between ‘back to the office’ and ‘flexible working’ arguments. Both sides make some good points, but perhaps the most certain uncertainty is that the nature of office-based work is changing rapidly, and this is likely to accelerate.

The technology genie is out of the bottle, both in terms of the ways in which humans communicate, and more recently in terms of how artificial intelligence (AI) will reshape how and what humans work on. It would be very easy to be lost in this topic for several paragraphs of speculation. What our universe of REITs is positioned for in this sector is that, again, ESG factors, not least energy efficiency, immediately rule out a large part of this market without significant expenditure. Again, local factors mean that there will always be exceptions, but by and large, prime offices still have an important role in corporate life, although the future of regional offices is less certain. That is very far from saying non-existent, however: after all, people around the country still work every day in offices. Again, for a different, more hands-on investor, there is probably a value opportunity. But, for the steady income and growth model, it seems too uncertain. Once again, our universe is underweight this, with a shared view that it is certain that regional offices are risky and uncertain.

We’re all online shoppers now, even when we’re in the shops…

In conclusion, managers in the sector have all seen the changes to the way people shop, the way that industry works and the way that supply chains have evolved. The principal overweight sectors in our universe are industrial and logistics, and retail warehouses. These are somewhat interlinked themes, as a retail warehouse may double as a tenant’s ‘last mile’ logistics hub, serving the click and collect market. If we were to summarise this as the ‘Amazon economy’, we think most readers would follow what we mean. Even if it’s not Amazon itself, the economy is still reshaping itself around this model and it seems quite certain that it’s not reversing.

Assets in the space are not in oversupply and for the steady growth, income-seeking trusts, this is an attractive attribute, as is the fairly straightforward nature of the assets themselves, being more readily adapted to meet ESG standards. ESG standards aren’t, by the way, an optional extra, as regulations will be getting tougher over the next few years. In terms of certainty, it seems highly certain that these assets will continue to be in demand. What is also certain is that neither are new themes and one very fair question is: have valuations got ahead of themselves? Helpfully, Industrials REIT Ltd (LSE:MLI), which specialises in - you guessed it - industrial assets, recently agreed to a £750 million cash offer at close to net asset value from a private equity fund. This at least shows that there are willing sellers and buyers at around current levels, which is a good start.

Big discounts, big opportunity. Right?

So, to conclude, with large discounts to net asset value, generally conservative gearing, M&A activity and portfolios positioned in what we feel comfortable as describing as growth sectors, it’s very tempting to identify the current situation as a one-off opportunity. It’s especially tempting as one trust within Kepler’s universe of REITs, CT Property Trust Ord (LSE:CTPT), has just announced an agreed all-share bid from LondonMetric Property (LSE:LMP), a FTSE 250 REIT. CTPT fits our template perfectly: a strategic move away from traditional retail and offices towards industrial and retail warehouses has been executed successfully over several years, with conservative gearing and cash available for acquisitions. It’s a perfect fit for LMP, which is focussed on much the same sectors. So, if one was being picky, one could say that this is a relative value transaction by an established player in the same sector.

Will Fulton, the manager of UK Commercial Property REIT (LSE:UKCM), laid out his views on the property market very recently in a presentation hosted by Kepler, which you can watch here. Richard Kirby, manager of Balanced Commercial Property (LSE:BCPT), has also positioned his trust very positively towards these sectors and we will have a note on BCPT very soon. Both are conservatively geared and trade at discounts close to 30%, with attractive dividend yields. Nick Montgomery also set out his views at a Kepler event in March and you can view that here.

We’re not 100% sure about that…

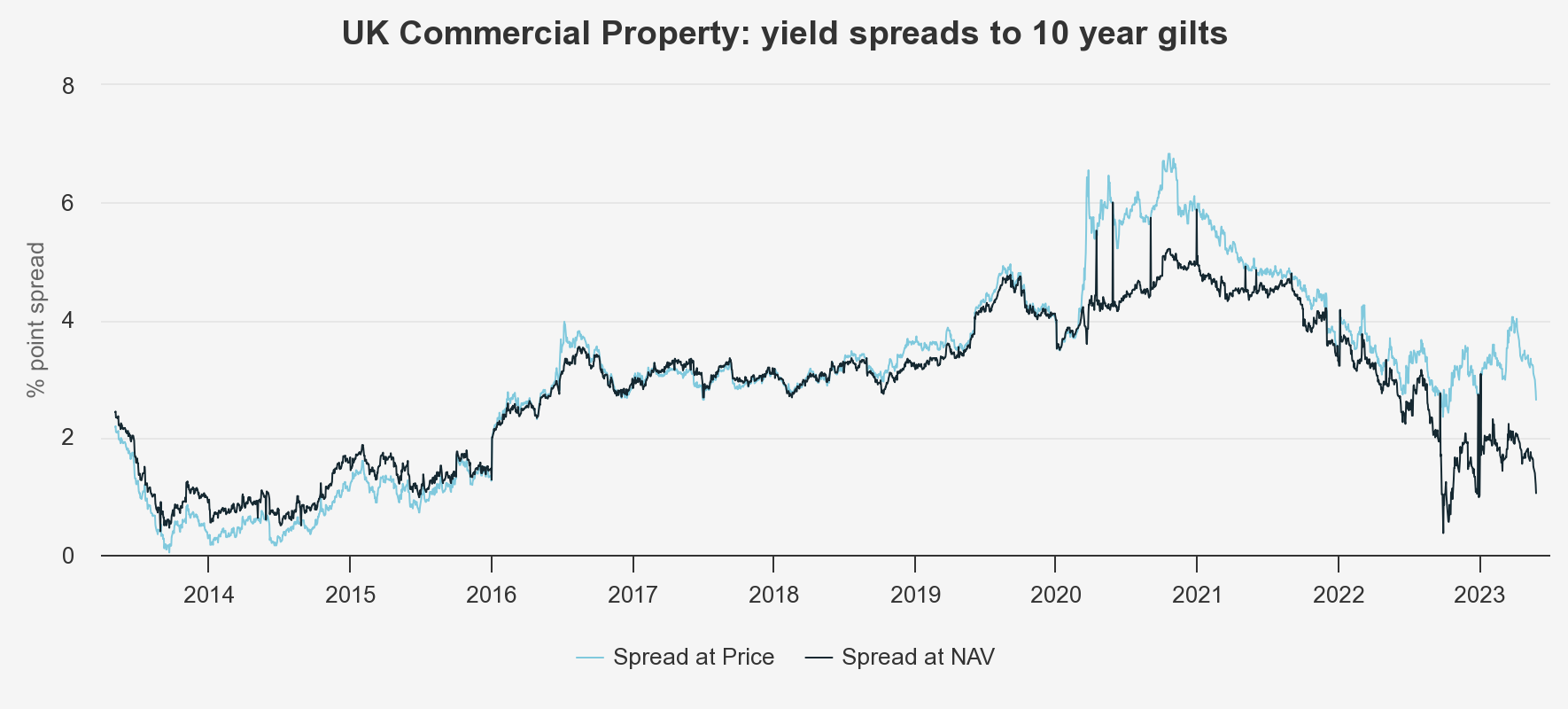

Which brings us to our main uncertainty, which we can’t solve with a single snappy sentence. There’s an old rule of thumb in property that the long-term average spread over 10-year gilts should be about 200bps to 300bps. At the time of writing, the 10-year gilt is yielding over 4% and, no doubt, gilts are suddenly being considered as an investment by some for the first time.

Dividend yields on the property trusts are indeed averaging about 6%, albeit with some outliers with much higher headline yields. These dividend yields are, however, the result of an approximately 30% discount to net asset value, so the underlying property yields are somewhat lower than that. The chart below shows the average dividend yield at both share price and net asset value for the UK commercial property peer group, illustrating this point. Property yields grow, of course, and although UK leases don’t tend to have inflation indexation, there is a long-term correlation with inflation. As we’ve discussed, our universe of trusts is well-positioned in the right sectors.

UK COMMERCIAL PROPERTY TRUST DIVIDEND YIELD VERSUS 10-YEAR GILT

Source: Morningstar, Bloomberg

This means one needs to see gilts yields falling and rental growth coming through strongly to believe that discounts will narrow rapidly to net asset value. Neither of those things is implausible and the latter seems quite likely. So, the listed property trusts are at a point where a long-term investor should be considering their next move. However, despite the M&A, they aren’t at a point where investors can just rely on mean reversion to close the discounts. It is, as they say, what it is.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.