Do all you can to avoid your own personal pensions Nomadland

23rd June 2021 11:50

by Rebecca O'Connor from interactive investor

Want to tell us how retirement is looking for you? Participate in this year’s Great British Retirement Survey and you could win a prize of up to £1,000

Picture credit: Disney+

The film Nomadland portrays the itinerant life of a woman left destitute and jobless along with thousands of others after the closure of the main employer in her hometown, around which the whole town was established.

She lives in her van, which is of course often freezing; toilets in a bucket, works shifts in an Amazon (NASDAQ:AMZN) factory and tries to keep her head high, finding relief and perspective by connecting with those in similar circumstances around her.

We learn she used to be a tutor and had a valued role in the local community and that she does not want to accept help from concerned friends, preferring instead to find her own way.

It is fair to say life took a nosedive for her at a time in life when nosedives must be pretty hard to deal with. Her head might be high, there might be pearls of friendships and profound moments of realisation along her path, but it is clear this is not the life she, or any of her peers, would have chosen.

Such a level of bad luck might be unusual among the over-50s, but a degree of misfortune certainly isn’t.

- Pensions tax raid: government warned not to tinker

- Don't be shy, ask ii…am I saving enough for a decent retirement?

- Pensions jargon buster

According to the Interactive Investor Great British Retirement Survey 2020, unexpected life events wreck the pension plans of one in four people. Illness and divorce were the most cited adversities, but they also included redundancy, bereavement and caring responsibilities. **** happens, as the t-shirt says, but we are not always prepared for it when it does. Many people find they have to just keep ploughing on with work.

According to the Office for National Statistics (ONS), one in 10 people aged 65 years and over was still working in 2019. A high proportion are self-employed and part time.

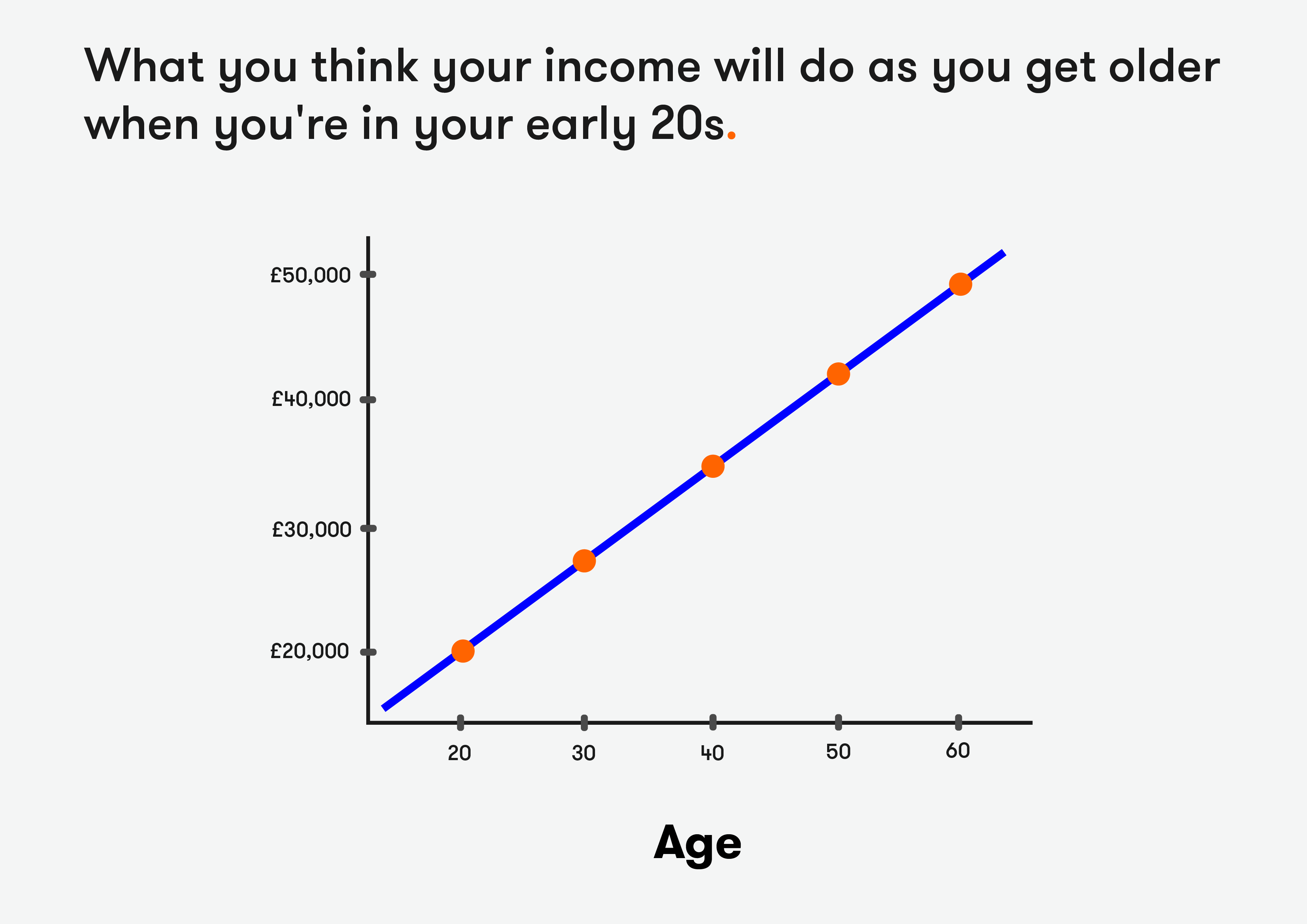

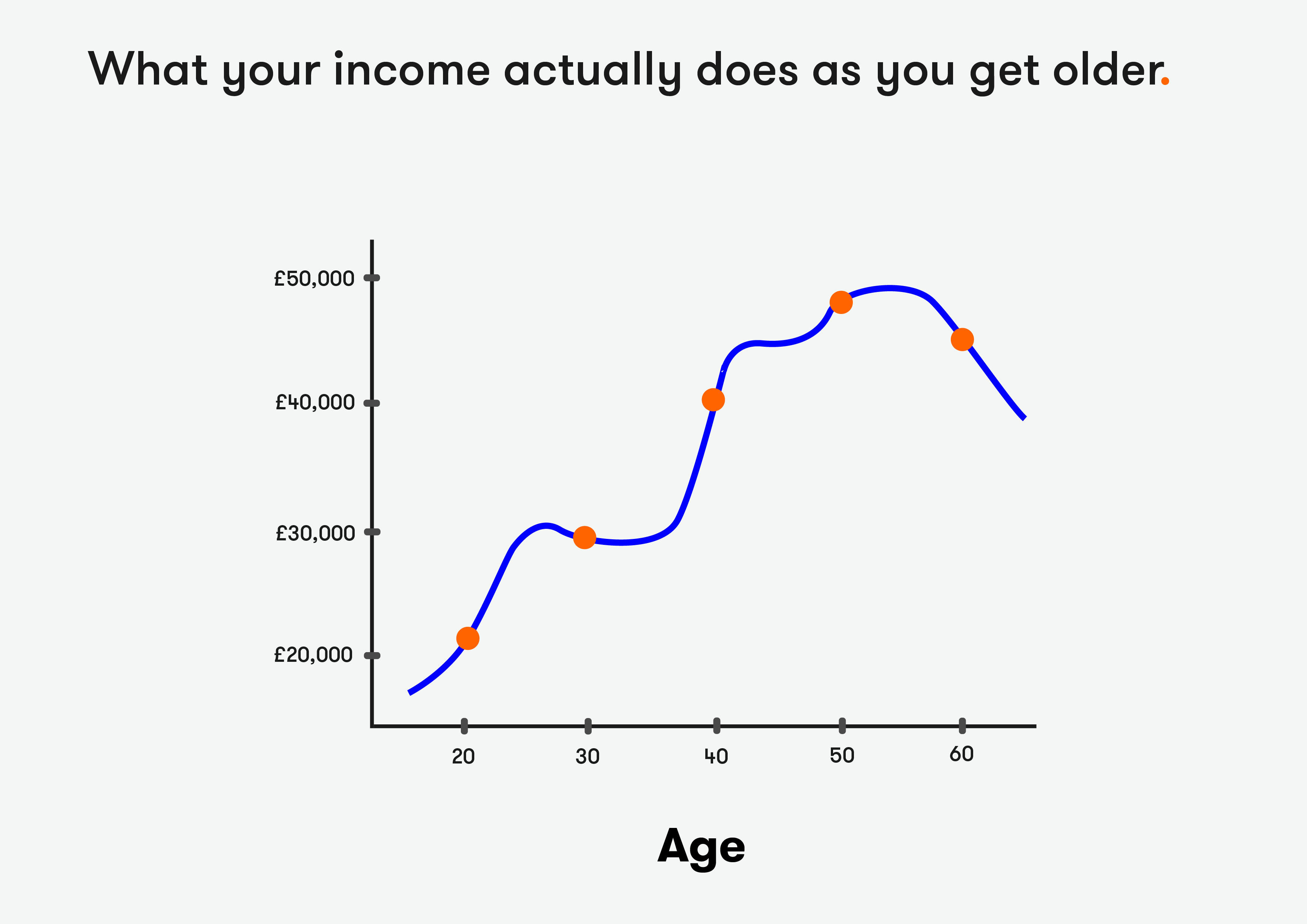

You might think when you start your career that your salary growth will be all uphill from here. On average, earnings go down once your 40s are done. So older workers who did not make hay while the sun was shining may find they need to work harder to combat the gravity of age-related diminishing returns.

Older workers were disproportionately affected by the effect of the pandemic on the labour market. The unemployment rate for those aged between 50 and 64 increased from 3% in December 2019 to 4.1% by December 2020, with more men than women out of work. That means more than 100,000 people in this age group over the course of 2020 became unemployed. Will they find work again? That is a big material question for them, because at this point in life, time to fill income and pension gaps is potentially running out.

Many people champion the growing cohort of older workers as a social victory, as it shows people have more opportunity, choice and flexibility to work if they want to.

There are clear benefits for some older people to continue to work rather than retiring, which may prompt identity crises and depression if it is not the right choice for the individual.

But it is a wilful misinterpretation, I think, to believe that all older workers are in employment because they love work and because it keeps their mind and body healthy. This may be true for half, but for the other half the reality is the exact opposite. Work is hard, they are tired, they would rather be doing other things such as spending time with grandchildren, going for nice walks around National Trust properties and reading more books, but their financial circumstances mean this is not an option for them. Some choose to work later, while others are forced to by circumstance. The problem for this latter group is whether they physically and mentally can work.

- Here’s how much money you need to retire in 40 UK cities

- Pension investors could lose out over Department of Work and Pensions proposals, warns ii

- Are you saving enough for retirement? Our pension calculator can help you find out.

Health is a big determinant of whether someone will be able to plug their pension gap by working for longer - it cannot be blithely assumed that we can all bound on until we drop. Joe Biden is able to be a 78-year old president because he is in excellent health. He is an exception. A recent report from the Institute for Fiscal Studies found that 49% of people aged 50 to 69 report a longstanding health problem. This affects their ability to work, reducing the amount they can pay into a pension and even forces early retirement, meaning their pension pot is likely to be eroded sooner.

But a pension that is insufficient to cope, even with a fortunate set of circumstances going into retirement, will certainly not be enough to cover additional misfortunes that require people to end higher-paid roles sooner, or to pay out large amounts of cash unexpectedly, such as may be required in a divorce. The overall decline in the generosity of pensions, alongside private misfortunes - not to mention the likelihood of rising housing costs in the form of mortgage or rent payments - could increasingly mean more older people have to work for longer, even sometimes in spite of ongoing health problems. This might raise their income but is also likely to exacerbate their wellbeing and foreshorten lifespans.

A major challenge that could make plugging any gaps by working longer even harder, is that the jobs older people need might not even be there for them. While working in a library, or the John Lewis fashion department a couple of days a week might seem like a tolerable way to earn some income in your late 60s, the reality is likely to be less ideal: more manual gig economy jobs for those who are physically able to do them, a la Nomadland, or for those who managed to cling to their careers despite the waves of young blood beneath them: professional services jobs, which, as the IFS says, are likely to be “more stressful and cognitively demanding jobs”. The middle ground of relatively demand-lite, part-time roles, in which there is time for a cup of tea and a chat and you are home in time for Garden Rescue, may increasingly be gold dust for the older generation of reluctant workers.

If pensions are likely to become less sufficient for tomorrow's retirees, then the provision of appropriate work will become more important.

The increase to the state pension entitlement age, especially for women, as well as the removal of the security blanket of more generous defined benefit schemes, and their replacement with less generous, defined contribution schemes, the rise in numbers of self-employed people, the general rise in the normal minimum pension age and then rising housing costs going into retirement, are all massive changes that threaten retirement as we know it. They have all taken place quickly - within a generation.

- Is 12% the new 8%?

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The result is likely to mean that we will be demanding more of our minds and bodies through having to work later than might feel right. We don't know what effect these pressures to continue to earn are likely to have on all of us as we grow older. We might be lucky and find our pension is enough to get by, or we might not. Our health might stand the test of time, or it might not. Either way things feel a lot less secure than they used to. The privilege of being able to take for granted a relaxed retirement has gone. Personal responsibility is key. Do all you can, then if **** does happen, at least you know you did your best to limit the damage.

Want to tell us how retirement is looking for you? Participate in this year’s Great British Retirement Survey and you could win a prize of up to £1,000 https://survey.coredataresearch.com/?r=survey/index&sid=247939

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.