Data watch: Inflation and retail sales

13th November 2017 10:48

by Emil Ahmad from interactive investor

The week that was…

UK

After all the noise around this month's interest rate decision, last week was more subdued on the economic news front. The Christmas shopping spree hardly began with a bang, with the poorest growth in non-food spending in over five years.

The BRC Retail Sales Monitor indicated like-for-like sales in October had dropped by 1% compared to 2016, significantly below forecasts of a 0.9% rise. The Halifax House Price Index made month-on-month gains of 0.3%, with the year-on-year figure consistent with expectations of a 4.5% rise. This contrasts with Wednesday's RICS House Price Balance release which presented a slightly less bullish outlook.

Manufacturing Production seems to be defying Brexit uncertainty, with a sharp monthly improvement of 0.7% in September versus August's more modest 0.4% upturn. On an annualised basis, the gains of 2.7% were also ahead of forecasts, solidifying a more upbeat outlook. The other main event on Friday was the Industrial Production release. Total month-on-month industrial production was up 0.7%, the fastest rate of growth since Q1.

US

Tuesday was notable for the September JOLTs Job Openings report. September openings were very close to forecasts of 6.091 million, with the flat market partially due to the hurricanes inhibiting restaurant and hotel hiring. Storms notwithstanding, the employment market remains relatively healthy.

Fed Chair Yellen spoke on Tuesday, her first public address since Trump's nomination of Powell as her replacement. Although Yellen failed to comment on the US economy, she emphasised that the public must have complete confidence in the Fed's ethical stance.

Rebalancing of the oil market continues to be a tricky task, with Crude Oil Inventories posting an unexpected weekly gain in stockpiles of 2.2 million barrels. This defied analysts' expectations of a 2.9 million-barrel inventory reduction.

Initial Jobless Claims for the prior week were 8,000 above forecasts of 231,000, indicating that storm-related processing disruptions had eased. After hitting record highs of 101.1 in October by spiking 6.3%, the Michigan Consumer Sentiment Report suffered its biggest losses in a year on Friday.

Key releases for the week beginning 13th November

UK

Tuesday November 14th

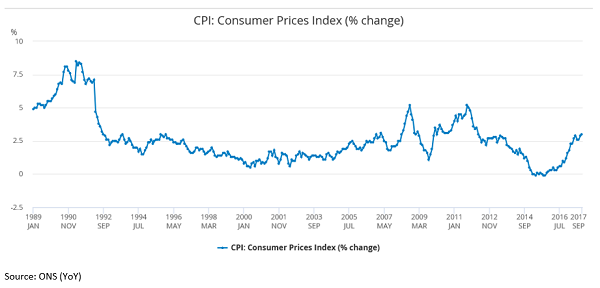

One of the most important releases this week is the Consumer Price Index (CPI). Measuring the change in price of goods and services within a basket of consumer items, this is regarded as the principal measure of inflation.

Inflation currently stands at 3%, a five-year high. Forecasts indicate that year-on-year inflation will hit 3.1% this month, with Bank of England governor Mark Carney expecting a peak in the next couple of months. Interest rates typically have an inverse relationship with inflation and November has been notable for the first rate rise in a decade.

However, this simply reverses the emergency post-Brexit cut and market sentiment arguably suggests this token gesture could further undermine fragile economic growth. Households are already feeling the squeeze with high inflation outpacing weak wage growth. This rate rise is not good for borrowers and puts an increasingly debt-laden nation under further pressure.

Carney has priced in two more hikes over the next three years. While inflation is expected to ease over the next couple of years, households will not be encouraged by Carney's expectations of it remaining above the 2% target level.

Tuesday is also notable for the release of Producer Price Index (PPI) Input figures. This indicator assesses the change in input prices relating to goods and services, essentially factors of production.

Input prices have been steadily rising on a month-on-month basis, with September's and August's figures coming in at 0.4% and 2.3% respectively. Although last month's figure was below forecasts, the 8.4% year-on-year increase still makes for sobering reading. This is expected to drop below 5% for October with a monthly forecast of 1% anticipated.

While companies may be able to absorb some price increases, there is little doubt that profit margins will suffer at these levels unless consumers bear some of these costs. Higher PPI Input prices will ultimately filter through to the CPI and provide inflationary headwinds. Post-Brexit sterling weakness will do little to help producers reliant on imported factors of production.

With such an uncertain investment climate, higher input prices can potentially provide further grounds to put business expansion plans on hold. As a developed nation so reliant on consumption for GDP growth, any future easing in input prices would be welcomed by the UK economy. This could lead to wider profit margins for producers, thus encouraging capital investment. In these circumstances, some of the savings may be passed on to the end-user which could lead to a growth in consumer spending.

Wednesday November 15th

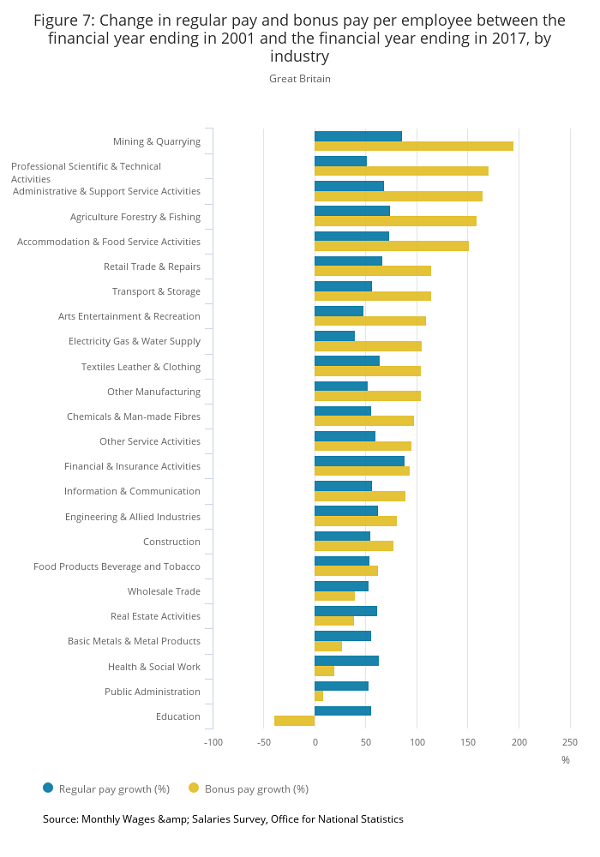

Market attention turns towards the Average Earnings Index midweek. As the name suggests, this looks at wage increases and has implications for inflation. Wage growth and inflation typically have a positive relationship i.e. levels of pay should rise with inflation.

There are two measures for this index, with the one incorporating bonus payments regarded as being the more important indicator. However, it should be noted that bonuses are volatile and can be mainly attributed to the City. Consequently, it could be argued that the Average Earnings Index plus Bonus is not necessarily reflective of the broader employee demographic.

In August, the 'plus bonus' year-on-year figure was 0.1% ahead of expectations at 2.2%, matching July's figure. Excluding bonuses, annual wage increases stood at 2.1% in August. This is anticipated to remain at this level for the month of September. In Q2 2017, pay growth officially lagged inflation for the first time in two years. The trend has continued since and highlights the impact of Brexit uncertainty on the beleaguered UK employee.

It is essential to emphasise that while wages are rising, workers are actually worse off in real terms. When inflation exceeds wage growth, purchasing power is eroded, thus adversely impacting disposable income and personal consumption. With unemployment levels recently hitting 42-year lows of 4.3%, it would be natural to assume a pick-up in wages. Higher competition for workers should drive wage increases, a relationship encapsulated by the Phillips Curve.

However, this relationship has not been evident in recent times as there are arguably other factors at play; these include the controversial topic of cheap EU workers, higher labour costs and weaker unions. On a more positive note, the Bank of England does expect real wage growth in 2018.

As sterling's post-Brexit slump works its way through the system, there should be a reduction in inflation. Imports should be comparatively cheaper on a year-on-year basis. There are some rumblings from recruitment firms that low workforce availability is starting to translate to wage growth in some sectors. If these record employment levels persist, wage growth could gather pace in 2018 but this could be mitigated by Brexit negotiations and associated uncertainty.

Thursday November 16th

Consumption really does appear to be the theme of next week, with Retail Sales figures the last prominent event on the economic calendar. October's figures are not expected to reverse last month's contraction in sales (-0.8%), with a modest gain of 0.1% expected.

This is not good news for the retail sector, failing to build on the momentum of the three-month summer rally which brought the High Street some respite. On a yearly basis, the figures are similarly disappointing with a 0.7% contraction consensus. A slight uptick of 0.1% is forecast for the core monthly figure, which excludes volatile auto-vehicle sales and fuel. September's monthly fall of 0.7% represents the lowest 'growth' rate in retail sales for over 4 years.

Although year-on-year growth for Q3 remained in positive territory (1.5%), this has to be put into perspective. We can fully see the impact of the impending EU divorce, as annual growth averaged 4% between 2014 and 2016.

Supermarkets and food retailers, department stores and petrol stations were struggling last month but clothes shops were a rare bright spot (+ 7%). Many of the usual suspects are responsible for this retail sales malaise, including inflation and the erosion of purchasing power.

The sector has also been hit hard by a weak pound and reduced margins. While the retail sector will be hoping for a Black Friday and festive season boost, the recent rate rise will do little to enhance credit-fueled consumption.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.