Data watch: CBI, Budget and GDP

20th November 2017 13:06

by Emil Ahmad from interactive investor

The week that was…

UK

Last week got off to an inauspicious start with Tuesday's releases doing little to ease the doom and gloom of Brexit.

The year-on-year CPI reading held steady at 3% for October but remains at five-year highs. Core CPI was also consistent with September's figure of 2.7%, undershooting forecasts by 0.1%. The other main measure of inflation is the RPI and its annualised October reading was 4%, having moved 0.1% higher over the month.

Further inflationary evidence came in the form of the PPI, with prices for materials and fuels (input prices) climbing 4.6% higher in the year to October. This is a marked drop from September's 8.1% spike. As expected, UK Average Earnings growth failed to exceed inflation for another month. Weekly earnings grew at an annual rate of 2.2% in the three months to September, decreasing in real terms by 0.8%.

The retail sector was not the bearer of good news on Thursday, with Retail Sales falling on an annualised basis for the first time in four years. This 0.3% downturn in October was not as damaging as the 0.6% decrease anticipated.

US

On Tuesday, PPI figures also came in across the Atlantic. The PPI moved 0.4% higher on a monthly basis in October against a 0.1% forecast, given impetus by a spike in services costs. Indications of a rise in wholesale inflation will also offer some encouragement.

Spending continues unabated, with Retail Sales up 0.2% in October, adding to September's 1.9% hurricane-driven sales surge. With the figures supporting a robust retail sector, a quarter point rate hike in December looks increasingly likely.

Key releases for the week beginning 20th November

Tuesday 21st November

Market attention is focused on Phillip Hammond and his delivery of the inaugural Autumn Budget. However, there are a couple of UK economic releases which may provide a slight diversion from the chancellor's fiscal manoeuvrings.

On Tuesday, it's the CBI Industrial Trends Survey (Orders). This survey has been running since 1958 and continues to be a good gauge of UK manufacturing and wider economic sentiment. As a leading indicator of business conditions, senior manufacturing executives share expert qualitative opinion on industry matters.

Growth in order and output remains above historic norms with companies operating at capacity levels approaching 20-year highs. Conversely, concerns over skill shortages hit four-year highs in October and efforts to reduce capital expenditure will effect investment in tangible goods.

Manufacturing is a vital contributor to GDP and in terms of output, the UK ranks ninth in the global tables. Roughly three million people are employed in the sector which supports a similar number of services sector roles. Although the UK runs a trade deficit, 45% UK exports can be directly attributed to the sector (EEF).

With time running out for a transitional Brexit deal, we can expect this month's survey to show a similarly downbeat outlook. Nevertheless, the government does have a chance to revitalise the manufacturing industry this week with the budget.

A muted scrap of the 4% rise in business rates for the new tax year could provide a timely boost. Even linking increases to the CPI (Consumer Price Index) rather than the RPI (Retail Price Index) could have a positive effect on reducing overheads, as the former's inflation projections are typically lower.

Thursday 23rd November

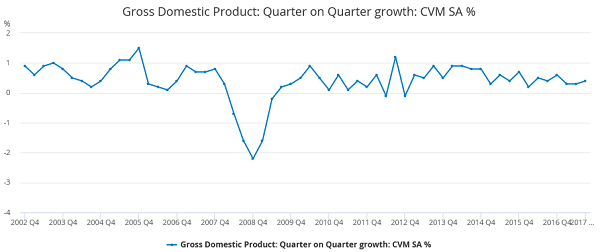

In terms of the economic calendar, the Gross Domestic Product (GDP) release on Thursday may capture most of the headlines. It could be argued that GDP is the most important indicator of all, primarily because it tries to reflect the overall health of the economy in a single number.

While the UK remains on the right side of expansion-contraction divide, business is hardly booming. The Brexit effect ensures the UK lags well behind the Eurozone's decade-high growth rate of 2.5%, with domestic year-on-year growth currently standing at 1.5%. With the EU divorce negotiations seemingly making little headway, corporate investment may remain depressed in the coming months.

The government continued to retain its positive stance after last month's release, emphasising the robust UK economy and tight employment market. October's release confirmed growth in Q3 was 0.4%, slightly ahead of forecasts of a 0.3% expansion. Relative strength in business services and finances helped offset significant weakness in construction over the quarter. The dominant services sector made steady gains of 0.4% despite falling short of Q2's 0.5% advance.

Business confidence undoubtedly remains in the balance and consumption continues to suffer from a lack of real wage growth. The EU has cut the UK's GDP growth forecast to 1.3% in 2018, with 2019's figure coming in 0.2% lower. However, the good news is that the chancellor has the opportunity to right some of these economic wrongs on Wednesday.

We have already mentioned potential business rates amendments, but the budget is likely to address the consumption slowdown too. While the probability of some of these changes is remote at best, the UK economy will take any help it can get. Millennials could benefit from the scrapping of National Insurance contributions and a cut in stamp duty for first-time buyers.

Consumption and economic activity may get further impetus from a rise in the personal allowance, a lifting of the public-sector pay cap and an increase in the National Living Wage. While the conservatives appear eager to re-engage with the younger voting demographic, it is hoped that the focus of the budget will remain rooted in the greater economic good in these trying times.

Source: ONS

US - the week ahead

Tuesday 21st November

As our American cousins look forward to impending gastronomic delights, there are a couple of economic events in next week's calendar to distract them from their forthcoming Thanksgiving Day celebrations.

Existing Home Sales quantifies the change in the annualised number of residential properties sold in the prior month. As the US economy is sensitive to housing market conditions, figures which significantly deviate from forecasts can drive dollar volatility.

After three months of consecutive drops, house sales reversed course in September and a 0.7% gain equated to seasonally adjusted rate of 5.39 million over the month. This slight gain defied expectations of a 500,000 downturn in sales, as analysts assessed declines in associated indices and hurricane-related impediments.

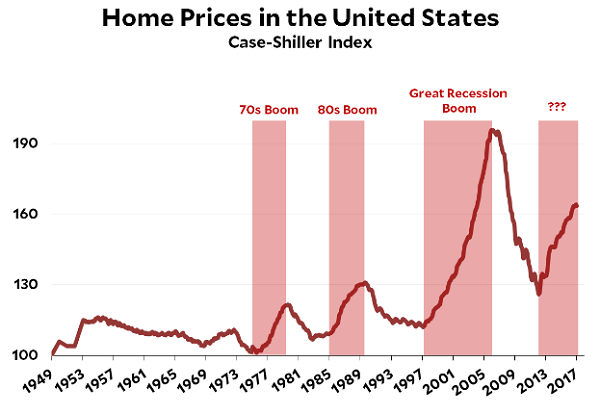

House sales are expected to move slightly higher in October to 5.42 million, an increase of approximately 0.6%. Residential property prices rose 4.2% in September on a year-on-year basis, reflective of a strengthening market and a healthy economic backdrop. This is the 67th consecutive month of annual price increases.

The second biggest housing boom in US history (Source: Kevin Drum, Robert Shiller)

Friday 24th November

After Thursday's holiday, normal service resumes on Friday with the Markit Services PMI release. As the services sector account for approximately 80% of US private sector GDP, the survey's role as an indicator of US economic health cannot be underestimated.

Growth in the sector maintained its steady upwards trajectory in October with the 55.3 reading coming in slightly below the 55.9 forecast. This is expected to tick upwards to 55.6 in November.

In October, hiring was still at healthy levels, driven by growing business needs and client demand. However, there is some evidence of a sector slowdown, with the rate of growth for new business orders and the pace of price increases losing momentum.

This survey reflects the dilemma currently facing the Fed; economic growth is buoyant, but deflationary pressures remain. Deflation adds an additional degree of complexity to the supply chain. A fall in input costs can filter through to the consumer, hence the pronounced drop in the rate of increase of average prices charged for goods and services. October data as a whole supports strong GDP growth for Q4, with further tightening from the Fed fully priced in for December.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.