Dart: A real growth story worth buying

21st September 2018 13:24

by Richard Beddard from interactive investor

Jet2.com, Dart's airline, has come a long way since it flew for the first time from Leeds Bradford Airport to Amsterdam. It is showing no signs of slowing up. Companies analyst Richard Beddard reports.

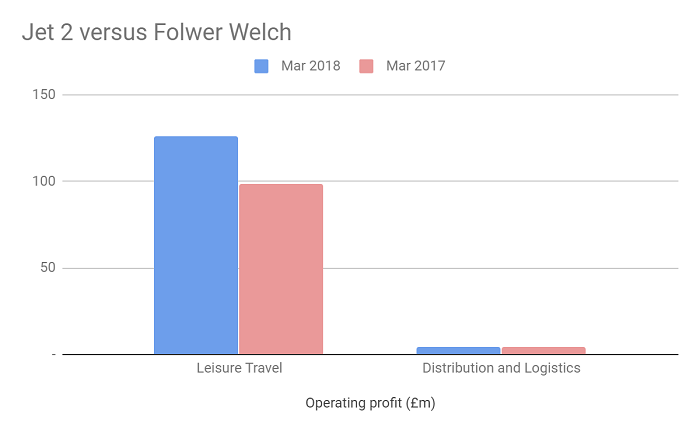

Before I start on Jet2.com, let me dispense with Fowler Welch, a business Dart has owned for longer than Jet2.com has existed.

Fowler Welch is one of the UK's leading distributors of fresh produce. This road haulage and warehousing business is much smaller and less profitable than the airline, so I am barely going to mention it.

That is disappointing, as whenever we travel up the motorway I take satisfaction in observing Fowler Welch's colourful wagons, and the tangible evidence of my investment in Dart.

Source: interactive investor Past performance is not a guide to future performance

As usual I'm scoring Dart to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Score: 1

Dart earned an after-tax return on capital of 10% in the year to March 2018, just under its healthy eleven year average of 11%.

Source: interactive investor Past performance is not a guide to future performance

Profitability though depends on putting bums on seats rather than earning a lot of profit from each bum. The firm's after-tax adjusted profit margin, the proportion of revenue that is turned into profit, is typically just 5%. If fewer customers fly, the company still has to pay to operate its planes, which could send profitability into a tailspin. We can see this in the first year of my chart, the year of the Great Financial Crisis, when Jet2.com was a much smaller airline and return on capital slumped to 4%.

This is why investors put so much store on how airlines are financed. If an airline owes a lot of money to banks or leasing companies it may not be able to make the interest or lease payments when times get tough.

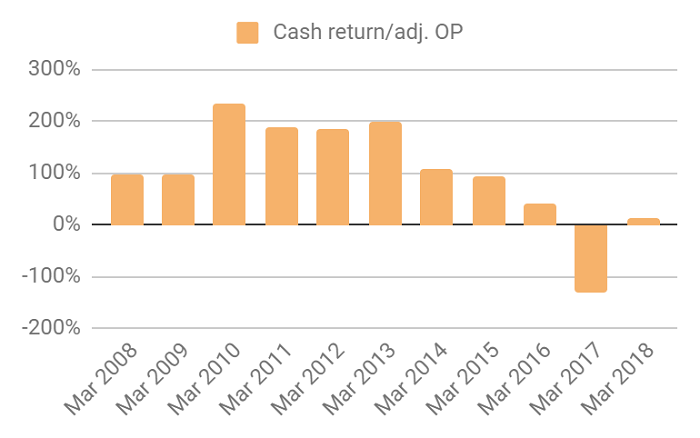

Jet2's expansion has required it to binge on Boeings, and the spending has gobbled up cash, turning cash returns after capital expenditure negative in the year to March 2017:

Source: interactive investor Past performance is not a guide to future performance

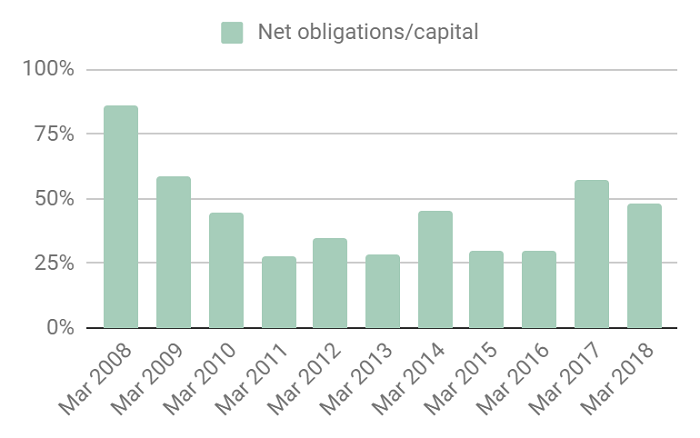

It has also required the firm to borrow more money:

Source: interactive investor Past performance is not a guide to future performance

Dart owes more money than it did a couple of years ago, and it is less profitable than it was. That might appear to be bad news, but I think it is good news. Dart is still very profitable and mostly self-financed, even though it has borrowed a lot of money to expand its fleet. That money should earn a higher return as new routes become established.

Since summer 2016, the fleet has expanded from 64 planes to 90 in the summer just gone. For summer 2019, Jet2.com is increasing capacity by another 25%. This rapid growth will only be good news if people fill the seats profitably, but Dart has a pretty good record, having increased revenue five-fold and profit six-fold in the last 11 years:

Source: interactive investor Past performance is not a guide to future performance

In the year to March 2018 revenue increased 35% and profit increased 28%.

This is how it Dart is doing it...

Adaptable: How will it make more money?

Score: 2

Jet2.com flies people on holiday to the Mediterranean, Canary Islands and European cities. It flew its first flight from Leeds Bradford to Amsterdam in 2003. It has steadily expanded north and south, reaching Birmingham and London Stansted in 2017.

In the year to March 2018, Jet2.com's first year flying from Stansted, it flew 6,300 flights and more than a million passengers from the airport. About a third of Jet2's passengers flew as part of a package including accommodation and car hire in what Jet2holidays, the firm's package tour brand, has trademarked "Real Package Holidays".

Jet2holidays is the most profitable part of the business. Jet2.com is now Britain's third biggest airline and second biggest package tour operator.

I once asked Philip Meeson, the five times British Acrobatics champion who has owned and managed Dart since before even it was called Dart, what differentiates a "Real Package Holiday". He deflected the question by suggesting I go on one.

I have yet to follow his advice, but I have a theory nevertheless. I think the company is distancing itself from other up and comping holiday companies like On The Beach and Expedia. These are the dynamic packagers. They don't own planes or hotels, they are marketing platforms that match customers’ requirements with scheduled flights and buy rooms wholesale from so-called "bed banks".

As a provider of "Real Package Holidays", Jet2.com has much more control of the product, delighting the customer, it likes to say, from start to finish.

A real package holiday is what you get when you fly with Tui, the UK's biggest tour operator, or Thomas Cook, the third biggest after Jet2holidays. But being a younger company Jet2.com does not have an expensive network of high street travel agents to support or a sprawling empire of sub-brands, legacy systems, and other travel related businesses.

Jet2.com is focused on families, so it differentiates itself by offering low deposits on holidays, family friendly flight times, generous baggage allowances and Resort-Flight Check-In, which minimises time spent in airports. Unusually, Jet2.com set up its own aircraft handling operations to improve punctuality at East Midlands, Birmingham and Stansted airports in the year to March 2018. It is the top UK Airline for punctuality and as every parent will testify, delays are a lot less bearable when you have kids to occupy. Because Jet2.com was born in the internet age, 60% of package holidays and 97% of unpackaged flights are sold direct over the Internet or by phone.

I think Dart is right when it says "Real Package Holidays™ take considerable organisation and attention to detail and are not easily replicated by non-specialists."

Resilient: What could go wrong?

Score: 1

Dart's immediate prospects are good. At the AGM earlier this month the company reported air travel bookings are growing slightly ahead of its 25% increase in seat capacity and the proportion of high margin package holiday customers has increased slightly. If, as I believe, Jet2.com has a winning strategy, long-term prospects are good too, with one proviso: It has to get through the medium term.

Dart is flagging up cost pressures (the oil price is rising, so are wages), which could combine with an unfavourable Brexit outcome and cause the company trouble.

Dart mostly flies to the EU, business that depends on the UK's membership of the European Common Aviation Area, or a new arrangement that confers similar rights. Travel could also be inhibited by tax and border changes, and if holidaymakers post Brexit require visas. The company might also find it more difficult to employ European staff and, depending on the status of UK airlines post-Brexit, UK investors may be forced to sell shares or give up their voting rights to comply with EU regulations on airline ownership.

The worst case scenario is probably pretty awful, but would probably not benefit the EU or the UK. In the face of uncertainty, my view is the companies with the strongest businesses will ultimately prosper, and I put Dart in that category.

Equitable: Will we all benefit?

Score: 2

Dart frequently makes the news for throwing drunks off planes, and goes out of its way to ensure customers "have a lovely holiday". It is the recipient of customer awards from Tripadvisor and Which? Each employee is trained on the "importance of delivering service excellence at each point in our customers journey". It boasts it is the highest ranked airline for customer service according to the Institute of Customer Service.

I am confident Jet2.com is customer focused, but I am not so sure about staff. Jet2.com gets mixed reviews on recruitment site glassdoor. Too often for comfort, the company's culture is depicted by employees and ex-employees as: 'old school', 'macho', and "good only if you fit in". There is a certain type of manager that believes a corollary of the maxim that the customer is always right is the staff are always wrong.

I'm inclined to give Dart the benefit of the doubt though. Staff relations are rarely universally harmonious when a firm is growing very rapidly. Many employees say Jet2.com is an exciting place to work, pay is good and so are the prospects of promotion. Dart has shown good instincts in launching a profit share scheme for all staff employed for more than 12 months, and chairman Philip Meeson says Dart "is delighted to be sharing our success with our wonderful colleagues!"

Dart's three executives are paid very well but the bonus system avoids the worst excesses of modern incentives, and Meeson owns 38% of the shares, making him by far the biggest beneficiary of the company's prosperity to date.

Cheap: Is the firm's valuation modest?

Score: 1

Dart shares cost about 17 times profit in 2018, adjusted for debt and many other things.

A score of 7/10 means I think Dart is suitable for long-term investment.

Here are some of Richard's recent articles:

- Goodwin: Jam yesterday and more jam tomorrow

- Colefax: Does old faithful hit the magic number?

- Games Workshop: Verdict on this stunning performer

- System1: Testing its powers of recovery

- MS International: Can the rebound last?

- Castings: Between a rock and a hard place

- Trifast: Continuous improvement adds up

- Vp: An acquisition too far

- Air Partner: Talks a good business

- Sprue Aegis: Do this and they'll be 'dirt cheap'

- 16 conviction shares to consider

- Walker Greenbank: Cheap but fearful

- Hollywood Bowl close to joining exclusive club

- Anpario: Gearing up for growth

- Are Next shares a buy for the long term?

- 16 shares for the future

- Is Portmeirion in the 'buy' zone?

- XP Power shares: They're electrifying!

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Richard owns shares in Dart.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.