The dangers of paying too much for your pension

A new report finds that choosing low-cost drawdown provider interactive investor could save you £12,000 in fees in just five years.

13th February 2024 12:26

by Craig Rickman from interactive investor

There are numerous threats that stand between you and a financially comfortable retirement.

Stock market performance, inflation, and interest rates can all affect whether you hit your later-life goals. And although having a well-thought-out retirement strategy and diversifying your portfolio can mitigate these risks, they are often outside your control.

- Invest with ii: Open a Low Cost SIPP | What is a SIPP | ii vs HL SIPP compared

These threats become more acute as you hit old age, especially if you opt for income drawdown and keep your savings invested. Falling stock markets sometimes work in your favour when you’re saving for retirement, as you can buy shares at cheaper prices, but can wreak havoc once you start taking income.

Another threat, and one that’s less obvious, is charges. Paying over the odds can cause significant harm to your retirement prospects.

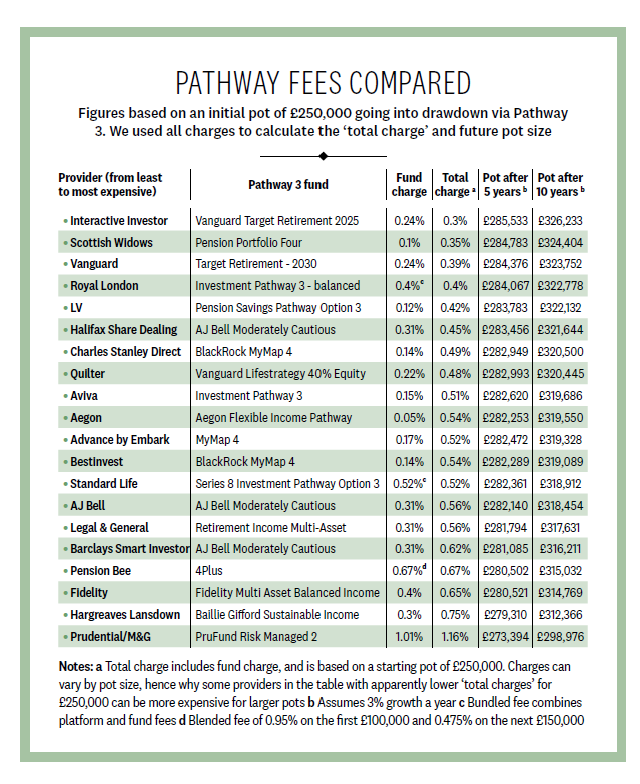

A recent report by Which? supports this assertion. The research found that on a savings pot of £250,000 over a five-year time frame, the difference between the most and least expensive drawdown providers is a whopping £12,139. Over a decade the gap swells to more than £27,000.

Source: Which?

In short, high costs that fail to deliver better results could swallow a year’s worth of retirement income every five years.

Needless to say, interactive investor was found to be the lowest-cost drawdown provider – something we’re understandably proud of.

We recognise the punitive effect that charges can have on your financial goals, hence why all our plans have low, flat-rate fees that remain consistent however much your investments rise or fall. It means not only do you get to keep more of your wealth, but you know exactly what you’re being charged every year, too.

As I noted in a previous article, understanding your portfolio costs should be front and centre when managing your wealth.

It’s not the only consideration, of course: you need to invest in things that are suitable for the specific goals you aim to achieve. But as the Which? research serves to highlight, if paying extra doesn’t lead to improved performance, your retirement pot could drain years sooner.

The threat of reverse compounding

The personal finance sector regularly beats the drum about the power of compound interest, and for good reason.

Albert Einstein described it as the eighth wonder of the world, while investment guru Warren Buffett believes it is an investor’s best friend.

The longer your investment time frame, the more you benefit from compounding, but its effects work both ways. When it comes to costs, the reverse occurs. The cumulative effect of paying high fees over time can be your worst enemy.

Platform fees are only one element

As the table shows, the Which? research factors in investment costs too. These were calculated using investment pathways.

In case you’re not familiar with what the pathways are all about, the initiative was launched by the Financial Conduct Authority (FCA) in February 2021, and seeks to help self-directed investors make sensible decisions with their retirement savings based on what they want to achieve. I guess you could call it a halfway house between doing it yourself and taking financial advice. It’s for those who would like some steer but don’t feel they need (or want to pay for) expert help.

Investors have four options, or pathways, to choose from over a five-year time horizon:

- I have no plans to touch my money

- I plan to use my money to set up a guaranteed income (annuity)

- I plan to start taking money as a long-term income

- I plan to take out all of my money.

If you use pathways with your chosen provider and select option three, they will guide you towards a suitable investment solution. For the sake of balance, there is an apples and pears element to the Which? study’s findings. The most expensive, M&G, coaxes investors into one of its Prufund range, which is an actively managed fund, so the costs are inevitably higher.

However, if you swerve pathways and head down the DIY route, you get to choose which funds or investment trusts to invest in.

In some cases, forking out a bit extra can make sense. While many active managers underperform their respective benchmarks, some still do beat it.

And the task of finding fair and reasonable costs should not be limited to your pensions, but your other investments too, such as individual savings accounts (ISAs) and general investment accounts (GIA).

While other fees such as those incurred in financial advice can also eat into your savings, if you need the reassurance that any decisions you make are right for you, then expert help can be truly valuable.

- How to make the most of your pension allowances before April

- Can these four ‘rules of thumb’ help you reach your retirement goals?

The big takeaway here is to be mindful about what you’re paying. Not doing so could be a costly oversight. That’s why price and value is one of the four pillars financial firms must assess in the FCA’s new consumer duty regime.

To be clear, the responsibility under the Duty lies with platforms such as ii rather than you, the investor. We must create a system where those who seek our services get a fair product for the price they pay.

That said, the big decisions still rest with investors. It is unlikely we’ll ever reach a point where uniform charging structures becomes a thing. Unless you receive and pay for financial advice, the need to assess which platform and investment solutions provide the best value for you is a decision that rests on your shoulders.

Use freedom to your advantage

Few will disagree that the pensions freedoms, which were introduced in 2015 and allowed savers to access money from their pensions however they like, have been a positive step.

Consumer calls for flexibility were answered, and savers are making the most of it. This is illustrated by the fact that income drawdown sales have since outstripped annuities by three to one.

But though there are obvious risks to trading your pot for a guaranteed income via an annuity - the decision is irreversible, unless you choose index-linked payments inflation will erode your income, and there’s no pot for anyone to inherit - drawdown requires close attention. This is particularly the case for those who heavily rely on their savings to meet the bulk of their retirement outgoings. Your money remains invested, so you must manage withdrawals effectively.

- Day in the life of a pension fund manager: Invesco’s Matthew Henly

- SIPP or ISA: which should you prioritise?

On the plus side, drawdown allows you to keep your options open. If you feel your costs are on the toppy side, you have the freedom to switch your self-invested pension plan, or SIPP, to a platform that offers better value.

And the less you pay in fees, the more money you’ll have to spend on things and activities that bring you joy.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.