Covid-19 updates: Persimmon, Bellway, Halfords, Rentokil

Despite more reports of damaged profits and dividend cuts, many shares have surged.

25th March 2020 14:44

by Graeme Evans from interactive investor

Despite more reports of damaged profits and dividend cuts, many shares have surged.

More housebuilders turned off the dividend taps today, with Persimmon (LSE:PSN) and Bellway (LSE:BWY) pledging to focus their efforts on preserving cash in the face of coronavirus uncertainty.

They were not alone in doing so, with Halfords (LSE:HFD) and Rentokil Initial (LSE:RTO) Initial among a number of other well-known stocks announcing that they are pulling forthcoming payments.

While sacrificing the dividend is clearly the right thing for companies to do in the current economic crisis, it's still a massive blow for retail investors reliant on the income. Their hope will be that some of these dividends are postponed rather than cancelled outright.

- Taylor Wimpey and Redrow switch to cash-saving mode

- A checklist for finding dividend shares in a crisis

- AIM dividends: Who’s cutting and who’s raising the payout

Bellway, for example, hopes that an interim dividend can be paid later in the year when there is more clarity about the economic outlook. Persimmon's £400 million return of surplus capital has been cancelled just a week before it is due, although the housebuilder hasn't ruled out eventually paying July's annual dividend of 110p once conditions improve.

It said:

“Whilst the company's regular annual payment of at least 110p per share has been stress tested for payment through the housebuilding industry cycle, the Covid-19 virus presents an exceptional set of circumstances.”

The move comes as Persimmon prepares to close all its sales offices from tomorrow, with only essential work taking place in order to make partly built homes safe and secure.

It said its current cash position of £610 million, revolving credit facility of £300 million and measures to manage cash flows were sufficient to preserve the strength of the group. The 125p a share capital return, however, is no longer considered “surplus”.

The update was welcomed by shareholders today, with Persimmon up 6% to continue the rebound seen since last week's 1,500p low. Shares are currently at 1,810p, compared with the UBS price target of 3,250p prior to Covid-19 disruption. Bellway shares were down 2% at 2024p today after it posted a 7% fall in half-year profits to £291.8 million.

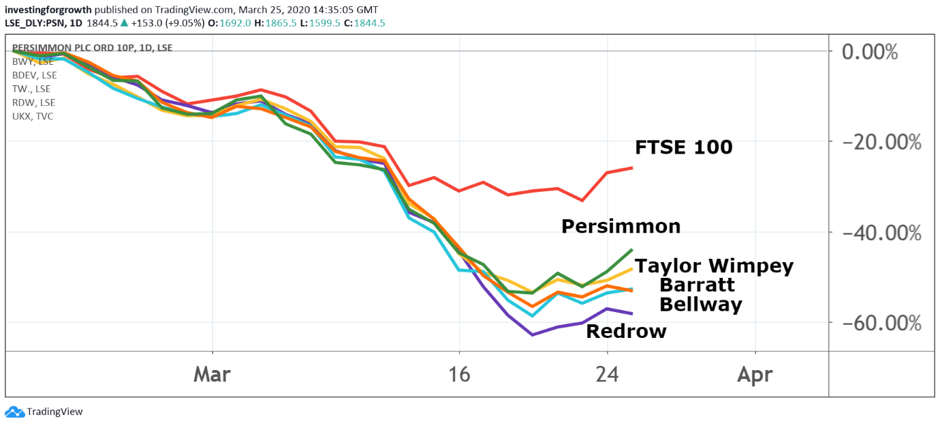

Source: TradingView Past performance is not a guide to future performance

Its reservations have fallen in the past two weeks, but UBS believes the company is well placed to withstand the downturn thanks to its “relatively solid balance sheet and liquidity position”.

Historic dividend yields in excess of 5% — but sometimes as much as double that — have seen investors flocking to the housebuilding sector for income in recent years.

Yesterday, however, Taylor Wimpey (LSE:TW.) cancelled final and special dividend payments to shareholders worth £485 million, while Redrow (LSE:RDW) axed next month's half-year dividend worth £37 million. Berkeley Group also recently postponed shareholder returns worth £455 million.

McCarthy & Stone (LSE:MCS) is the most exposed of the builders to coronavirus, given that its core customer base of over 70s are in a period of self-isolation. It has already cancelled its final dividend payment worth 3.5p a share, but added today that a package of other cash saving measures should enable it to operate with no sales revenue for a period of 2.5 years. Shares rallied 9% to 52.9p, having plunged as low as 40p on Thursday.

There was also cheer for Halfords Group (LSE:HFD) investors today after the car parts and cycles retailer said it was confident it could operate within existing debt facilities in the 2021 financial year.

Trading had been “very strong” in the last couple of weeks, but volumes are now set for a material reduction due to the Government's stay-at-home measures. Based on its core forecast scenario for significant sales declines between April and June and weakness the following nine months, Halfords thinks the overall cost will amount to a 25% or £300 million decline in sales.

It has suspended dividend payments in order to save £24 million, while it is also seeking rent relief from landlords and reducing capital expenditure from £40-60 million to £10-15 million. CEO Graham Stapleton added: “We have a strong balance sheet, with significant liquidity headroom and low levels of financial debt.” Shares jumped 20% to 72.6p following the update.

Rentokil Initial shares moved in the opposite direction after the hygiene services group saw a significant impact on trading over the past 10 days as many markets entered the advanced stages of lockdown. It is withdrawing financial guidance for 2020 and suspending dividend payments for the timebeing, including the final dividend from full-year results in February.

The pest control company, whose wage bill amounts to around 45% of revenues, said it was looking to reduce its costs by £100 million, including through boardroom pay cuts.

It has also drawn down its revolving credit facility to give it cash funds of over £650 million.

Some of its customer sectors have been substantially closed, such as in hotels and catering, but this is offset by increased demand for hygiene disinfection services across a number of its markets. Shares fell 21% to a low of 289p, compared with 530p just three weeks ago.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.