Coronavirus poll: How you are trading during the corona crisis

A recent ii poll shows that more active investors are buying than they were at the end of February.

17th March 2020 15:20

by Rebecca O'Keeffe from interactive investor

A recent ii poll shows that more active investors are buying than they were at the end of February.

interactive investor coronavirus poll: More armchair investors go shopping – but many are still waiting for further falls

As the coronavirus pandemic continues to send global markets South, a poll of 2,295 interactive investor customers between 11 - 16 March 2020 shows that more active investors are buying than they were at the end of February.

This second wave of investor research follows on from a wave 1 poll of 2,337 investors between 28 February – 2 March 2020, when market jitters were taking hold.

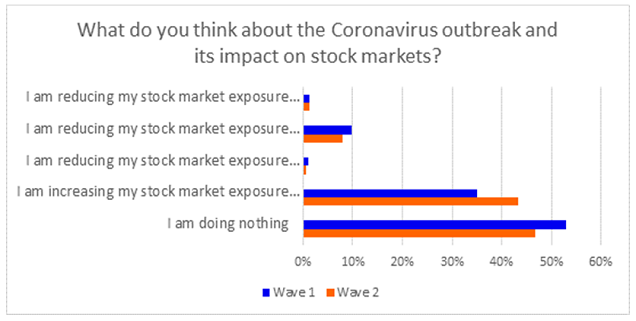

The most recent wave 2 survey shows that whilst many investors are still doing nothing amid Covid-19 concerns, this is down 6 percentage points (from 53% to 47%) two weeks ago. Instead, more investors are starting to take the plunge and buy – some 43% of investors said they are increasing their stock market exposure - up 8 percentage points from the last survey (35%).

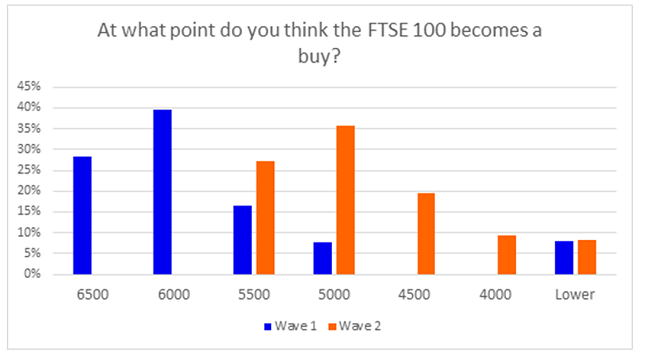

However, many investors are all too aware that the market could sink lower. Some 19% of investors think the FTSE 100 becomes a buy if it heads down to 4,500, 9% think 4,000 and 8% think even lower.

There has been little change in the proportion of investors saying they have deliberately increased their cash (8% vs 10% two weeks ago), while those moving into gold or bond funds remains at 1% respectively.

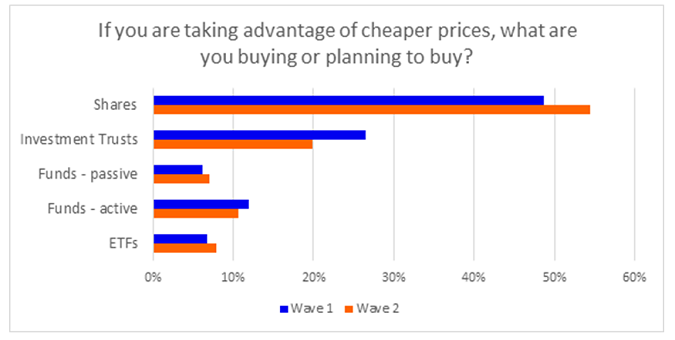

Those who are still investing after market falls are tending to favour shares (55%, up from 49% in wave 1), followed by investment trusts (20%, down from 26% in wave 1). Some 11% of investors are looking at active funds, and 7% passive funds, and 8% are looking at ETFs.

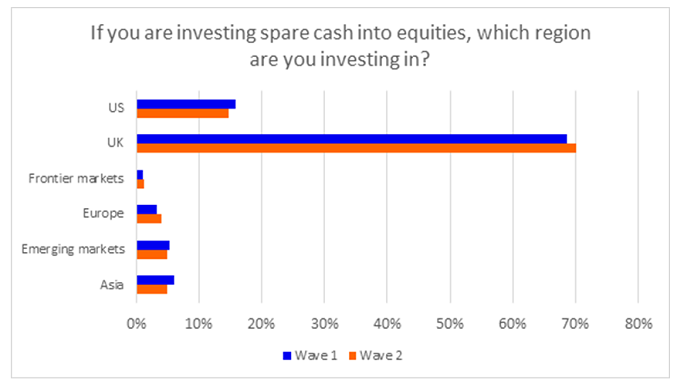

The UK was the most favoured region for those increasing their stock market exposure (70%), followed by the US (15%) and this was very similar to the wave one research.

Rebecca O’Keeffe, Head of Investment, interactive investor, says: “History suggests that the best time to buy is when the market is fearful – and the market is firmly in panic mode now. Many of us can look back and wish that we had held off buying, but it is nigh on impossible to call the bottom of a market.

“Most global markets were at or close to record levels before the start of the sell off, with some (such as the US) arguably at stretched valuation levels, so there was always plenty of potential downside in the event of a negative shock. Most of us have (mercifully) not experienced an event such as Covid-19 in our lifetimes so there is a huge element of uncertainty still around.

“Selling now would crystallise losses for many investors. Yes, it could still get much worse, but history suggests that, if you have a reasonable time horizon for your investments, then it is usually better to be buying during these periods of extreme fear and risk aversion than it is to be selling.

“And you also have to think about dividends and total returns – something that investors often forget in times of pronounced market stress. The FTSE 100 may be back at levels not seen since 2010, but it has paid out high levels of dividends since then and while there may be some companies that are forced to cut their dividends over the coming months, the likelihood is that dividends will still continue to be paid at a reasonable rate.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.