Coronavirus crisis: An essential guide for all investors

Our head of equity strategy provides an insight into what investors must consider in a crisis.

16th March 2020 16:46

by Lee Wild from interactive investor

Investment decisions have certainly been complicated due to the coronavirus pandemic. Our head of equity strategy provides an insight into what investors should know during a crisis.

It’s ISA season, and time to utilise your full tax-free allowance is running out. But this year, investment decisions are made many times more complicated by the coronavirus pandemic.

The global health crisis has already had severe consequences for financial markets. Trillions of dollars have been wiped off share prices in the US in just a few days, and some very well-known UK companies have halved in value.

- Learn with ii: How to become an ISA millionaire | ISA Investment Ideas | Top ISA Funds

The US-China trade war and Brexit, and more recently an oil price war triggered by Saudi Arabia and Russia, had created problems in recent months, but it is coronavirus that caused the real panic in March.

Markets famously do not like uncertainty, and Covid-19 brings that in spades. Shutting shops, closing factories and offices, grounding flights, cancelling sporting events and quarantining huge sections of some populations, is having a massive economic impact, and not just in China and Italy where the outbreak has been most virulent.

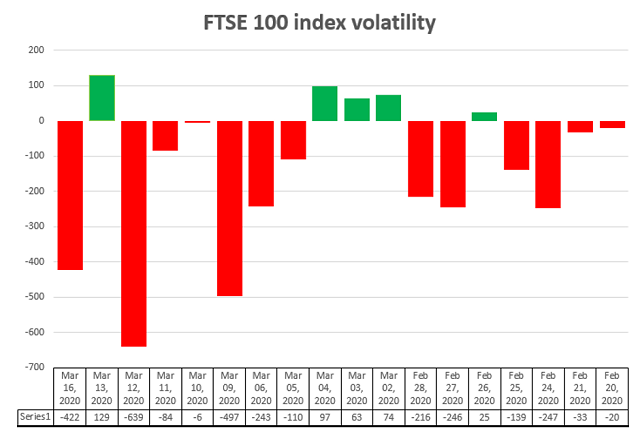

Global financial markets are as volatile as at any time since the Great Financial Crisis between 2007 and 2009. The FTSE 100 has fallen 10% in just one day and risen sharply on other days. But, since the 20 February, the UK’s main index is down as much as 2,500 points, or 34%! It’s the same in the US and pretty much everywhere else.

Source: interactive investor Closing prices

Source: TradingView Past performance is not a guide to future performance

Action taken by governments in the US, Europe and elsewhere will have inevitable economic consequences, the scale of which it is difficult to predict. It is equally hard to estimate the impact on corporate profits, although transport sectors like the airlines, cruise liners and train companies are already seeking government help to avoid collapse.

Politicians have promised hundreds of billions of dollars to industry and taxpayers via fiscal stimulus, while central banks have been quick to slash interest rates and use other tools at their disposal to keep the system ticking over.

Some industries will receive help and companies will survive. Others won’t.

But amidst the turmoil, for investors, there will be great opportunities.

The famous quote by one of the world’s most successful investors Warren Buffett, to “be fearful when others are greedy and to be greedy only when others are fearful”, has been used widely recently.

He has been proved right of course on numerous occasions over the past few decades – whether it be the 1987 crash, Dotcom crash or Great Financial Crisis, stock markets have recovered every time.

Source: TradingView Past performance is not a guide to future performance

There is no reason to assume this time will be any different, but knowing precisely when to ‘be greedy’ is not easy.

12 important things for every investor to consider in a crisis

With shares looking so cheap, investors might feel like a child in a sweet shop - so many great stocks to choose from. But investors must think before acting in this market. Here are some key things to remember:

1. Without knowing the impact of coronavirus on company profits, accurately valuing stocks is difficult. Stocks may only look cheap on valuation grounds based on historic earnings, not future profits.

2. What is cheap? Valuations tend to reflect historic norms, but professional investors are often less willing to pay say 15 times future earnings for a stock, as they might have done previously. We saw this at its most extreme during the Credit Crunch when great companies could be bought for low single-digit price/earnings (PE) ratios.

3. Dividend yields will have been flattered by sharply lower share prices, and some payouts may be at risk if profits are hit hard.

4. Markets have recovered after every stock market crash in history. Unless the capitalist system suffers a fatal blow, they should this time, too, but the timing is unclear.

5. You will rarely pick the bottom of the market and share prices might keep on falling. Remember the words of economist John Maynard Keynes: “Markets can stay irrational longer than you can stay solvent.” Be certain you have a long enough investment timeframe to weather further short-term market declines.

6. If you’ve bought into the market on the way down, you will need patience before you’re breakeven, then in profit. It’s worth remembering that, because patience (and solvency) is the only difference between an investor who buys regularly on the way down, and one who buys regularly on the way up.

7. It is no coincidence that defensive stocks like supermarkets, utilities and drugs companies are among those that have fallen least in the recent rout. It is likely they will be among the weakest risers when the market does recover.

8. In terms of sector performance - Food & Drug Retailers, like supermarkets and food producers, have been least affected by the sell-off, but the sector is still down sharply.

| FTSE 350 sector | Share price change since 20 Feb 2020 (%) | 1-week change (%) | Price change in 2020 so far (%) | Share price performance in 2019 (%) |

|---|---|---|---|---|

| Food & Drug Retailers | -13.6 | -8.54 | -16.0 | 27.5 |

| Pharmaceuticals & Biotechnology | -18.1 | -12.1 | -21.0 | 24.1 |

| Gas, Water & Multi-Utilities | -21.8 | -13.2 | -14.6 | 17.4 |

| Personal Goods | -22.5 | -12.9 | -20.4 | 8.5 |

| Tobacco | -23.4 | -14.3 | -22.5 | 14.9 |

| Banks | -31.0 | -10.8 | -35.3 | 2.2 |

| General Retailers | -43.3 | -26.4 | -44.0 | 35.8 |

| Travel & Leisure | -51.3 | -33.1 | -51.8 | 17.1 |

| Oil & Gas Producers | -45.3 | -19.4 | -50.6 | -4.37 |

| Automobiles & Parts | -52.4 | -26.7 | -58.9 | -18.4 |

| Oil Equipment, Services & Distribution | -55.4 | -29.8 | -55.6 | -19.9 |

| Source: SharePad as at 16 March 2020 | ||||

9. A lot of good companies have been dragged lower in the chaos, and it is those that will suffer little financial impact from coronavirus that will be most sought-after by bargain hunters. Look for companies with high long-term returns on capital, high profit margins, strong free cashflow, and little or no debt. Also favour strong brands and large market share.

10. Each firm should pass at least seven of the nine checks in the Piotroski F-Score. The F-Score looks for improving trends in a company’s profitability, debt, liquidity, share dilution and operating efficiency.

11. Remember, only you know the make-up of your investment portfolio, so any share tips or fund ideas should only be considered if they meet your personal investment criteria and maintain the integrity of a well-diversified portfolio.

12. Crucially, ISA rules let investors utilise their annual allowance with cash, which is placed within the ISA and used when the investor wishes. This gives valuable flexibility depending on the investment strategy.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.