Compelling case for short duration bonds

4th July 2023 14:53

by Mark Munro from Aberdeen

From elevated yields to defensive characteristics, we make the case for short-duration bonds.

Amid high inflation and an unprecedented period of monetary tightening, the last 18 months have undoubtedly been challenging for global bond markets. However, with substantially higher yields across the board and a growing perception that central bank rate-hiking cycles are moving closer to a pause phase, the overall outlook for bonds appears to be brightening. Still, within the hugely diverse bond universe, some segments look much more attractive than others. One area where we feel the investment case looks especially compelling is short-duration bonds.

Inverted yield curves

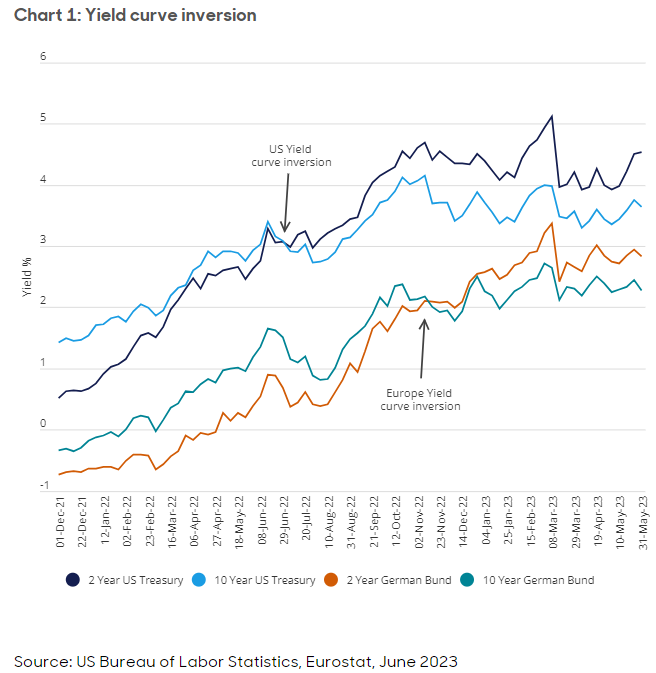

The current support for short-duration bonds comes from the marked ‘inversion’ of yield curves. In normal conditions, yields for longer-dated bonds are higher than for shorter-dated bonds. This makes sense. Longer-dated bonds, if held to maturity, take more time for the initial investment to be paid back and should therefore compensate you with more yield.

However, in the current challenging economic environment, yields are ‘inverted’. This means 1- and 2-year bond yields are higher than long-term yields, such as 10-year yields. As a result, there’s no additional yield compensation for holding longer-maturity bonds, making shorter-maturity bonds much more attractive from an income perspective.

The path to inversion

For context, it’s worth remembering that as recently as end-2021, yields were much lower and upward-sloping yield curves were the norm. For example, the 10-year US Treasury yield was 1.51%, while the 2-year yield was 0.73%. Of course, during 2022 there was a massive increase in yields across the board. However, the rate of increase was far greater for short-dated bonds. So much so, that by the end of the year, the 2-year Treasury yield of 4.42% was far above the 10-year yield of 3.88%. The inversion has increased even further in 2023, with the 2-year yield rising to 4.74% and the 10-year yield down to 3.78%. (1)

As shown in Chart 1, it’s a similar story in Germany, the other most important global ‘core’ government bond market (albeit at different levels and timings).

Advantages of short-duration bonds

Short-dated bonds also have well-known structural advantages. In particular, they have a defensive reputation due in large part to their lower duration and higher liquidity.

Lower duration means they are less responsive (or sensitive) to any interest rate change, which means lower return volatility but less vulnerability in rate-rising environments. Indeed, it’s clear in the recent aggressive rate-hiking cycle that short-duration bonds have held up much better than their long-dated equivalents. On the liquidity front, shorter-duration bonds’ advantage stems from higher trading volumes. At maturities of less than 24 months, high-quality bonds are often seen as highly liquid, ‘near-cash’ equivalents.

Potential capital gains from the ‘pull-to-par’ effect

Another potential advantage of shorter-duration bonds is the ‘pull-to-par’ effect. For bonds trading at a discount to face value, this refers to the natural gravitation towards the original issuance price as the maturity time nears, resulting in capital gains. The extent of gains from the pull-to-par effect depends on the extent of the discount-to-par value. Today, many bonds fall into this category thanks to their sharply increased yields (which move inversely to prices).

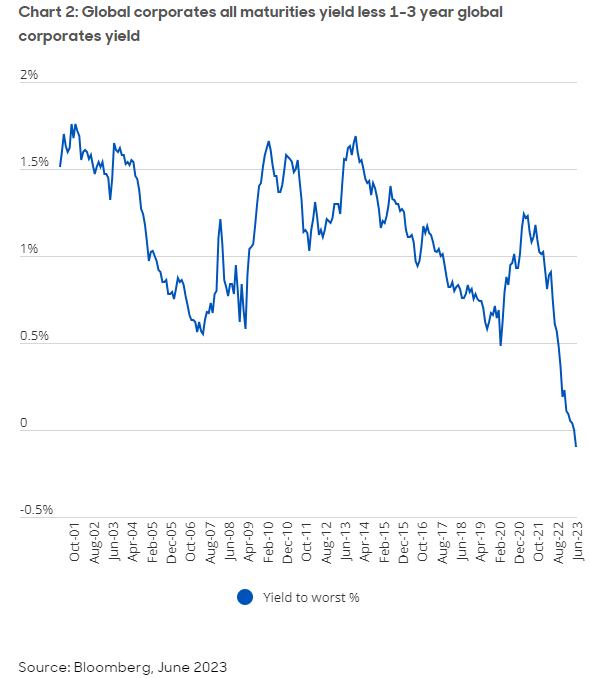

Yield enhancement from short-duration corporate bonds

While the case for short-duration bonds looks compelling, in practice investors also need to consider various other factors, including quality orientation. Risk appetite is key. For example, highly risk-averse investors could look to create a portfolio solely of short-dated ‘risk-free’ core government bonds such as Treasuries, bunds, gilts, supranationals and highly rated commercial paper.

By contrast, less risk-averse investors can look to enhance yields and total returns by focusing on short-dated corporate bonds. Here, we also see yield inversion (see Chart 2). However, relatively greater yields are also possible thanks to additional compensation for credit risk, which is reflected in credit spreads above risk-free core government bonds.

The case for high-quality, short-duration corporate bonds

An issue for all corporate bonds is that the current tough economic environment of weaker growth, high inflation and much higher debt servicing costs entails increasing credit and default risks. On the growth front, rising recessionary conditions would elevate credit risks. This would result in wider credit spreads and a negative impact on total returns. It’s also worth noting that inverted yield curves are widely seen as prime recession indicators.

Investors should therefore be careful where they seek to gain exposure to short-dated bonds within global fixed income. Given the current climate, we are cautious on high-yield bonds, where stock selection is of paramount importance. We prefer selective exposure to investment-grade corporate bonds both from financial and non-financial companies. In our view, they provide the correct balance of risk and yield enhancement, relative to cash and government bonds.

Putting everything together

Gaining higher yields over cash rates, while taking on as little additional risk as possible, will always be a goal for investors. For many, generating a robust income through short-duration corporate bonds can be an attractive strategy during most stages of the economic cycle. Right now, there’s a strong case for an increased allocation to short-duration bonds thanks to the significantly increased absolute level of yields, coupled with yield-curve inversion. In our view, the most attractive short-dated segment at present is 1-3 year investment-grade corporate bonds, which can potentially offer a better risk/reward trade-off compared to short-dated government and high-yield corporate bonds.

(1) as of 22 June 2023

Mark Munro is Investment Director at abrdn

ii is an abrdn business.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.