A company that’s unlikely to disappoint shareholders

30th June 2021 13:02

by Rodney Hobson from interactive investor

Investors who followed this share tip have made a handsome profit, but what now? Our overseas investing expert explains what he’d do.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

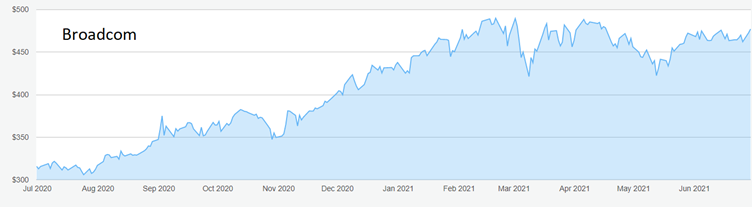

Few shares have rebounded as far as those of Broadcom (NASDAQ:AVGO) over the past 15 months, yet the yield is still attractive and there could be more to come. The company looks as good an investment as other comparable operators in the sector.

Broadcom has a diverse range of products including semiconductors and software used in data centres, networking and the storage of information. The Avago side of the business focusses on radio frequency filters and amplifiers.

The group has a wide range of markets including smartphones such as Apple iPhone and Samsung Galaxy, plus wired communication systems. Its chips handle broadband and can be found in television set-top boxes and security systems.

These are growing markets, ones that are always looking to introduce new products that provide faster and more secure services. It is hard to see Broadcom failing to continue its expansion.

- Dinosaur or diamond? Dow Jones Industrial Average turns 125

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Check out our award-winning stocks and shares ISA

Following the pandemic, the semiconductor market has found itself in an unreal situation. Major markets such as vehicles and consumer electronics have bounced back after months in the doldrums, creating a temporary shortage as chip makers race to catch up with demand. In addition, lockdowns have speeded up the transformation of the workplace into digital systems, while the rollout of 5G phone networks and the development of electric vehicles provide further boosts to demand.

Source: interactive investor. Past performance is not a guide to future performance

Chip production has also been affected by the trade war between the US and China and by a shift in production from the US to Asia, leading to longer delivery times.

The time lag between ordering semiconductors and taking delivery is still getting longer and is reported to have reached 18 weeks on average, with delays of up to six months in some industries.

Experts generally believe that the shortages will not bottom out until the second half of this year at the earliest, and that the situation will not stablise for a couple of years, giving continued strong growth of at least 5% a year. American companies, which dominate the design of, and sales of, chips will be the main beneficiaries.

Intel (NASDAQ:INTC), the world’s largest chipmaker, has promised to step up US production capacity and to open its factories to other chipmakers.

Broadcom chief executive Hock Tan has sought to play down expectations, saying chip production is a mature industry, but the company’s 15% increase in sales in the first quarter of 2021 suggest otherwise. The spread of the Internet of Things should play well for Broadcom.

- Where has the value rally been strongest?

- Bill Ackman: I think this could be the Black Swan event of 2021

There has been some concern that Broadcom would be hurt by rival Nvidia (NASDAQ:NVDA) using its proposed takeover of chip maker Arm to restrict the use of Arm’s technology and raise prices. Broadcom’s chief executive Hock Tan has allayed these fears by actually supporting Nvidia’s acquisition of Arm, saying that assurances have been given that Nvidia will invest in Arm’s technology and keep its products available for all companies to use.

Broadcom sunk below $200 in March 2020 but has since recovered to a peak of $490 in February this year. At the current level around $477, the share price has already factored in continued sales growth. However, the company is unlikely to disappoint shareholders and the yield of nearly 3% offers considerable comfort.

Hobson’s choice: I picked Broadcom as one of the five best US stocks to put in an ISA in March 2019 at under $300, so those who took the opportunity are up more than 60%, including dividends. The case to buy now is less clear cut and more cautious investors may prefer to see if the shares fall back, but the downside looks limited. Consider buying up to $480.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.